I deposit $1000/mo into a Fidelity investment account, $34,000 total since 2022. I try to pick stocks to hold until retirement.

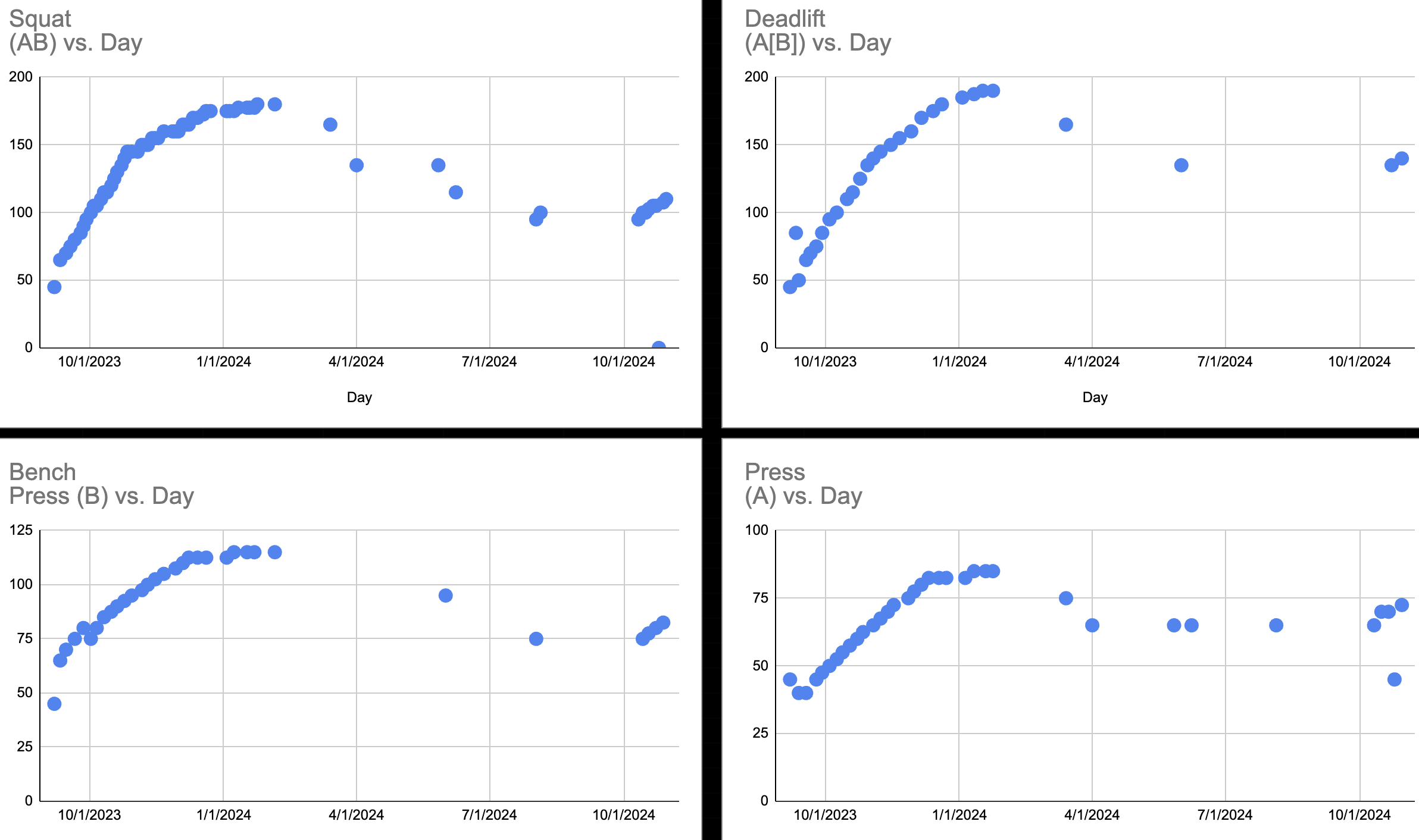

While we’re looking at graphs, I’ve been back in the gym. (I was laid off in February fwiw.)

My favorite book this month is Angela T. Davis, Women, Race & Class (243 pages)

| Fund | 1-month | 3-month | YTD | 1-year |

|---|---|---|---|---|

| My Fund | -1% | 1.9% | 13.5% | 34.1% |

| S&P 500 | -0.9% | 3.7% | 21% | 38% |

| Dow Jones | -0.7% | 3.5% | 19.8% | 38% |

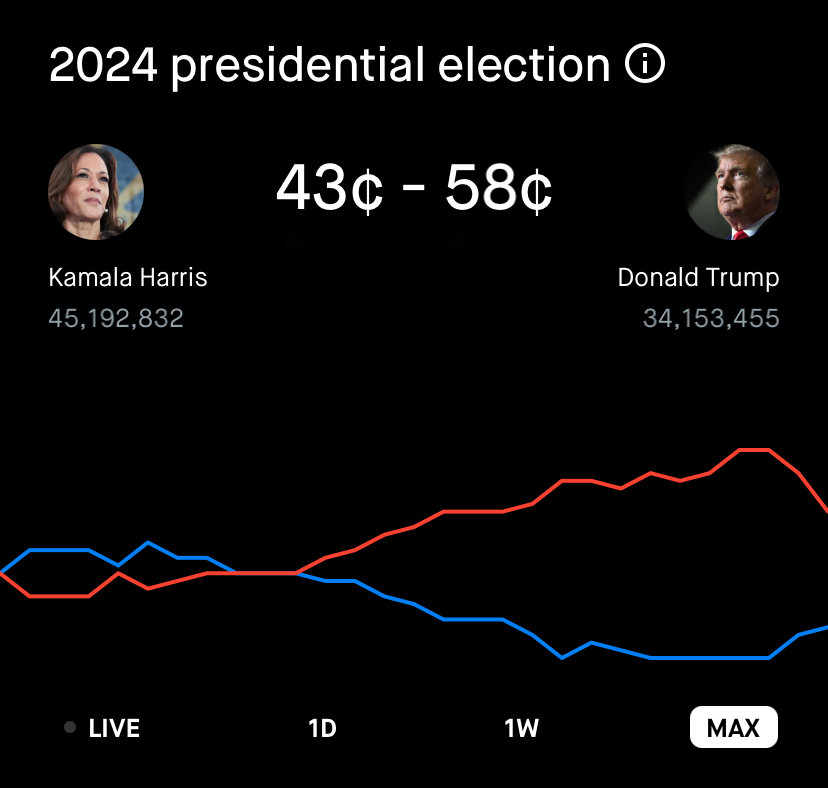

Robinhood released a betting market for the election, which they only announced a few days ago. (Many Bothans died in the crunch for this feature.)

I wish I knew more about bookie math, but this must be a lucrative feature. We’ll see more of this stuff.

The mainstreaminization of election betting is unsettling, paired with apps like Robinhood that enable meme-timing and rug pulls. I don’t like this thumb on the scales of elections.

Imagine a January 6th backed by a shitcoin. Picture an NFL game stormed by fans securing their bag, or a coach throwing a game. Rigged events are staggeringly more profitable than uncontrolled ones. Dangerous.

I hope I’m just overvaluing the impact of my own discipline and the research I’ve been doing for my book. See you on the other side.

Anyway, I heard Costco is making up to $200 million a month selling gold bars, and they’re expanding into platinum.

And SMCI is down a bunch after they reported their auditor resigned. I saw they were 11% of NVDA’s revenue, their 3rd largest customer. I think I hadn’t bought them because they looked inflated, but now they look cheap - if they don’t go under, I guess.

Airlines Check In

Let’s check in on my airlines, it’s been about a year since I got into them.

| shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 3.2 | $ 117 | $ 183 | $ 68 | 58% | DAL | 1.5% | DELTA AIR L | 0.4% | travel | USA | air |

| 2.2 | $ 88 | $ 172 | $ 84 | 95% | UAL | 0.0% | UNITED AIRL | 0.4% | travel | USA | air |

| 2 | $ 54 | $ 61 | $ 9 | 13% | LUV | 2.4% | SOUTHWEST A | 0.1% | travel | USA | air |

| 0 | $ (0) | $ - | $ 0 | 0% | ALK | 0.0% | ALASKA AIR | 0.0% | travel | USA | air |

| 0 | $ 18 | $ - | $ (18) | -22% | AAL | 0.0% | AMERICAN AI | 0.0% | travel | USA | air |

| 0 | $ (3) | $ - | $ 3 | 9% | JBLU | 0.0% | JETBLUE AWY | 0.0% | travel | USA | air |

| 0 | $ 31 | $ - | $ (29) | -36% | ALGT | 1.9% | ALLEGIANT T | 0.0% | travel | USA | air |

| 0 | $ 27 | $ - | $ (26) | -60% | SAVE | 2.2% | SPIRIT AIRL | 0.0% | travel | USA | air |

I sold off most of them, but held onto the larger ones, mostly Delta and United, and they had a good month. It looks like I “should have” held on to Alaska, American, and Jet Blue as well.

Travel continues to be my most profitable category by percent gained.

| cat | gain% | gain$ |

|---|---|---|

| multi | 32% | $3,985 |

| finance | 28% | $1,894 |

| tech | 21% | $1,233 |

| health | -8% | -$271 |

| energy | -3% | -$94 |

| coms | 12% | $178 |

| industry | 6% | $140 |

| food | 5% | $61 |

| cars | 32% | $449 |

| travel | 47% | $823 |

| retail | -15% | -$311 |

| media | -7% | -$91 |

| ETF | 9% | $92 |

My overall strategy was not to try to time the market, but I couldn’t help myself in this category, and here we are. Lesson learned? I’m more willing to hold airlines long term than I was with cruises, but I haven’t made up my mind.

Exits

Speaking of cruises, I left 20 more positions this month, continuing my quest to consolidate.

| thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -$19 | 0 | $ 0 | $ 0 | $ 0 | 0% | SCHW | 1.1% | SCHWAB CHAR | 0.0% | finance | USA | bank |

| -$20 | 0 | $ (5) | $ 0 | $ 5 | 35% | KKR | 0.5% | KKR &CO INC | 0.0% | multi | USA | invest |

| -$34 | 0 | $ (8) | $ - | $ 8 | 15% | BUD | 1.6% | ANHEUSER-BU | 0.0% | food | Europe | beer |

| -$25 | 0 | $ 98 | $ - | $ (98) | -39% | WBD | 0.0% | WARNER BROS | 0.0% | media | USA | |

| -$24 | 0 | $ 3 | $ - | $ (3) | -10% | GMAB | 0.0% | GENMAB AS S | 0.0% | health | Europe | biotech |

| -$24 | 0 | $ 12 | $ - | $ (9) | -15% | NTR | 4.1% | NUTRIEN LTD | 0.0% | industry | America | fertal |

| -$24 | 0 | $ (4) | $ - | $ 4 | 19% | AZPN | 0.0% | ASPEN TECHN | 0.0% | industry | USA | sw |

| -$23 | 0 | $ (20) | $ - | $ 35 | 46% | OMF | 19.8% | ONEMAIN HLD | 0.0% | finance | USA | insure |

| -$23 | 0 | $ (3) | $ - | $ 3 | 7% | ORLY | 0.0% | OREILLY AUT | 0.0% | cars | USA | parts |

| -$23 | 0 | $ (4) | $ - | $ 4 | 23% | MS | 2.1% | MORGAN STAN | 0.0% | finance | USA | bank |

| -$21 | 0 | $ (70) | $ - | $ 70 | 37% | NCLH | 0.0% | NORWEGIAN C | 0.0% | travel | USA | cruise |

| -$20 | 0 | $ 110 | $ - | $ (91) | -44% | WB | 8.9% | WEIBO ADR R | 0.0% | tech | China | sw |

| -$19 | 0 | $ (8) | $ - | $ 8 | 29% | AMT | 1.2% | AMERICAN TO | 0.0% | coms | USA | reit |

| -$19 | 0 | $ (95) | $ - | $ 95 | 66% | CCL | 0.0% | CARNIVAL CO | 0.0% | travel | USA | cruise |

| -$17 | 0 | $ 10 | $ - | $ (9) | -36% | DG | 0.9% | DOLLAR GEN | 0.0% | retail | USA | |

| -$17 | 0 | $ (80) | $ - | $ 80 | 58% | CUK | 0.0% | CARNIVAL AD | 0.0% | travel | USA | cruise |

| -$15 | 0 | $ (1) | $ - | $ 1 | 7% | MTD | 0.0% | METTLER-TO | 0.0% | industry | USA | science |

| -$13 | 0 | $ (3) | $ - | $ 3 | 35% | BN | 0.6% | BROOKFIELD | 0.0% | finance | America | invest |

| -$12 | 0 | $ (2) | $ - | $ 2 | 23% | BAM | 2.7% | BROOKFIELD | 0.0% | finance | USA | invest |

| -$11 | 0 | $ (2) | $ - | $ 2 | 17% | WAT | 0.0% | WATERS COR | 0.0% | industry | USA | science |

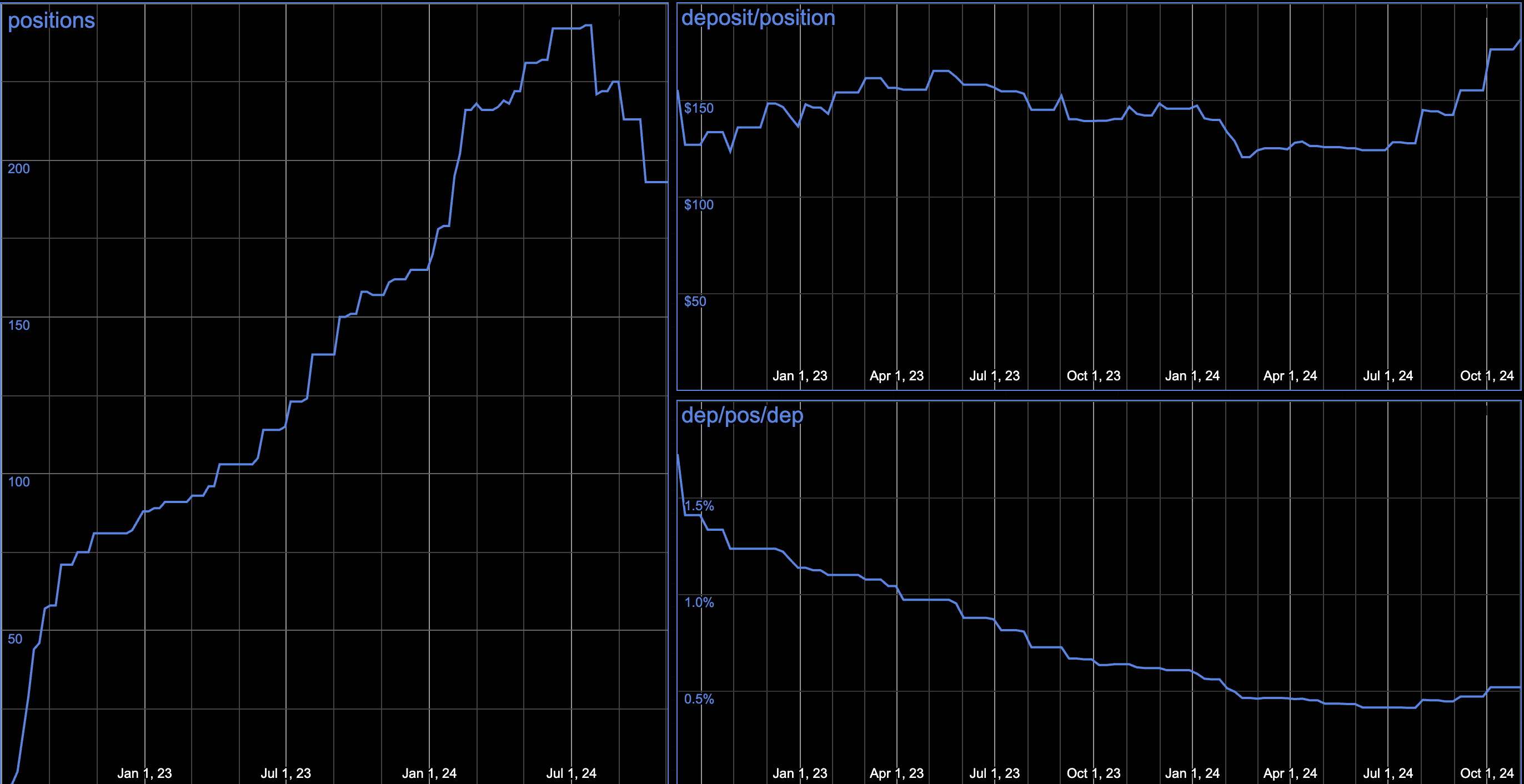

Here are the graphs I use to track my consolidation.

I’m back under 200 positions. My average position size (relative to how much I’ve deposited rather than the current value of my account) is higher than it was at the start of 2023, and that average size is a little over 0.5% of my total account.

There’s more consolidation to go, and I’m still not quite sure where it’ll settle out, but it’s exciting to watch.

Reduced

These are the positions I’m getting ready to exit, slow and steady.

| %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -26% | -$27 | 0.6 | $ 10 | $ 76 | $ 74 | 34% | CE | 3.8% | CELANESE CO | 0.2% | industry | USA | chem |

| -26% | -$19 | 0.75 | $ 46 | $ 54 | $ 8 | 12% | OKTA | 0.0% | OKTA INC CL | 0.1% | tech | USA | secure |

| -46% | -$44 | 0.25 | $ (376) | $ 52 | $ 428 | 261% | RCL | 0.1% | ROYAL CARIB | 0.1% | travel | USA | cruise |

| -35% | -$27 | 0.5 | $ 25 | $ 50 | $ 27 | 33% | MKSI | 2.2% | MKS INSTRS | 0.1% | industry | USA | sc’s |

| -33% | -$21 | 1.5 | $ 32 | $ 42 | $ 14 | 19% | SCHD | 4.6% | SCHWAB US D | 0.1% | ETF | USA | |

| -34% | -$21 | 0.5 | $ 28 | $ 41 | $ 15 | 22% | CF | 3.3% | CF INDUSTRI | 0.1% | industry | USA | fertal |

| -35% | -$19 | 0.5 | $ 24 | $ 36 | $ 12 | 16% | KMX | 0.0% | CARMAX INC | 0.1% | cars | USA | used |

| -47% | -$24 | 1 | $ 73 | $ 27 | $ (46) | -21% | SIRI | 0.0% | LIBERTY MED | 0.1% | media | USA | liberty |

| -51% | -$22 | 0.04 | $ 20 | $ 22 | $ 1 | 3% | ROP | 0.3% | ROPER TECHN | 0.1% | industry | USA | science |

Bought

I expanded 66 different positions this month. That’s still a lot, and I’m going to have to narrow my focus as my selling slows down.

| # | %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 7% | $230 | 16 | $ 2,916 | $ 3,615 | $ 709 | 24% | AAPL | 0.4% | APPLE INC | 8.6% | multi | USA | tech |

| 2 | 7% | $214 | 8.2 | $ 3,162 | $ 3,332 | $ 183 | 6% | MSFT | 0.4% | MICROSOFT C | 7.9% | multi | USA | tech |

| 4 | 7% | $169 | 15.8 | $ 2,072 | $ 2,728 | $ 661 | 32% | GOOG | 0.3% | ALPHABET IN | 6.5% | multi | USA | tech |

| 5 | 8% | $185 | 13.3 | $ 2,258 | $ 2,476 | $ 218 | 10% | AMZN | 0.0% | AMAZON.COM | 5.9% | multi | USA | tech |

| 6 | 4% | $46 | 2.7 | $ 1,074 | $ 1,217 | $ 143 | 13% | BRK.B | 0.0% | BERKSHIRE H | 2.9% | multi | USA | |

| 7 | 2% | $18 | 4.6 | $ 474 | $ 876 | $ 411 | 87% | TSM | 1.9% | TAIWAN SEMI | 2.1% | tech | Asia | sc’s |

| 12 | 11% | $50 | 1 | $ 461 | $ 500 | $ 40 | 9% | MA | 0.1% | MASTERCARD | 1.2% | finance | USA | credit |

| 13 | 13% | $55 | 1.7 | $ 462 | $ 493 | $ 31 | 7% | V | 0.2% | VISA INC | 1.2% | finance | USA | credit |

| 19 | 6% | $24 | 3.2 | $ 259 | $ 425 | $ 166 | 64% | NVDA | 0.0% | NVIDIA CORP | 1.0% | tech | USA | sc’s |

| 34 | 5% | $13 | 0.8 | $ 275 | $ 262 | $ (13) | -5% | CHTR | 0.0% | CHARTER COM | 0.6% | coms | USA | |

| 35 | 5% | $11 | 12 | $ 403 | $ 258 | $ (129) | -32% | INTC | 3.9% | INTEL CORP | 0.6% | tech | USA | sc’s |

| 36 | 5% | $12 | 2.2 | $ 246 | $ 257 | $ 19 | 8% | XOM | 3.5% | EXXON MOBIL | 0.6% | energy | USA | oil |

| 37 | 5% | $12 | 0.44 | $ 229 | $ 248 | $ 21 | 9% | UNH | 0.9% | UNITEDHEALT | 0.6% | health | USA | insure |

| 40 | 6% | $14 | 0.85 | $ 177 | $ 230 | $ 54 | 30% | AXP | 0.6% | AMERICAN EX | 0.5% | finance | USA | credit |

| 41 | 17% | $32 | 1.4 | $ 224 | $ 224 | $ 3 | 2% | JNJ | 1.4% | JOHNSON &JO | 0.5% | health | USA | tech |

| 43 | 9% | $17 | 1.2 | $ 166 | $ 204 | $ 39 | 24% | AVGO | 0.7% | BROADCOM IN | 0.5% | tech | USA | sc’s |

| 47 | 10% | $17 | 1.1 | $ 141 | $ 185 | $ 45 | 32% | ORCL | 0.6% | ORACLE CORP | 0.4% | tech | USA | cloud |

| 51 | 9% | $14 | 2.7 | $ 172 | $ 176 | $ 8 | 5% | KO | 2.2% | COCA-COLA C | 0.4% | food | USA | cola |

| 64 | 10% | $14 | 0.5 | $ 132 | $ 146 | $ 14 | 11% | CRM | 0.2% | SALESFORCE | 0.3% | tech | USA | cloud |

| 66 | 8% | $10 | 0.3 | $ 167 | $ 143 | $ (24) | -14% | ADBE | 0.0% | ADOBE INC C | 0.3% | tech | USA | sw |

| 67 | 6% | $9 | 1.8 | $ 134 | $ 143 | $ 12 | 9% | NEE | 2.2% | NEXTERA ENE | 0.3% | energy | USA | util |

| 69 | 9% | $12 | 0.84 | $ 143 | $ 140 | $ (1) | -1% | PEP | 1.6% | PEPSICO INC | 0.3% | food | USA | cola |

| 71 | 45% | $41 | 0.2 | $ 175 | $ 135 | $ (40) | -23% | ASML | 0.1% | ASML HOLDIN | 0.3% | tech | Europe | sc’s |

| 74 | 14% | $16 | 0.9 | $ 142 | $ 130 | $ (12) | -9% | AMD | 0.0% | ADVANCED MI | 0.3% | tech | USA | sc’s |

| 75 | 12% | $13 | 1.9 | $ 124 | $ 128 | $ 8 | 6% | SHEL | 2.9% | SHELL PLC S | 0.3% | energy | Europe | oil |

| 76 | 11% | $11 | 0.5 | $ 102 | $ 112 | $ 10 | 10% | ADI | 0.7% | ANALOG DEVI | 0.3% | tech | USA | sc’s |

| 77 | 14% | $14 | 0.45 | $ 115 | $ 111 | $ (4) | -3% | DHR | 0.2% | DANAHER COR | 0.3% | industry | USA | health |

| 79 | 11% | $10 | 0.45 | $ 81 | $ 100 | $ 20 | 24% | TMUS | 0.4% | T-MOBILE US | 0.2% | coms | USA | |

| 86 | 16% | $13 | 0.23 | $ 90 | $ 93 | $ 3 | 3% | DE | 0.5% | DEERE & CO | 0.2% | industry | USA | farm |

| 89 | 15% | $12 | 0.8 | $ 104 | $ 90 | $ (14) | -13% | NVO | 0.4% | NOVO NORDIS | 0.2% | health | Europe | pharm |

| 91 | 17% | $13 | 0.65 | $ 89 | $ 88 | $ (1) | -2% | ABNB | 0.0% | AIRBNB INC | 0.2% | travel | USA | rent |

| 92 | 16% | $12 | 0.16 | $ 79 | $ 87 | $ 9 | 11% | LMT | 1.0% | LOCKHEED MA | 0.2% | industry | USA | aero |

| 93 | 17% | $12 | 0.37 | $ 91 | $ 86 | $ (4) | -4% | UNP | 0.7% | UNION PAC C | 0.2% | industry | USA | rail |

| 94 | 13% | $10 | 0.26 | $ 79 | $ 83 | $ 5 | 6% | AMGN | 0.7% | AMGEN INC | 0.2% | health | USA | pharm |

| 96 | 15% | $11 | 0.4 | $ 73 | $ 83 | $ 11 | 15% | IBM | 0.8% | INTERNATIO | 0.2% | tech | USA | cloud |

| 97 | 15% | $11 | 0.9 | $ 95 | $ 82 | $ (13) | -13% | BIDU | 0.0% | BAIDU INC S | 0.2% | tech | China | sw |

| 98 | 18% | $12 | 0.15 | $ 87 | $ 82 | $ (5) | -5% | TMO | 0.1% | THERMO FISH | 0.2% | health | USA | tech |

| 100 | 18% | $12 | 1.4 | $ 98 | $ 79 | $ (17) | -14% | CVS | 1.9% | CVS HEALTH | 0.2% | retail | USA | health |

| 104 | 14% | $9 | 0.8 | $ 67 | $ 71 | $ 6 | 8% | MDT | 1.1% | MEDTRONIC P | 0.2% | health | Europe | devices |

| 105 | 20% | $12 | 0.12 | $ 64 | $ 69 | $ 4 | 7% | MSCI | 0.1% | MSCI INC | 0.2% | finance | USA | indices |

| 106 | 20% | $11 | 0.6 | $ 65 | $ 68 | $ 3 | 5% | ABT | 0.3% | ABBOTT LAB | 0.2% | health | USA | tech |

| 108 | 21% | $12 | 0.24 | $ 66 | $ 68 | $ 2 | 3% | CB | 0.3% | CHUBB LIMI | 0.2% | finance | USA | insure |

| 110 | 20% | $11 | 0.6 | $ 68 | $ 66 | $ (2) | -3% | COP | 0.5% | CONOCOPHIL | 0.2% | energy | USA | oil |

| 113 | 21% | $11 | 0.24 | $ 58 | $ 63 | $ 5 | 9% | LOW | 0.6% | LOWES COMPA | 0.1% | retail | USA | home |

| 117 | 13% | $7 | 0.19 | $ 65 | $ 60 | $ (5) | -8% | CI | 0.6% | THE CIGNA G | 0.1% | health | USA | insure |

| 119 | 10% | $5 | 0.22 | $ 45 | $ 58 | $ 13 | 30% | CEG | 0.1% | CONSTELLAT | 0.1% | energy | USA | nuclear |

| 120 | 15% | $7 | 0.8 | $ 57 | $ 58 | $ 1 | 1% | UBER | 0.0% | UBER TECHNO | 0.1% | travel | USA | ride |

| 122 | 22% | $10 | 0.14 | $ 75 | $ 57 | $ (17) | -23% | ELV | 0.4% | ELEVANCE HE | 0.1% | health | USA | insure |

| 123 | 16% | $8 | 0.15 | $ 51 | $ 56 | $ 5 | 10% | CAT | 0.5% | CATERPILLAR | 0.1% | industry | USA | farm |

| 124 | 12% | $6 | 0.45 | $ 40 | $ 56 | $ 17 | 42% | VST | 0.3% | VISTRA COR | 0.1% | energy | USA | nuclear |

| 125 | 17% | $8 | 0.012 | $ 47 | $ 56 | $ 9 | 20% | BKNG | 0.2% | BOOKING HO | 0.1% | travel | USA | sw |

| 131 | 25% | $10 | 0.25 | $ 50 | $ 51 | $ 1 | 2% | HON | 0.4% | HONEYWELL I | 0.1% | industry | USA | aero |

| 132 | 29% | $11 | 0.5 | $ 60 | $ 51 | $ (9) | -14% | MRK | 0.6% | MERCK &CO. | 0.1% | health | America | pharm |

| 134 | 15% | $7 | 0.8 | $ 55 | $ 50 | $ (4) | -8% | TTE | 1.4% | TOTAL ENER | 0.1% | energy | Europe | oil |

| 139 | 21% | $8 | 0.12 | $ 45 | $ 47 | $ 3 | 7% | HD | 1.0% | HOME DEPOT | 0.1% | retail | USA | home |

| 140 | 12% | $5 | 0.9 | $ 41 | $ 47 | $ 6 | 14% | CCJ | 0.0% | CAMECO COR | 0.1% | energy | USA | nuclear |

| 147 | 51% | $15 | 1.5 | $ 47 | $ 46 | $ (1) | -1% | E | 1.2% | ENI ADR | 0.1% | energy | Europe | oil |

| 148 | 25% | $9 | 0.5 | $ 40 | $ 45 | $ 5 | 12% | PEG | 0.7% | PUBLIC SVC | 0.1% | energy | USA | nuclear |

| 150 | 28% | $9 | 0.25 | $ 42 | $ 43 | $ 1 | 2% | GE | 0.2% | GE AEROSPA | 0.1% | industry | America | aero |

| 151 | 38% | $12 | 4 | $ 50 | $ 43 | $ (4) | -7% | VALE | 7.1% | VALE S.A. S | 0.1% | industry | America | mine |

| 152 | 48% | $14 | 0.3 | $ 36 | $ 42 | $ 6 | 18% | ARM | 0.0% | ARM HOLDIN | 0.1% | tech | Europe | hw |

| 156 | 25% | $8 | 0.15 | $ 40 | $ 41 | $ 1 | 4% | FDX | 0.9% | FEDEX CORP | 0.1% | industry | USA | post |

| 159 | 22% | $7 | 0.25 | $ 33 | $ 39 | $ 6 | 20% | DASH | 0.0% | DOORDASH I | 0.1% | food | USA | delivery |

| 173 | 25% | $6 | 0.5 | $ 30 | $ 32 | $ 2 | 7% | HDB | 0.5% | HDFC BANK L | 0.1% | finance | Asia | bank |

| 178 | 40% | $8 | 0.2 | $ 34 | $ 29 | $ (5) | -15% | MPC | 0.0% | MARATHON P | 0.1% | energy | USA | oil |

| 185 | 66% | $10 | 0.3 | $ 31 | $ 24 | $ (6) | -20% | NTES | 1.3% | NETEASE INC | 0.1% | tech | China | games |

All Holdings

See the attached PDF of my holdings, it’s colorful. (BMWYY is going through an event that I’m still sorting out, so that data is off.)