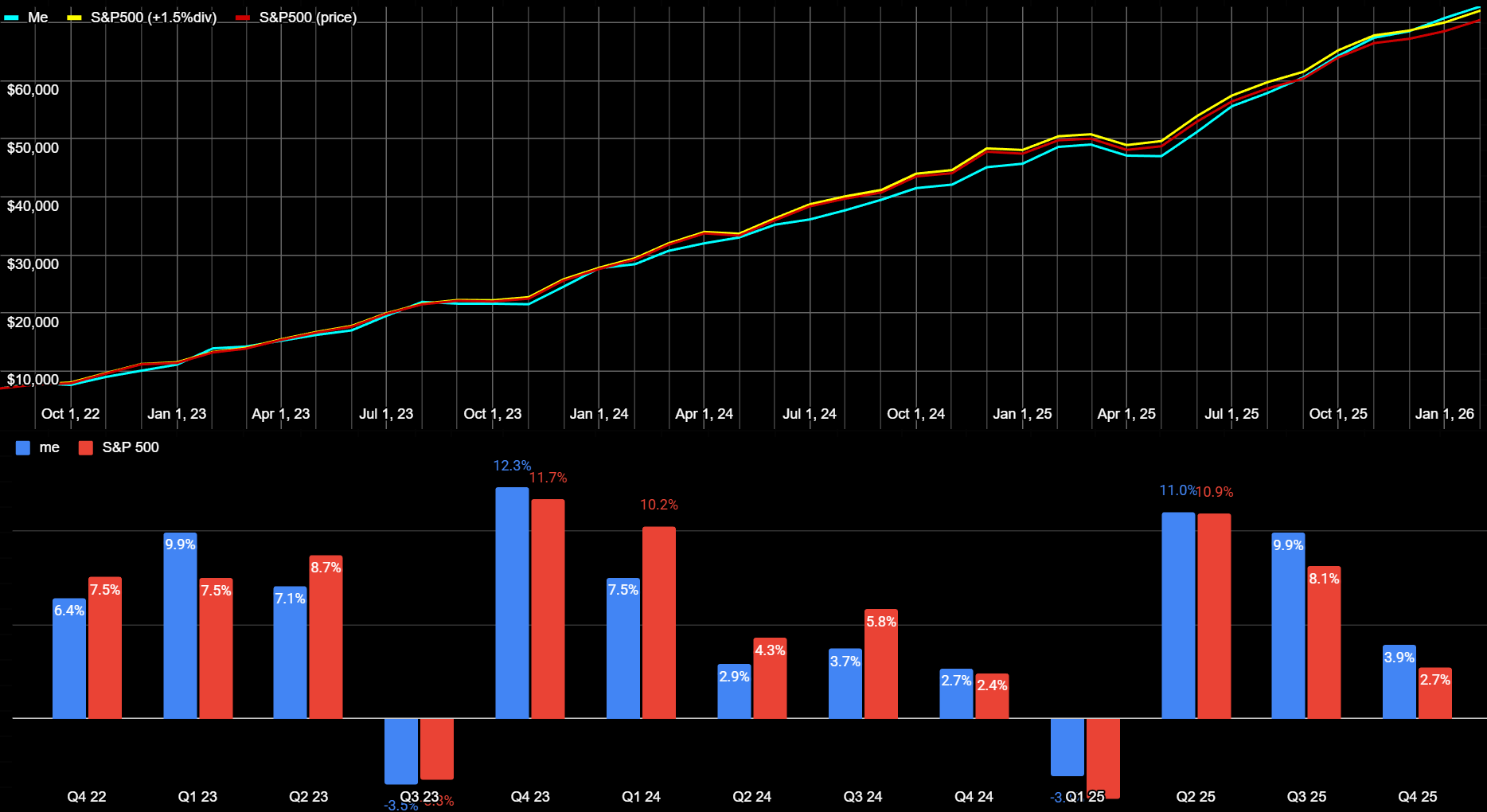

I deposit $1000/mo into a Fidelity investment account, $49,000 total since 2022. I try to pick stocks to hold until retirement.

This is my penultimate regular email, as next month I’ll hit my $50k deposited target and stop further deposits.

| Fund | 1-month | 3-month | 1 Year | 3 Year |

|---|---|---|---|---|

| My Fund | 2.7% | 3.5% | 20.9% | 64.6% |

| S&P 500 | 1.5% | 1.8% | 16.4% | 77.7% |

| Dow Jones | 1.6% | 1.7% | 15.3% | 73.5% |

I had a good month! Micron Tech (MU) had another good month, I’m up +686% from $167 to $1313.

One year ago, January 2025, I had this to say:

This is the year that AI becomes undeniable, the year that we lose the comfort blanket that it’s just another silicon valley mirage. If it’s going to take jobs, I want to buy companies that have high revenue and employees to lose.

I don’t know if I bought the right companies, we’ll see, but I think I was sentimentally right. For one, I see AI everywhere in advertising. My parents bought me two pieces of AI art for Christmas, and I’m sure they have no idea and just thought they were neat. Though, I still see people clinging to the AI-is-a-fad comfort blanket, so maybe I was not as right as I hoped to be, or maybe I’ve just been successfully hit by rage bait. In any case, January 2026 feels different than January 2025, and there’s no going back. AI is going to write a metric megaton of code this year.

Also I read Infinite Jest this month, so that makes me cool.

Bought

No sales this month, just 53 buys. Tidying up shares before I turn the money hose off.

| # | %pos> | thismo | shrs | cost | value | %price | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1% | $47 | 19.6 | $ 2,815 | $ 6,150 | 118% | GOOG | 0.9% | ALPHABET IN | 8.8% | multi | USA | tech |

| 2 | 2% | $91 | 29.5 | $ 3,773 | $ 5,502 | 46% | NVDA | 0.0% | NVIDIA CORP | 7.9% | tech | USA | sc’s |

| 3 | 1% | $57 | 19.4 | $ 3,712 | $ 5,274 | 42% | AAPL | 0.9% | APPLE INC | 7.6% | multi | USA | tech |

| 4 | 1% | $71 | 10 | $ 3,962 | $ 4,836 | 22% | MSFT | 1.3% | MICROSOFT C | 6.9% | multi | USA | tech |

| 5 | 1% | $47 | 16.55 | $ 2,964 | $ 3,820 | 29% | AMZN | 0.0% | AMAZON.COM | 5.5% | multi | USA | tech |

| 8 | 2% | $29 | 5.8 | $ 748 | $ 1,763 | 136% | TSM | 2.5% | TAIWAN SEMI | 2.5% | tech | Asia | sc’s |

| 13 | 2% | $17 | 2.2 | $ 626 | $ 772 | 23% | V | 1.1% | VISA INC | 1.1% | finance | USA | credit |

| 14 | 1% | $11 | 1.3 | $ 624 | $ 742 | 19% | MA | 0.8% | MASTERCARD | 1.1% | finance | USA | credit |

| 19 | 2% | $11 | 0.63 | $ 498 | $ 674 | 35% | ASML | 0.7% | ASML HOLDIN | 1.0% | tech | Europe | sc’s |

| 23 | 2% | $11 | 1.32 | $ 322 | $ 488 | 52% | AXP | 1.6% | AMERICAN EX | 0.7% | finance | USA | credit |

| 29 | 14% | $53 | 2 | $ 311 | $ 428 | 38% | AMD | 0.0% | ADVANCED MI | 0.6% | tech | USA | sc’s |

| 35 | 14% | $42 | 5 | $ 328 | $ 350 | 7% | KO | 4.0% | COCA-COLA C | 0.5% | retail | USA | food |

| 37 | 6% | $19 | 1.6 | $ 153 | $ 342 | 50% | TM | 5.0% | TOYOTA MOTO | 0.5% | industry | Asia | cars |

| 39 | 3% | $10 | 1.65 | $ 255 | $ 322 | 26% | ORCL | 1.4% | ORACLE CORP | 0.5% | tech | USA | cloud |

| 44 | 5% | $12 | 0.46 | $ 178 | $ 264 | 48% | CAT | 1.3% | CATERPILLAR | 0.4% | industry | USA | farm |

| 47 | 4% | $10 | 0.48 | $ 194 | $ 245 | 26% | MCO | 1.4% | MOODYS CORP | 0.4% | finance | USA | rating |

| 49 | 8% | $18 | 0.28 | $ 233 | $ 241 | 4% | COST | 0.7% | COSTCO WHOL | 0.3% | retail | USA | store |

| 50 | 7% | $15 | 0.46 | $ 205 | $ 240 | 17% | SPGI | 1.3% | S&P GLOBAL | 0.3% | finance | USA | rating |

| 51 | 5% | $11 | 0.68 | $ 175 | $ 240 | 37% | CEG | 0.5% | CONSTELLAT | 0.3% | energy | USA | nuclear |

| 54 | 7% | $15 | 1.65 | $ 263 | $ 237 | -10% | PEP | 3.4% | PEPSICO INC | 0.3% | retail | USA | food |

| 55 | 5% | $12 | 0.4 | $ 215 | $ 232 | 8% | TMO | 0.3% | THERMO FISH | 0.3% | health | USA | tech |

| 58 | 6% | $12 | 1.7 | $ 176 | $ 222 | 26% | BIDU | 0.0% | BAIDU INC S | 0.3% | tech | China | search |

| 60 | 5% | $10 | 0.67 | $ 199 | $ 219 | 10% | AMGN | 3.0% | AMGEN INC | 0.3% | health | USA | pharm |

| 62 | 7% | $13 | 0.45 | $ 215 | $ 218 | 1% | LMT | 2.7% | LOCKHEED MA | 0.3% | industry | USA | aero |

| 63 | 7% | $14 | 0.8 | $ 172 | $ 217 | 26% | ADI | 2.3% | ANALOG DEVI | 0.3% | tech | USA | sc’s |

| 64 | 7% | $14 | 0.7 | $ 152 | $ 216 | 42% | GE | 0.5% | GE AEROSPA | 0.3% | industry | USA | aero |

| 69 | 6% | $12 | 0.66 | $ 184 | $ 206 | 12% | CB | 1.0% | CHUBB LIMI | 0.3% | finance | USA | insure |

| 70 | 11% | $21 | 0.19 | $ 157 | $ 204 | 30% | LLY | 0.5% | ELI LILLY & | 0.3% | health | USA | pharm |

| 72 | 8% | $15 | 1.4 | $ 218 | $ 201 | -8% | PG | 3.5% | PROCTER AND | 0.3% | retail | USA | health |

| 75 | 25% | $38 | 1 | $ 208 | $ 195 | -6% | HON | 1.6% | HONEYWELL I | 0.3% | industry | USA | aero |

| 78 | 9% | $15 | 0.65 | $ 137 | $ 193 | 41% | IBM | 3.7% | INTERNATIO | 0.3% | tech | USA | multi |

| 81 | 7% | $11 | 0.8 | $ 152 | $ 183 | 20% | ABBV | 2.8% | ABBVIE INC | 0.3% | health | USA | pharm |

| 82 | 7% | $12 | 1.6 | $ 187 | $ 181 | -3% | PDD | 0.0% | PDD HOLDING | 0.3% | retail | China | tech |

| 84 | 9% | $14 | 0.38 | $ 158 | $ 177 | 12% | DE | 1.7% | DEERE & CO | 0.3% | industry | USA | farm |

| 90 | 9% | $13 | 1.2 | $ 138 | $ 165 | 20% | NVS | 1.2% | NOVARTIS A | 0.2% | health | Europe | biotech |

| 93 | 8% | $13 | 1.3 | $ 151 | $ 163 | 8% | ABT | 1.9% | ABBOTT LAB | 0.2% | health | USA | care |

| 94 | 8% | $12 | 0.7 | $ 168 | $ 162 | -3% | UNP | 2.6% | UNION PAC C | 0.2% | industry | USA | rail |

| 99 | 8% | $12 | 0.65 | $ 159 | $ 157 | -2% | LOW | 1.8% | LOWES COMPA | 0.2% | retail | USA | home |

| 100 | 9% | $13 | 0.6 | $ 115 | $ 154 | 34% | AMAT | 0.5% | APPLIED MA | 0.2% | tech | USA | sc’s |

| 103 | 13% | $18 | 0.45 | $ 130 | $ 152 | 16% | COR | 0.4% | CENCORA IN | 0.2% | health | USA | tech |

| 107 | 10% | $13 | 0.31 | $ 134 | $ 141 | 5% | VRTX | 0.0% | VERTEX PHA | 0.2% | health | USA | pharm |

| 110 | 8% | $10 | 0.39 | $ 113 | $ 131 | 16% | GD | 1.0% | GENERAL DY | 0.2% | industry | USA | aero |

| 115 | 10% | $11 | 0.35 | $ 134 | $ 120 | -10% | HD | 2.5% | HOME DEPOT | 0.2% | retail | USA | home |

| 116 | 10% | $11 | 0.21 | $ 112 | $ 120 | 7% | NOC | 0.9% | NORTHROP G | 0.2% | industry | USA | aero |

| 118 | 18% | $18 | 0.07 | $ 104 | $ 118 | 14% | FICO | 0.0% | FAIR ISAAC | 0.2% | finance | USA | credit |

| 120 | 11% | $11 | 0.33 | $ 122 | $ 116 | -5% | SYK | 0.5% | STRYKER CO | 0.2% | health | USA | tech |

| 124 | 12% | $11 | 0.19 | $ 92 | $ 108 | 16% | ISRG | 0.0% | INTUITIVE | 0.2% | health | USA | robo |

| 135 | 98% | $46 | 1 | $ 86 | $ 92 | 7% | AZN | 0.0% | ASTRAZENECA | 0.1% | health | Europe | pharm |

| 139 | 14% | $11 | 0.4 | $ 91 | $ 87 | -5% | NXPI | 1.1% | NXP SEMICO | 0.1% | tech | Europe | sc’s |

| 147 | 12% | $8 | 0.5 | $ 76 | $ 77 | 0% | NOW | 0.0% | SERVICENOW | 0.1% | tech | USA | cloud |

| 156 | 17% | $10 | 0.7 | $ 69 | $ 67 | -4% | BSX | 0.0% | BOSTON SCI | 0.1% | health | USA | tech |

| 157 | 19% | $11 | 0.3 | $ 65 | $ 66 | 1% | WM | 0.5% | WASTE MANAG | 0.1% | industry | USA | trash |

| 159 | 20% | $10 | 0.3 | $ 64 | $ 59 | -7% | NET | 0.0% | CLOUDFLARE | 0.1% | tech | USA | cloud |

| 161 | 42% | $17 | 0.1 | $ 65 | $ 58 | -10% | SPOT | 0.0% | SPOTIFY TEC | 0.1% | media | Europe | music |

| 165 | 34% | $13 | 0.2 | $ 49 | $ 52 | 6% | FSLR | 0.0% | FIRST SOLAR | 0.1% | energy | USA | solar |

| 173 | 26% | $9 | 0.5 | $ 45 | $ 44 | -1% | SRE | 0.1% | SEMPRA COM | 0.1% | energy | USA | util |

| 176 | 47% | $13 | 0.3 | $ 43 | $ 39 | -8% | ANET | 0.0% | ARISTA NETW | 0.1% | tech | USA | hw |

| 180 | 49% | $12 | 0.15 | $ 38 | $ 36 | -4% | SAP | 0.0% | SAP ADR REP | 0.1% | tech | Europe | sw |

All Holdings

See attached Technicolor PDF of All Holdings.