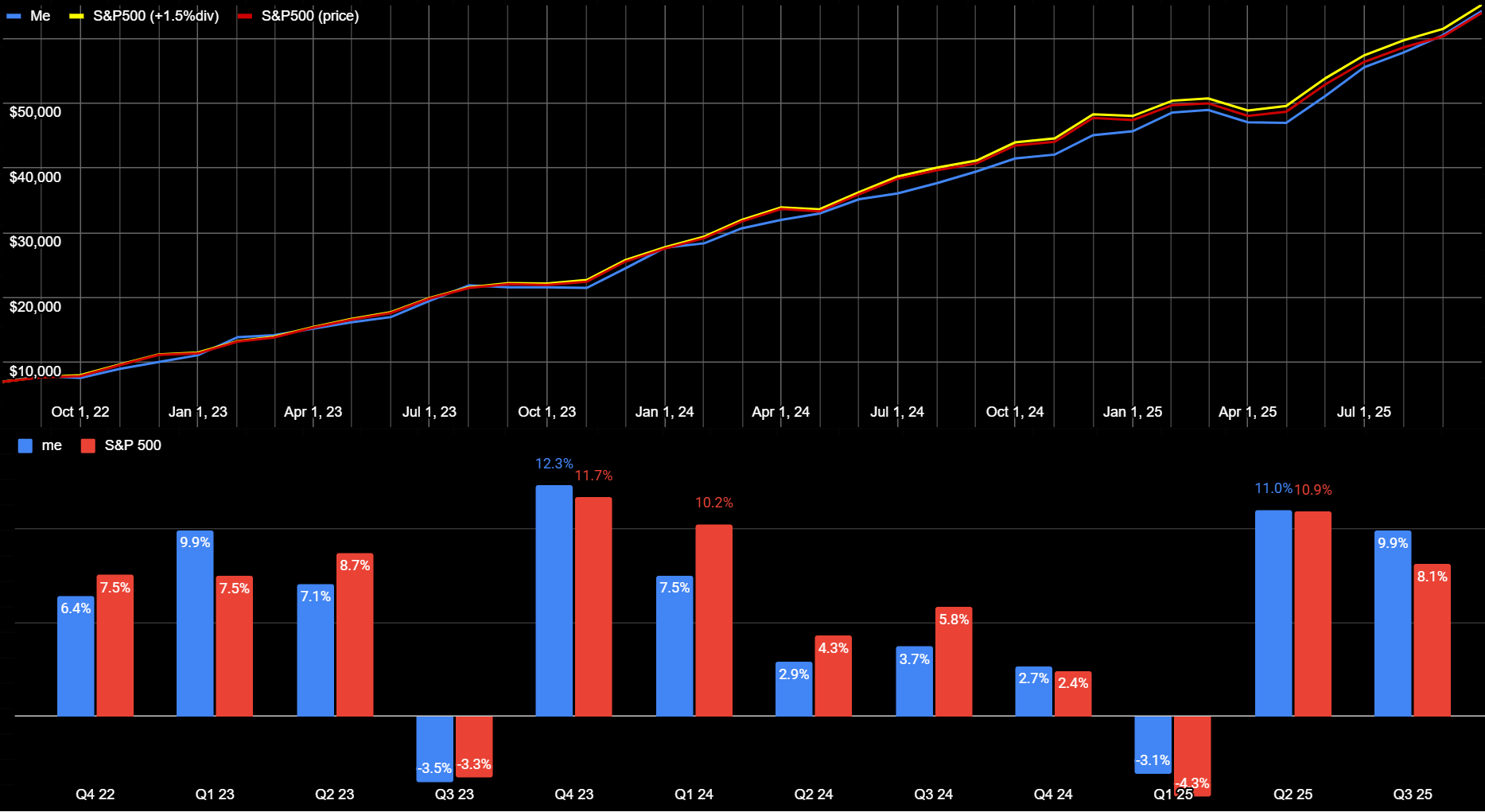

I deposit $1000/mo into a Fidelity investment account, $45,000 total since 2022. I try to pick stocks to hold until retirement.

This month I finished The Brothers Karamazov (Dostoevsky 1880), now I’ve read each Dostoevsky novel, and I finished the five-volume biography I was reading alongside (Joseph Frank 1976-2002). I got this idea from David Foster Wallace in the footnotes of an essay (Consider the Lobster 2005).

| Fund | 1-month | 3-month | 1 Year | 3 Year |

|---|---|---|---|---|

| My Fund | 4.4% | 9.9% | 21.3% | 88.9% |

| S&P 500 | 3.7% | 8.1% | 17.6% | 95.0% |

| Dow Jones | 3.5% | 8.2% | 17.5% | 91.4% |

I had a strong month for a winning quarter.

Intel (INTC) went up 39% this month, I was down -27% and now I’m even. Strong month for Semiconductors: MU, INTC, LRCX, ASML, AMAT each +30-40%.

Sold

I trimmed ALLY again, a bit over-invested in a smaller company.

| # | %pos> | thismo | shrs | cost | value | $gain | %price | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 26 | -8% | -$44 | 12 | $ 325 | $ 470 | $ 190 | 36% | ALLY | 11.2% | ALLY FINANC | 0.7% | finance | USA | bank |

Bought

We praise Megacorpia, excluding Meta for they have plenty. We praise NVDA most of all. We praise health, long may we compound! Blessed are the returns that go up.

| # | %pos> | thismo | shrs | cost | value | $gain | %price | $div-f | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 5% | $223 | 27.3 | $ 3,351 | $ 5,094 | $ 1,743 | 52% | $ 0 | NVDA | 0.0% | NVIDIA CORP | 7.9% | tech | USA | sc’s |

| 2 | 1% | $50 | 9.65 | $ 3,787 | $ 4,998 | $ 1,254 | 32% | $ 43 | MSFT | 1.1% | MICROSOFT C | 7.8% | multi | USA | tech |

| 3 | 1% | $46 | 18.8 | $ 3,550 | $ 4,787 | $ 1,266 | 35% | $ 29 | AAPL | 0.8% | APPLE INC | 7.5% | multi | USA | tech |

| 4 | 1% | $52 | 19 | $ 2,651 | $ 4,627 | $ 1,997 | 75% | $ 20 | GOOG | 0.8% | ALPHABET IN | 7.2% | multi | USA | tech |

| 6 | 1% | $45 | 15.9 | $ 2,812 | $ 3,491 | $ 679 | 24% | $ - | AMZN | 0.0% | AMAZON.COM | 5.4% | multi | USA | tech |

| 7 | 3% | $50 | 3.77 | $ 1,585 | $ 1,895 | $ 310 | 20% | $ - | BRK.B | 0.0% | BERKSHIRE H | 3.0% | multi | USA | |

| 8 | 2% | $34 | 5.55 | $ 675 | $ 1,550 | $ 894 | 130% | $ 15 | TSM | 2.2% | TAIWAN SEMI | 2.4% | tech | Asia | sc’s |

| 14 | 1% | $10 | 2.09 | $ 589 | $ 713 | $ 131 | 21% | $ 6 | V | 1.0% | VISA INC | 1.1% | finance | USA | credit |

| 15 | 2% | $12 | 1.24 | $ 591 | $ 705 | $ 119 | 19% | $ 4 | MA | 0.7% | MASTERCARD | 1.1% | finance | USA | credit |

| 19 | 5% | $29 | 1.85 | $ 316 | $ 610 | $ 298 | 93% | $ 4 | AVGO | 1.2% | BROADCOM IN | 1.0% | tech | USA | sc’s |

| 20 | 5% | $29 | 0.58 | $ 448 | $ 561 | $ 117 | 25% | $ 3 | ASML | 0.6% | ASML HOLDIN | 0.9% | tech | Europe | sc’s |

| 21 | 5% | $27 | 2.8 | $ 444 | $ 519 | $ 89 | 17% | $ 14 | JNJ | 3.2% | JOHNSON &JO | 0.8% | health | USA | goods |

| 28 | 3% | $11 | 1.5 | $ 217 | $ 422 | $ 207 | 94% | $ 3 | ORCL | 1.3% | ORACLE CORP | 0.7% | tech | USA | cloud |

| 29 | 2% | $10 | 1.23 | $ 290 | $ 409 | $ 122 | 41% | $ 4 | AXP | 1.4% | AMERICAN EX | 0.6% | finance | USA | credit |

| 33 | 4% | $12 | 13.5 | $ 521 | $ 344 | $ (125) | -34% | $ 52 | PFE | 10.0% | PFIZER INC | 0.5% | health | USA | pharm |

| 39 | 3% | $10 | 1.77 | $ 214 | $ 294 | $ 89 | 37% | $ 9 | QCOM | 4.2% | QUALCOMM IN | 0.5% | tech | USA | sc’s |

| 41 | 4% | $10 | 1.4 | $ 114 | $ 268 | $ 172 | 45% | $ 16 | TM | 4.6% | TOYOTA MOTO | 0.4% | industry | Asia | cars |

| 51 | 5% | $9 | 0.23 | $ 187 | $ 213 | $ 28 | 14% | $ 1 | COST | 0.7% | COSTCO WHOL | 0.3% | retail | USA | store |

| 61 | 5% | $10 | 0.81 | $ 168 | $ 194 | $ 28 | 15% | $ 3 | TMUS | 1.5% | T-MOBILE US | 0.3% | media | USA | coms |

| 64 | 7% | $12 | 0.58 | $ 140 | $ 191 | $ 52 | 36% | $ 1 | CEG | 0.5% | CONSTELLAT | 0.3% | energy | USA | nuclear |

| 65 | 7% | $12 | 0.4 | $ 146 | $ 191 | $ 47 | 31% | $ 2 | CAT | 1.2% | CATERPILLAR | 0.3% | industry | USA | farm |

| 66 | 5% | $9 | 0.38 | $ 182 | $ 190 | $ 11 | 4% | $ 3 | LMT | 1.8% | LOCKHEED MA | 0.3% | industry | USA | aero |

| 67 | 6% | $10 | 0.8 | $ 218 | $ 190 | $ (27) | -13% | $ 1 | CRM | 0.5% | SALESFORCE | 0.3% | tech | USA | cloud |

| 68 | 5% | $9 | 1.9 | $ 141 | $ 186 | $ 46 | 32% | $ - | UBER | 0.0% | UBER TECHNO | 0.3% | tech | USA | rides |

| 71 | 6% | $10 | 0.9 | $ 212 | $ 178 | $ (33) | -16% | $ 1 | DHR | 0.4% | DANAHER COR | 0.3% | health | USA | industry |

| 74 | 7% | $12 | 1.3 | $ 148 | $ 172 | $ 24 | 16% | $ (0) | PDD | 0.0% | PDD HOLDING | 0.3% | tech | China | retail |

| 76 | 6% | $10 | 3.6 | $ 180 | $ 170 | $ 2 | -6% | $ 11 | SNY | 5.8% | SANOFI ADR | 0.3% | health | Europe | pharm |

| 79 | 9% | $14 | 0.55 | $ 107 | $ 165 | $ 59 | 54% | $ 0 | GE | 0.5% | GE AEROSPA | 0.3% | industry | America | aero |

| 80 | 6% | $10 | 0.34 | $ 183 | $ 165 | $ (17) | -10% | $ 0 | TMO | 0.2% | THERMO FISH | 0.3% | health | USA | tech |

| 84 | 8% | $12 | 0.56 | $ 166 | $ 158 | $ (3) | -5% | $ 5 | AMGN | 2.7% | AMGEN INC | 0.2% | health | USA | pharm |

| 87 | 8% | $11 | 0.54 | $ 150 | $ 152 | $ 4 | 2% | $ 1 | CB | 0.9% | CHUBB LIMI | 0.2% | finance | USA | insure |

| 90 | 8% | $11 | 0.65 | $ 118 | $ 151 | $ 35 | 27% | $ 3 | ABBV | 2.6% | ABBVIE INC | 0.2% | health | USA | pharm |

| 91 | 8% | $11 | 0.7 | $ 149 | $ 147 | $ 0 | -1% | $ 2 | HON | 1.6% | HONEYWELL I | 0.2% | industry | USA | aero |

| 92 | 8% | $11 | 0.86 | $ 112 | $ 144 | $ 33 | 29% | $ 1 | RTX | 1.2% | RTX CORPOR | 0.2% | industry | USA | aero |

| 99 | 11% | $13 | 1.55 | $ 155 | $ 130 | $ (22) | -16% | $ 3 | MRK | 1.7% | MERCK &CO. | 0.2% | health | America | pharm |

| 110 | 12% | $13 | 0.9 | $ 99 | $ 115 | $ 18 | 17% | $ 2 | NVS | 1.7% | NOVARTIS A | 0.2% | health | Europe | biotech |

| 112 | 9% | $10 | 0.85 | $ 72 | $ 114 | $ 42 | 59% | $ 0 | LRCX | 0.3% | LAM RESEAR | 0.2% | tech | USA | sc’s |

| 113 | 11% | $11 | 2.05 | $ 198 | $ 114 | $ (81) | -43% | $ 2 | NVO | 1.0% | NOVO NORDIS | 0.2% | health | Europe | pharm |

| 114 | 11% | $11 | 0.2 | $ 112 | $ 113 | $ 3 | 2% | $ 1 | MSCI | 1.1% | MSCI INC | 0.2% | finance | USA | indices |

| 117 | 15% | $14 | 0.14 | $ 92 | $ 108 | $ 16 | 18% | $ 0 | MCK | 0.1% | MCKESSON C | 0.2% | health | USA | tech |

| 119 | 12% | $11 | 0.45 | $ 115 | $ 106 | $ (8) | -8% | $ 2 | FDX | 1.3% | FEDEX CORP | 0.2% | industry | USA | post |

| 123 | 11% | $10 | 0.3 | $ 82 | $ 102 | $ 21 | 24% | $ 1 | GD | 0.8% | GENERAL DY | 0.2% | industry | USA | aero |

| 124 | 17% | $15 | 0.13 | $ 103 | $ 99 | $ (4) | -4% | $ 1 | LLY | 0.5% | ELI LILLY & | 0.2% | health | USA | pharm |

| 130 | 15% | $12 | 0.15 | $ 77 | $ 91 | $ 15 | 18% | $ 1 | NOC | 0.8% | NORTHROP G | 0.1% | industry | USA | aero |

| 131 | 15% | $12 | 0.24 | $ 89 | $ 89 | $ 0 | 0% | $ 0 | SYK | 0.4% | STRYKER CO | 0.1% | health | USA | tech |

| 132 | 15% | $12 | 0.28 | $ 74 | $ 88 | $ 13 | 18% | $ 0 | COR | 0.3% | CENCORA IN | 0.1% | health | USA | tech |

| 139 | 17% | $12 | 0.21 | $ 92 | $ 82 | $ (10) | -11% | $ - | VRTX | 0.0% | VERTEX PHA | 0.1% | health | USA | pharm |

| 140 | 11% | $8 | 0.4 | $ 67 | $ 82 | $ 15 | 22% | $ 0 | AMAT | 0.5% | APPLIED MA | 0.1% | tech | USA | sc’s |

| 163 | 52% | $17 | 0.3 | $ 46 | $ 48 | $ 2 | 5% | $ - | NTRA | 0.0% | NATERA INC | 0.1% | health | USA | tests |

| 168 | 27% | $9 | 0.1 | $ 49 | $ 45 | $ (4) | -8% | $ - | ISRG | 0.0% | INTUITIVE | 0.1% | health | USA | robo |

| 171 | 31% | $10 | 0.16 | $ 40 | $ 41 | $ 1 | 3% | $ 0 | EFX | 0.2% | EQUIFAX IN | 0.1% | finance | USA | report |

| 176 | 45% | $11 | 0.35 | $ 35 | $ 34 | $ (1) | -3% | $ - | BSX | 0.0% | BOSTON SCI | 0.1% | health | USA | tech |

| 178 | 46% | $10 | 0.15 | $ 31 | $ 32 | $ 1 | 5% | $ - | NET | 0.0% | CLOUDFLARE | 0.1% | tech | USA | cloud |

| 179 | new | $28 | 1 | $ 28 | $ 28 | $ (0) | -2% | $ - | OPCH | 0.0% | OPTION CARE | 0.0% | health | USA | home |

| 180 | 105% | $11 | 0.1 | $ 23 | $ 22 | $ (1) | -3% | $ - | WM | 0.0% | WASTE MANAG | 0.0% | industry | USA | trash |

| 181 | new | $15 | 0.2 | $ 15 | $ 15 | $ 0 | 2% | $ - | AZN | 0.0% | ASTRAZENECA | 0.0% | health | Europe | pharm |

| 182 | new | $11 | 0.05 | $ 11 | $ 11 | $ 0 | 1% | $ - | FSLR | 0.0% | FIRST SOLAR | 0.0% | energy | USA | solar |

| 183 | new | $9 | 0.03 | $ 9 | $ 9 | $ 0 | 1% | $ - | POOL | 0.0% | POOL CORP C | 0.0% | retail | USA | pool |

| 184 | new | $9 | 0.1 | $ 9 | $ 9 | $ 0 | 4% | $ - | SRE | 0.0% | SEMPRA COM | 0.0% | energy | USA | util |

Five new companies: two in health, two in energy, and a pool supplies company that Buffett owns.

All Holdings

See attached Technicolor PDF of All Holdings.