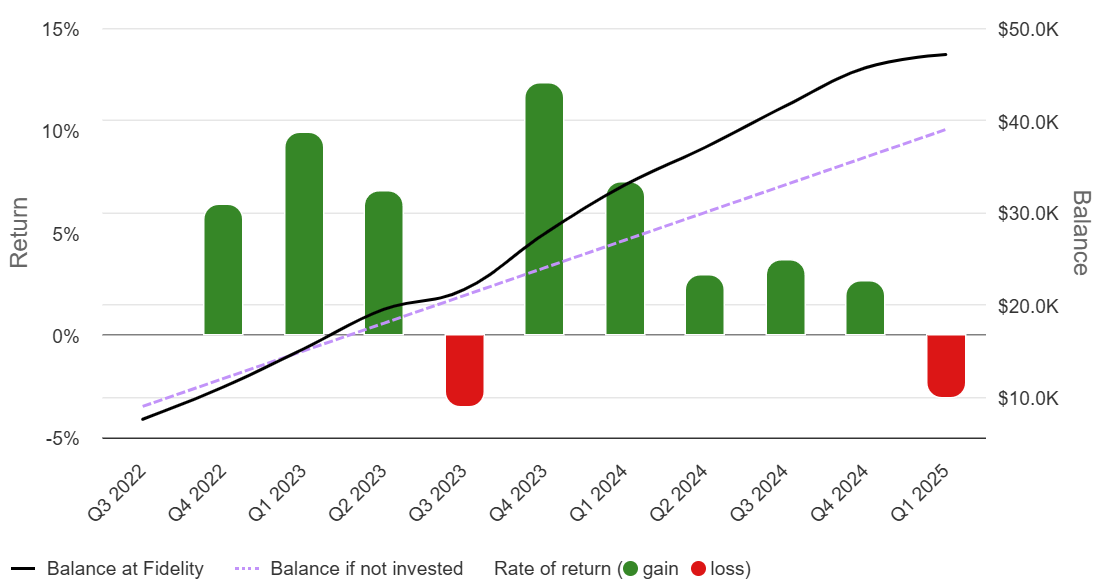

2025 March ($47,100)

I deposit $1000/mo into a Fidelity investment account, $39,000 total since 2022. I try to pick stocks to hold until retirement.

| Fund | 1-month | 3-month | 1 Year |

|---|---|---|---|

| My Fund | -5.8% | -3.1% | 6.2% |

| S&P 500 | -5.6% | -4.3% | 8.3% |

| Dow Jones | -5.9% | -4.9% | 7.1% |

Oof.

I removed four category labels: Cars (now Industry), Food (now retail), Coms (now Media) and Travel (a mix). And I cleaned up how dividends are calculated (after fees).

Sold

I sold five stocks this month, bye to Health Insurance and a few companies I don’t understand. I’ve exited 129 positions, far from thinking I’d never sell.

| %pos> | thismo | shrs | cost | value | %price | $div-f | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -100% | -$98 | 0 | $ (7) | $ - | 8% | $ 5 | VICI | 5.3% | VICI PPTYS | 0.0% | finance | USA | land |

| -100% | -$119 | 0 | $ 11 | $ - | -4% | $ 3 | UNH | 1.3% | UNITEDHEALT | 0.0% | health | USA | insure |

| -100% | -$37 | 0 | $ 7 | $ - | -7% | $ 11 | DOW | 10.9% | DOW INC COM | 0.0% | industry | USA | chem |

| -100% | -$90 | 0 | $ (9) | $ - | 11% | $ - | SNOW | 0.0% | SNOWFLAKE I | 0.0% | tech | USA | cloud |

| -100% | -$43 | 0 | $ 3 | $ - | -3% | $ - | ARM | 0.0% | ARM HOLDIN | 0.0% | tech | Europe | hw |

Bought

92 different stocks, including a few new healthcare companies. I’m taking $150 bites of NVDA, and still I’m under half the weight of the S&P 500.

| # | %pos> | thismo | shrs | cost | value | %price | $div-f | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1% | $48 | 17.95 | $ 3,365 | $ 3,987 | 19% | $ 19 | AAPL | 0.6% | APPLE INC | 8.5% | multi | USA | tech |

| 2 | 1% | $48 | 9.24 | $ 3,595 | $ 3,469 | -4% | $ 28 | MSFT | 0.8% | MICROSOFT C | 7.4% | multi | USA | tech |

| 4 | 2% | $43 | 15 | $ 2,621 | $ 2,854 | 9% | $ - | AMZN | 0.0% | AMAZON.COM | 6.1% | multi | USA | tech |

| 5 | 2% | $43 | 18 | $ 2,465 | $ 2,812 | 14% | $ 12 | GOOG | 0.5% | ALPHABET IN | 6.0% | multi | USA | tech |

| 6 | 3% | $52 | 3.39 | $ 1,396 | $ 1,805 | 29% | $ - | BRK.B | 0.0% | BERKSHIRE H | 3.8% | multi | USA | |

| 7 | 2% | $18 | 4.9 | $ 532 | $ 813 | 53% | $ 9 | TSM | 1.8% | TAIWAN SEMI | 1.7% | tech | Asia | sc’s |

| 8 | 1% | $10 | 16.4 | $ 993 | $ 810 | -18% | $ 23 | OXY | 2.3% | OCCIDENTAL | 1.7% | energy | USA | oil |

| 11 | 2% | $11 | 1.98 | $ 550 | $ 694 | 26% | $ 3 | V | 0.6% | VISA INC | 1.5% | finance | USA | credit |

| 12 | 28% | $153 | 6.4 | $ 650 | $ 694 | 7% | $ 0 | NVDA | 0.0% | NVIDIA CORP | 1.5% | tech | USA | sc’s |

| 14 | 2% | $12 | 1.17 | $ 551 | $ 641 | 16% | $ 2 | MA | 0.4% | MASTERCARD | 1.4% | finance | USA | credit |

| 24 | 5% | $17 | 2.3 | $ 361 | $ 381 | 6% | $ 8 | JNJ | 2.2% | JOHNSON &JO | 0.8% | health | USA | goods |

| 25 | 7% | $25 | 1 | $ 348 | $ 369 | 6% | $ - | CHTR | 0.0% | CHARTER COM | 0.8% | media | USA | coms |

| 29 | 4% | $11 | 2.7 | $ 302 | $ 321 | 6% | $ 13 | XOM | 4.4% | EXXON MOBIL | 0.7% | energy | USA | oil |

| 31 | 8% | $22 | 0.45 | $ 354 | $ 298 | -16% | $ 1 | ASML | 0.3% | ASML HOLDIN | 0.6% | tech | Europe | sc’s |

| 32 | 5% | $15 | 1.1 | $ 251 | $ 296 | 18% | $ 2 | AXP | 0.9% | AMERICAN EX | 0.6% | finance | USA | credit |

| 38 | 4% | $11 | 3.55 | $ 227 | $ 254 | 12% | $ 5 | KO | 2.3% | COCA-COLA C | 0.5% | retail | USA | food |

| 39 | 4% | $10 | 1.51 | $ 225 | $ 253 | 12% | $ 2 | AVGO | 0.8% | BROADCOM IN | 0.5% | tech | USA | sc’s |

| 41 | 3% | $8 | 1.6 | $ 188 | $ 246 | 31% | $ 8 | QCOM | 4.1% | QUALCOMM IN | 0.5% | tech | USA | sc’s |

| 42 | 7% | $15 | 8.5 | $ 242 | $ 235 | -3% | $ 17 | HPQ | 7.2% | HP INC COM | 0.5% | tech | USA | hw |

| 45 | 7% | $14 | 2.8 | $ 184 | $ 205 | 12% | $ 7 | SHEL | 3.8% | SHELL PLC S | 0.4% | energy | Europe | oil |

| 46 | 6% | $11 | 0.39 | $ 170 | $ 198 | 16% | $ 1 | SPGI | 0.8% | S&P GLOBAL | 0.4% | finance | USA | rating |

| 49 | 5% | $9 | 1.1 | $ 62 | $ 194 | 46% | $ 12 | TM | 4.3% | TOYOTA MOTO | 0.4% | industry | Asia | cars |

| 48 | 5% | $10 | 0.42 | $ 165 | $ 196 | 19% | $ 1 | MCO | 0.9% | MOODYS CORP | 0.4% | finance | USA | rating |

| 51 | 7% | $12 | 1.7 | $ 257 | $ 187 | -27% | $ 14 | UPS | 5.5% | UNITED PARC | 0.4% | industry | USA | post |

| 53 | 6% | $11 | 1.24 | $ 204 | $ 186 | -9% | $ 3 | PEP | 1.7% | PEPSICO INC | 0.4% | retail | USA | food |

| 52 | 96% | $91 | 2 | $ 172 | $ 187 | 9% | $ 2 | ITOCY | 1.1% | ITOCHU ADR | 0.4% | industry | Asia | multi |

| 55 | 5% | $8 | 1.3 | $ 175 | $ 182 | 4% | $ 1 | ORCL | 0.8% | ORACLE CORP | 0.4% | tech | USA | cloud |

| 56 | 6% | $11 | 0.19 | $ 148 | $ 180 | 21% | $ 1 | COST | 0.5% | COSTCO WHOL | 0.4% | retail | USA | food |

| 57 | 5% | $9 | 1.05 | $ 165 | $ 179 | 9% | $ 4 | PG | 2.5% | PROCTER AND | 0.4% | retail | USA | health |

| 60 | 8% | $13 | 0.65 | $ 128 | $ 173 | 35% | $ 1 | TMUS | 1.0% | T-MOBILE US | 0.4% | media | USA | coms |

| 61 | 7% | $12 | 0.64 | $ 176 | $ 172 | -3% | $ 1 | CRM | 0.3% | SALESFORCE | 0.4% | tech | USA | cloud |

| 64 | 17% | $23 | 2.35 | $ 152 | $ 159 | 4% | $ 5 | CVS | 2.6% | CVS HEALTH | 0.3% | retail | USA | health |

| 66 | 6% | $9 | 0.4 | $ 214 | $ 153 | -28% | $ - | ADBE | 0.0% | ADOBE INC C | 0.3% | tech | USA | sw |

| 65 | 7% | $11 | 1.7 | $ 183 | $ 155 | -15% | $ (0) | BNTX | 0.0% | BIONTECH SE | 0.3% | health | Europe | biotech |

| 68 | 7% | $10 | 3.2 | $ 44 | $ 150 | 29% | $ 7 | GM | 1.8% | GENERAL MTR | 0.3% | industry | USA | cars |

| 69 | 14% | $18 | 4 | $ 147 | $ 148 | 0% | $ 9 | CMCSA | 6.0% | COMCAST COR | 0.3% | media | USA | coms |

| 71 | 8% | $10 | 0.7 | $ 172 | $ 143 | -16% | $ 0 | DHR | 0.2% | DANAHER COR | 0.3% | health | USA | industry |

| 70 | 8% | $10 | 1.4 | $ 204 | $ 144 | -30% | $ - | AMD | 0.0% | ADVANCED MI | 0.3% | tech | USA | sc’s |

| 79 | 25% | $27 | 0.3 | $ 146 | $ 134 | -8% | $ 2 | LMT | 1.5% | LOCKHEED MA | 0.3% | industry | USA | aero |

| 80 | 7% | $9 | 0.43 | $ 128 | $ 134 | 5% | $ 2 | AMGN | 1.7% | AMGEN INC | 0.3% | health | USA | pharm |

| 83 | 11% | $12 | 0.55 | $ 133 | $ 130 | -2% | $ 1 | UNP | 0.9% | UNION PAC C | 0.3% | industry | USA | rail |

| 82 | 9% | $11 | 0.65 | $ 135 | $ 131 | -3% | $ 2 | ADI | 1.4% | ANALOG DEVI | 0.3% | tech | USA | sc’s |

| 84 | 9% | $11 | 0.25 | $ 142 | $ 124 | -12% | $ 0 | TMO | 0.1% | THERMO FISH | 0.3% | health | USA | tech |

| 86 | 8% | $9 | 0.4 | $ 110 | $ 121 | 10% | $ 1 | CB | 0.5% | CHUBB LIMI | 0.3% | finance | USA | insure |

| 89 | 9% | $9 | 1.1 | $ 119 | $ 116 | -3% | $ 2 | COP | 1.4% | CONOCOPHIL | 0.2% | energy | USA | oil |

| 90 | 8% | $9 | 1.2 | $ 121 | $ 110 | -9% | $ (0) | BIDU | 0.0% | BAIDU INC S | 0.2% | tech | China | sw |

| 91 | 8% | $8 | 1.5 | $ 106 | $ 109 | 3% | $ - | UBER | 0.0% | UBER TECHNO | 0.2% | tech | USA | car |

| 92 | 12% | $11 | 0.9 | $ 103 | $ 107 | 4% | $ (0) | PDD | 0.0% | PDD HOLDING | 0.2% | tech | China | retail |

| 94 | 11% | $11 | 0.5 | $ 105 | $ 106 | 1% | $ 1 | HON | 1.0% | HONEYWELL I | 0.2% | industry | USA | aero |

| 95 | 14% | $12 | 1.6 | $ 102 | $ 104 | 1% | $ 1 | TTE | 1.3% | TOTAL ENER | 0.2% | energy | Europe | oil |

| 96 | 10% | $9 | 0.33 | $ 92 | $ 103 | 12% | $ 2 | MCD | 2.3% | MCDONALD S | 0.2% | retail | USA | food |

| 97 | 11% | $10 | 0.44 | $ 109 | $ 103 | -6% | $ 1 | LOW | 0.9% | LOWES COMPA | 0.2% | retail | USA | home |

| 98 | 13% | $12 | 0.18 | $ 100 | $ 102 | 2% | $ 1 | MSCI | 0.6% | MSCI INC | 0.2% | finance | USA | indices |

| 101 | 14% | $12 | 0.16 | $ 102 | $ 98 | -3% | $ 1 | INTU | 0.4% | INTUIT INC | 0.2% | finance | USA | tech |

| 105 | 12% | $10 | 0.29 | $ 103 | $ 96 | -8% | $ 1 | CAT | 0.8% | CATERPILLAR | 0.2% | industry | USA | farm |

| 107 | 13% | $10 | 0.45 | $ 78 | $ 94 | 21% | $ 1 | ABBV | 1.7% | ABBVIE INC | 0.2% | health | USA | pharm |

| 108 | 12% | $10 | 0.02 | $ 85 | $ 92 | 8% | $ 0 | BKNG | 0.2% | BOOKING HO | 0.2% | tech | USA | hotel |

| 109 | 12% | $10 | 0.5 | $ 79 | $ 91 | 16% | $ - | DASH | 0.0% | DOORDASH I | 0.2% | retail | USA | tech |

| 113 | 14% | $11 | 2.66 | $ 93 | $ 90 | -3% | $ 4 | BP | 4.2% | BP PLC SPON | 0.2% | energy | Europe | oil |

| 112 | 13% | $10 | 0.45 | $ 80 | $ 90 | 13% | $ 0 | GE | 0.2% | GE AEROSPA | 0.2% | industry | America | aero |

| 111 | 11% | $9 | 1.3 | $ 152 | $ 90 | -41% | $ 0 | NVO | 0.2% | NOVO NORDIS | 0.2% | health | Europe | pharm |

| 115 | 11% | $9 | 1 | $ 109 | $ 90 | -18% | $ 1 | MRK | 0.9% | MERCK &CO. | 0.2% | health | America | pharm |

| 116 | 14% | $11 | 0.75 | $ 83 | $ 88 | 6% | $ 0 | VST | 0.3% | VISTRA COR | 0.2% | energy | USA | nuclear |

| 117 | 13% | $10 | 0.43 | $ 98 | $ 87 | -12% | $ 0 | CEG | 0.3% | CONSTELLAT | 0.2% | energy | USA | nuclear |

| 120 | 16% | $12 | 0.23 | $ 89 | $ 84 | -5% | $ 1 | HD | 1.4% | HOME DEPOT | 0.2% | retail | USA | home |

| 122 | 14% | $10 | 0.8 | $ 78 | $ 82 | 5% | $ 2 | NTES | 2.0% | NETEASE INC | 0.2% | tech | China | games |

| 121 | 13% | $9 | 0.045 | $ 59 | $ 83 | 40% | $ - | FICO | 0.0% | FAIR ISAAC | 0.2% | finance | USA | credit |

| 123 | 11% | $8 | 1 | $ 82 | $ 82 | 0% | $ 1 | PEG | 0.9% | PUBLIC SVC | 0.2% | energy | USA | nuclear |

| 124 | 15% | $11 | 0.55 | $ 86 | $ 80 | -7% | $ 1 | MPC | 0.7% | MARATHON P | 0.2% | energy | USA | oil |

| 125 | 20% | $13 | 0.6 | $ 73 | $ 79 | 8% | $ 0 | RTX | 0.5% | RTX CORPOR | 0.2% | industry | USA | aero |

| 128 | 16% | $11 | 0.31 | $ 83 | $ 76 | -9% | $ 1 | FDX | 0.7% | FEDEX CORP | 0.2% | industry | USA | post |

| 129 | 14% | $9 | 0.8 | $ 73 | $ 75 | 3% | $ 1 | CL | 1.0% | COLGATE-PAL | 0.2% | retail | USA | clean |

| 130 | 19% | $12 | 0.6 | $ 64 | $ 73 | 15% | $ 1 | DUK | 1.9% | DUKE ENERG | 0.2% | energy | Europe | util |

| 137 | 25% | $13 | 0.5 | $ 71 | $ 66 | -8% | $ 1 | VLO | 1.6% | VALERO ENER | 0.1% | energy | USA | oil |

| 136 | 16% | $9 | 0.08 | $ 66 | $ 66 | 0% | $ 0 | LLY | 0.4% | ELI LILLY & | 0.1% | health | USA | pharm |

| 139 | 16% | $9 | 0.7 | $ 56 | $ 64 | 14% | $ 1 | SO | 2.0% | SOUTHERN C | 0.1% | energy | USA | util |

| 140 | 17% | $9 | 0.08 | $ 59 | $ 64 | 8% | $ - | NOW | 0.0% | SERVICENOW | 0.1% | tech | USA | cloud |

| 144 | 27% | $12 | 0.15 | $ 54 | $ 56 | 3% | $ 0 | SYK | 0.2% | STRYKER CO | 0.1% | health | USA | tech |

| 145 | 25% | $11 | 0.5 | $ 51 | $ 56 | 10% | $ - | NVS | 0.0% | NOVARTIS A | 0.1% | health | Europe | biotech |

| 147 | 37% | $15 | 4 | $ 56 | $ 54 | -2% | $ 0 | FANUY | 0.8% | FANUC CORPO | 0.1% | industry | Asia | robo |

| 148 | 22% | $10 | 0.11 | $ 50 | $ 53 | 7% | $ - | VRTX | 0.0% | VERTEX PHA | 0.1% | health | USA | pharm |

| 149 | 23% | $10 | 0.6 | $ 46 | $ 53 | 14% | $ 0 | WMT | 0.5% | WALMART INC | 0.1% | retail | USA | food |

| 157 | 50% | $15 | 3 | $ 53 | $ 43 | -18% | $ 2 | WDS | 3.6% | WOODSIDE EN | 0.1% | energy | Australia | oil |

| 159 | 44% | $13 | 0.15 | $ 37 | $ 42 | 14% | $ - | COR | 0.0% | CENCORA IN | 0.1% | health | USA | tech |

| 163 | 45% | $13 | 0.15 | $ 38 | $ 41 | 8% | $ - | GD | 0.0% | GENERAL DY | 0.1% | industry | USA | aero |

| 165 | 46% | $13 | 0.06 | $ 37 | $ 40 | 10% | $ - | MCK | 0.0% | MCKESSON C | 0.1% | health | USA | tech |

| 168 | 35% | $9 | 0.07 | $ 32 | $ 36 | 11% | $ 0 | NOC | 0.3% | NORTHROP G | 0.1% | industry | USA | aero |

| 171 | 55% | $12 | 0.45 | $ 35 | $ 33 | -7% | $ - | LRCX | 0.0% | LAM RESEAR | 0.1% | tech | USA | sc’s |

| 172 | 38% | $8 | 0.2 | $ 35 | $ 29 | -16% | $ 0 | AMAT | 0.2% | APPLIED MA | 0.1% | tech | USA | sc’s |

| 175 | new | $15 | 0.1 | $ 15 | $ 14 | -7% | $ - | NTRA | 0.0% | NATERA INC | 0.0% | health | USA | testing |

| 176 | new | $10 | 0.02 | $ 10 | $ 10 | -2% | $ - | ISRG | 0.0% | INTUITIVE | 0.0% | health | USA | robo |

| 177 | new | $5 | 0.05 | $ 5 | $ 5 | 1% | $ - | BSX | 0.0% | BOSTON SCI | 0.0% | health | USA | tech |

All Holdings

See the attached PDF of my holdings, it’s colorful.