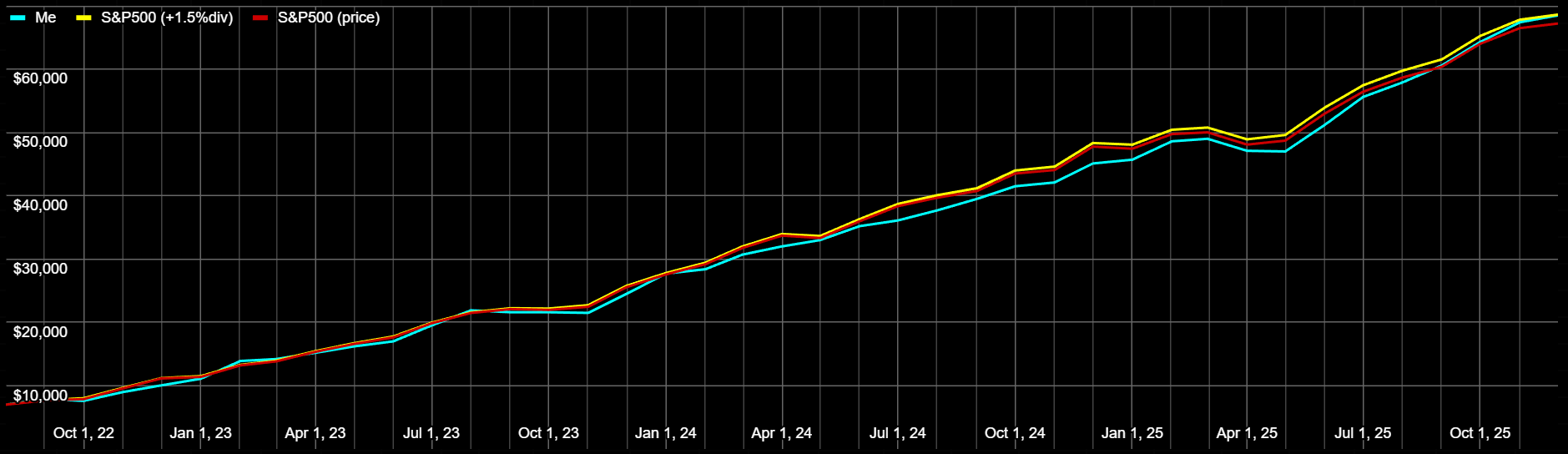

2025 November ($68,500)

I deposit $1000/mo into a Fidelity investment account, $47,000 total since 2022. I try to pick stocks to hold until retirement.

| Fund | 1-month | 3-month | 1 Year | 3 Year |

|---|---|---|---|---|

| My Fund | 0.1% | 7.8% | 20.9% | 73.8% |

| S&P 500 | 0.3% | 6.3% | 15.0% | 75.3% |

| Dow Jones | 0.2% | 5.9% | 13.5% | 75.3% |

Google had a strong month to become my top holding, while NVidia fell behind Apple down to my #3. Berkshire Hathaway bought into Google last quarter, it’s nice to be ahead of “Buffett” for once. I started buying Google in October 2022, I’m +122%.

Sold

I trimmed down some positions to whole-share values, $302 in total sales. I tell myself this makes stock events easier to process, but mostly it just feels better.

| # | %pos> | thismo | shrs | cost | value | %price | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 12 | -2% | -$17 | 5 | $ 412 | $ 806 | 92% | BABA | 4.9% | ALIBABA GRO | 1.2% | tech | China | retail |

| 22 | -4% | -$21 | 5 | $ 97 | $ 547 | 379% | NFLX | 0.0% | NETFLIX INC | 0.8% | media | USA | stream |

| 26 | -2% | -$8 | 3 | $ 469 | $ 451 | -4% | CVX | 9.7% | CHEVRON COR | 0.7% | energy | USA | oil |

| 27 | -10% | -$46 | 1 | $ 166 | $ 429 | 124% | TSLA | 0.0% | TESLA INC C | 0.6% | industry | USA | cars |

| 28 | -16% | -$77 | 10 | $ 248 | $ 412 | 40% | ALLY | 12.1% | ALLY FINANC | 0.6% | finance | USA | bank |

| 40 | -2% | -$7 | 10 | $ 299 | $ 301 | 1% | JD | 5.5% | JD.COM INC | 0.4% | retail | China | tech |

| 57 | -6% | -$14 | 3 | $ 30 | $ 221 | 53% | GM | 2.1% | GENERAL MTR | 0.3% | industry | USA | cars |

| 63 | -8% | -$19 | 2 | $ 69 | $ 209 | 158% | UAL | 0.0% | UNITED AIRL | 0.3% | industry | USA | air |

| 66 | -6% | -$12 | 8 | $ 230 | $ 201 | -12% | HPQ | 10.3% | HP INC COM | 0.3% | tech | USA | hw |

| 70 | -6% | -$12 | 3 | $ 105 | $ 195 | 78% | DAL | 3.3% | DELTA AIR L | 0.3% | industry | USA | air |

| 131 | -41% | -$68 | 1 | $ 115 | $ 96 | -10% | BNTX | 0.0% | BIONTECH SE | 0.1% | health | Europe | biotech |

Bought

More of the same, 76 different positions this month. Believe it or not I’m trying to tidy things up.

| # | %pos> | thismo | shrs | cost | value | %price | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1% | $56 | 19.45 | $ 2,768 | $ 6,147 | 122% | GOOG | 0.7% | ALPHABET IN | 9.0% | multi | USA | tech |

| 2 | 1% | $54 | 19.2 | $ 3,655 | $ 5,495 | 50% | AAPL | 0.9% | APPLE INC | 8.0% | multi | USA | tech |

| 3 | 3% | $146 | 29 | $ 3,682 | $ 5,262 | 43% | NVDA | 0.0% | NVIDIA CORP | 7.7% | tech | USA | sc’s |

| 4 | 1% | $52 | 9.85 | $ 3,891 | $ 4,827 | 24% | MSFT | 1.1% | MICROSOFT C | 7.1% | multi | USA | tech |

| 5 | 1% | $51 | 16.35 | $ 2,917 | $ 3,833 | 31% | AMZN | 0.0% | AMAZON.COM | 5.6% | multi | USA | tech |

| 7 | 3% | $57 | 4 | $ 1,697 | $ 2,027 | 19% | BRK.B | 0.0% | BERKSHIRE H | 3.0% | multi | USA | finance |

| 8 | 1% | $15 | 5.7 | $ 719 | $ 1,665 | 132% | TSM | 2.6% | TAIWAN SEMI | 2.4% | tech | Asia | sc’s |

| 13 | 2% | $19 | 2 | $ 367 | $ 763 | 108% | AVGO | 1.3% | BROADCOM IN | 1.1% | tech | USA | sc’s |

| 16 | 1% | $10 | 2.15 | $ 609 | $ 709 | 16% | V | 0.9% | VISA INC | 1.0% | finance | USA | credit |

| 17 | 2% | $11 | 1.28 | $ 613 | $ 699 | 14% | MA | 0.8% | MASTERCARD | 1.0% | finance | USA | credit |

| 18 | 2% | $11 | 0.62 | $ 487 | $ 687 | 41% | ASML | 0.7% | ASML HOLDIN | 1.0% | tech | Europe | sc’s |

| 20 | 3% | $19 | 3 | $ 482 | $ 616 | 28% | JNJ | 3.0% | JOHNSON &JO | 0.9% | health | USA | goods |

| 25 | 2% | $11 | 1.29 | $ 311 | $ 465 | 50% | AXP | 1.7% | AMERICAN EX | 0.7% | finance | USA | credit |

| 31 | 4% | $13 | 1.75 | $ 257 | $ 377 | 46% | AMD | 0.0% | ADVANCED MI | 0.6% | tech | USA | sc’s |

| 36 | 9% | $29 | 2 | $ 253 | $ 341 | 35% | QCOM | 4.2% | QUALCOMM IN | 0.5% | tech | USA | sc’s |

| 37 | 4% | $13 | 1.6 | $ 245 | $ 322 | 32% | ORCL | 1.4% | ORACLE CORP | 0.5% | tech | USA | cloud |

| 38 | 5% | $14 | 4.4 | $ 286 | $ 311 | 9% | KO | 3.8% | COCA-COLA C | 0.5% | retail | USA | food |

| 41 | 4% | $10 | 1.5 | $ 134 | $ 295 | 45% | TM | 4.3% | TOYOTA MOTO | 0.4% | industry | Asia | cars |

| 44 | 5% | $12 | 0.44 | $ 167 | $ 256 | 54% | CAT | 1.4% | CATERPILLAR | 0.4% | industry | USA | farm |

| 46 | 4% | $9 | 0.26 | $ 214 | $ 240 | 12% | COST | 0.7% | COSTCO WHOL | 0.4% | retail | USA | store |

| 49 | 5% | $11 | 0.65 | $ 164 | $ 236 | 44% | CEG | 0.4% | CONSTELLAT | 0.3% | energy | USA | nuclear |

| 50 | 19% | $38 | 1 | $ 266 | $ 235 | -12% | CRM | 0.5% | SALESFORCE | 0.3% | tech | USA | sw |

| 52 | 5% | $10 | 1.55 | $ 249 | $ 230 | -7% | PEP | 3.6% | PEPSICO INC | 0.3% | retail | USA | food |

| 55 | 4% | $10 | 0.46 | $ 184 | $ 224 | 22% | MCO | 1.2% | MOODYS CORP | 0.3% | finance | USA | rating |

| 58 | 5% | $11 | 0.38 | $ 204 | $ 221 | 8% | TMO | 0.3% | THERMO FISH | 0.3% | health | USA | tech |

| 59 | 6% | $12 | 0.64 | $ 189 | $ 217 | 15% | AMGN | 2.4% | AMGEN INC | 0.3% | health | USA | pharm |

| 60 | 5% | $10 | 0.43 | $ 190 | $ 211 | 11% | SPGI | 1.1% | S&P GLOBAL | 0.3% | finance | USA | rating |

| 61 | 17% | $31 | 1 | $ 209 | $ 210 | 1% | TMUS | 1.2% | T-MOBILE US | 0.3% | media | USA | coms |

| 64 | 6% | $12 | 0.75 | $ 159 | $ 205 | 29% | ADI | 2.0% | ANALOG DEVI | 0.3% | tech | USA | sc’s |

| 65 | 16% | $29 | 2 | $ 196 | $ 202 | 3% | MRK | 2.0% | MERCK &CO. | 0.3% | health | America | pharm |

| 73 | 7% | $12 | 1.6 | $ 165 | $ 190 | 16% | BIDU | 0.0% | BAIDU INC S | 0.3% | tech | China | search |

| 74 | 9% | $15 | 1.3 | $ 203 | $ 190 | -7% | PG | 3.8% | PROCTER AND | 0.3% | retail | USA | health |

| 76 | 9% | $16 | 0.65 | $ 137 | $ 188 | 37% | GE | 0.5% | GE AEROSPA | 0.3% | industry | USA | aero |

| 77 | 6% | $10 | 0.42 | $ 202 | $ 186 | -8% | LMT | 2.2% | LOCKHEED MA | 0.3% | industry | USA | aero |

| 78 | 6% | $11 | 0.62 | $ 172 | $ 183 | 6% | CB | 1.0% | CHUBB LIMI | 0.3% | finance | USA | insure |

| 79 | 9% | $15 | 0.6 | $ 121 | $ 181 | 49% | IBM | 3.4% | INTERNATIO | 0.3% | tech | USA | multi |

| 81 | 8% | $14 | 1.5 | $ 175 | $ 178 | 2% | PDD | 0.0% | PDD HOLDING | 0.3% | retail | China | tech |

| 82 | 11% | $17 | 0.17 | $ 136 | $ 178 | 31% | LLY | 0.4% | ELI LILLY & | 0.3% | health | USA | pharm |

| 88 | 7% | $11 | 0.75 | $ 141 | $ 168 | 19% | ABBV | 3.0% | ABBVIE INC | 0.2% | health | USA | pharm |

| 89 | 26% | $34 | 0.2 | $ 142 | $ 166 | 17% | MCK | 0.1% | MCKESSON C | 0.2% | health | USA | tech |

| 90 | 9% | $14 | 0.35 | $ 143 | $ 164 | 14% | DE | 1.8% | DEERE & CO | 0.2% | industry | USA | farm |

| 93 | 7% | $10 | 0.8 | $ 170 | $ 155 | -9% | HON | 1.4% | HONEYWELL I | 0.2% | industry | USA | aero |

| 94 | 9% | $12 | 1.2 | $ 139 | $ 152 | 9% | ABT | 2.1% | ABBOTT LAB | 0.2% | health | USA | care |

| 95 | 8% | $11 | 0.65 | $ 156 | $ 151 | -3% | UNP | 2.2% | UNION PAC C | 0.2% | industry | USA | rail |

| 96 | 11% | $15 | 0.5 | $ 143 | $ 150 | 5% | MCD | 2.4% | MCDONALD S | 0.2% | retail | USA | food |

| 97 | 9% | $12 | 0.55 | $ 101 | $ 146 | 44% | AMAT | 0.3% | APPLIED MA | 0.2% | tech | USA | sc’s |

| 98 | 9% | $12 | 0.6 | $ 147 | $ 146 | -1% | LOW | 1.9% | LOWES COMPA | 0.2% | retail | USA | home |

| 99 | 9% | $12 | 1.1 | $ 124 | $ 146 | 17% | NVS | 1.4% | NOVARTIS A | 0.2% | health | Europe | biotech |

| 103 | 35% | $37 | 3 | $ 246 | $ 142 | -42% | NVO | 0.8% | NOVO NORDIS | 0.2% | health | Europe | pharm |

| 104 | 14% | $17 | 0.4 | $ 113 | $ 140 | 24% | COR | 0.2% | CENCORA IN | 0.2% | health | USA | tech |

| 106 | 10% | $13 | 0.5 | $ 128 | $ 135 | 6% | FDX | 1.7% | FEDEX CORP | 0.2% | industry | USA | post |

| 112 | 12% | $13 | 0.28 | $ 121 | $ 121 | 0% | VRTX | 0.0% | VERTEX PHA | 0.2% | health | USA | pharm |

| 113 | 9% | $10 | 0.36 | $ 103 | $ 121 | 18% | GD | 1.1% | GENERAL DY | 0.2% | industry | USA | aero |

| 119 | 11% | $11 | 0.32 | $ 123 | $ 113 | -8% | HD | 2.0% | HOME DEPOT | 0.2% | retail | USA | home |

| 120 | 10% | $10 | 1 | $ 85 | $ 112 | 32% | WMT | 0.8% | WALMART INC | 0.2% | retail | USA | store |

| 121 | 11% | $11 | 0.3 | $ 111 | $ 110 | -1% | SYK | 0.5% | STRYKER CO | 0.2% | health | USA | tech |

| 124 | 20% | $18 | 0.06 | $ 86 | $ 107 | 24% | FICO | 0.0% | FAIR ISAAC | 0.2% | finance | USA | credit |

| 128 | 13% | $12 | 0.19 | $ 101 | $ 104 | 3% | NOC | 0.6% | NORTHROP G | 0.2% | industry | USA | aero |

| 131 | 12% | $11 | 0.17 | $ 81 | $ 97 | 19% | ISRG | 0.0% | INTUITIVE | 0.1% | health | USA | robo |

| 143 | 16% | $10 | 0.35 | $ 81 | $ 75 | -6% | NXPI | 1.3% | NXP SEMICO | 0.1% | tech | Europe | sc’s |

| 146 | 14% | $9 | 0.09 | $ 68 | $ 74 | 9% | NOW | 0.0% | SERVICENOW | 0.1% | tech | USA | cloud |

| 156 | 20% | $10 | 0.6 | $ 59 | $ 59 | 0% | BSX | 0.0% | BOSTON SCI | 0.1% | health | USA | tech |

| 160 | 23% | $10 | 0.25 | $ 54 | $ 54 | -2% | WM | 0.1% | WASTE MANAG | 0.1% | industry | USA | trash |

| 163 | 31% | $12 | 0.25 | $ 54 | $ 50 | -6% | NET | 0.0% | CLOUDFLARE | 0.1% | tech | USA | cloud |

| 169 | 23% | $8 | 0.5 | $ 40 | $ 45 | 12% | AZN | 0.0% | ASTRAZENECA | 0.1% | health | Europe | pharm |

| 171 | 24% | $8 | 0.2 | $ 48 | $ 42 | -13% | EFX | 0.2% | EQUIFAX IN | 0.1% | finance | USA | report |

| 173 | 45% | $12 | 0.07 | $ 47 | $ 40 | -15% | SPOT | 0.0% | SPOTIFY TEC | 0.1% | media | Europe | music |

| 174 | 53% | $14 | 0.15 | $ 36 | $ 39 | 9% | FSLR | 0.0% | FIRST SOLAR | 0.1% | energy | USA | solar |

| 177 | 34% | $9 | 0.4 | $ 36 | $ 36 | 2% | SRE | 0.2% | SEMPRA COM | 0.1% | energy | USA | util |

| 182 | 151% | $15 | 0.2 | $ 30 | $ 25 | -15% | ANET | 0.0% | ARISTA NETW | 0.0% | tech | USA | hw |

| 183 | 74% | $10 | 0.1 | $ 29 | $ 24 | -15% | POOL | 0.5% | POOL CORP C | 0.0% | retail | USA | pool |

| 184 | new | $26 | 0.1 | $ 26 | $ 24 | -7% | SAP | 0.0% | SAP ADR REP | 0.0% | tech | Europe | sw |

Just one new position, a big European software company.

All Holdings

See attached Technicolor PDF of All Holdings.