I deposit $1000/mo into a Fidelity investment account, $32,000 total since 2022. I try to pick stocks to hold until retirement.

I’m still writing my book, and reading a lot, like On Writing, a collection of Hemingway quotes about writing, like to his executors: “It is my wish that none of these letters written by me during my lifetime shall be published. Accordingly, I hereby request and direct you not to publish or consent to the publication by others, of any such letters.”

| Fund | 1-month | 3-month | YTD | 1-year |

|---|---|---|---|---|

| My Fund | 0.5% | 3.6% | 12% | 20.6% |

| S&P 500 | 2.4% | 7.4% | 18% | 27.1% |

| Dow Jones | 2.1% | 7.3% | 15.7% | 26.2% |

Once again defeated by the market.

Here’s how the last month’s changes (most of July) looked on finviz on August 3rd:

That’s more big red squares than usual, and red semiconductors.

The Chipotle CEO moved to Starbucks, I own both. Starbucks is up 25% this month, my one share is +10%.

Exits

I exited 22 positions this month - the consolidation begins.

| thismo | cost | $gain | %gain | tkr | div | description | cat | area | type | MCbil |

|---|---|---|---|---|---|---|---|---|---|---|

| -$61 | $ 15 | $ (5) | -2% | TSN | 4.1% | TYSON FOODS | food | USA | meat | 23 |

| -$61 | $ 7 | $ (6) | -5% | AAP | 1.6% | ADVANCE AUTO | cars | USA | parts | 3 |

| -$45 | $ 31 | $ (29) | -36% | ALGT | 1.9% | ALLEGIANT TR | travel | USA | air | 1 |

| -$37 | $ (18) | $ 19 | 33% | NOV | 1.9% | NOV INC COM | industry | USA | oil | 7 |

| -$28 | $ 6 | $ (4) | -13% | BEPC | 4.2% | BROOKFIELD R | energy | USA | green | 5 |

| -$28 | $ 1 | $ 0 | 1% | CWEN | 5.6% | CLEARWAY ENE | energy | USA | green | 6 |

| -$27 | $ 8 | $ (7) | -20% | MOS | 2.3% | MOSAIC CO NE | industry | USA | fertal | 9 |

| -$26 | $ 2 | $ (0) | -1% | NEP | 6.4% | NEXTERA ENER | energy | USA | util | 2 |

| -$23 | $ (10) | $ 16 | 16% | JBSAY | 6.0% | JBS SA SPON | food | America | meat | 10 |

| -$21 | $ (20) | $ 20 | 28% | LILA | 0.0% | LIBERTY LATI | media | America | liberty | 2 |

| -$20 | $ 122 | $ (122) | -68% | SATS | 0.0% | DISH NETWORK | media | USA | 5 | |

| -$19 | $ 42 | $ (42) | -36% | VSAT | 0.0% | VIASAT INC | coms | USA | 2 | |

| -$17 | $ (3) | $ 3 | 20% | GSHD | 0.0% | GOOSEHEAD IN | finance | USA | insure | 3 |

| -$16 | $ 1 | $ (1) | -2% | HE | 0.0% | HAWAIIAN ELE | energy | USA | util | 1 |

| -$14 | $ 3 | $ (2) | -5% | HPK | 0.9% | HIGHPEAK ENE | energy | USA | oil | 2 |

| -$13 | $ 1 | $ (1) | -7% | UTMD | 0.8% | UTAH MEDICAL | health | USA | devices | 0 |

| -$13 | $ 4 | $ (4) | -22% | DBRG | 0.1% | DIGITALBRIDG | finance | USA | land | 2 |

| -$13 | $ 0 | $ (0) | -2% | HHH | 0.0% | HOWARD HUGH | travel | America | land | 4 |

| -$13 | $ 27 | $ (27) | -68% | SEDG | 0.0% | SOLAREDGE TE | energy | USA | solar | 1 |

| -$11 | $ 79 | $ (69) | -58% | WBA | 8.6% | WALGREENS BO | retail | USA | health | 8 |

| -$3 | $ 27 | $ (26) | -60% | SAVE | 2.2% | SPIRIT AIRLI | travel | USA | air | 0 |

| -$2 | $ 27 | $ (27) | -70% | PLUG | 0.0% | PLUG POWER I | energy | USA | H | 2 |

You can see in the last column that these are small companies, with less than a $10bil market cap. I don’t know enough about these companies to overweight them, and their small size makes them volatile. The biggest ones, JBSAY and TSN, are both meat companies, and I don’t want to be in meat. Many of these were small positions (<$30) because they’re down (buy high sell low right?) and I didn’t have much confidence in them anyway (lol Spirit Airlines SAVE) and there’s no gains tax.

Here’s what that consolidation looks like:

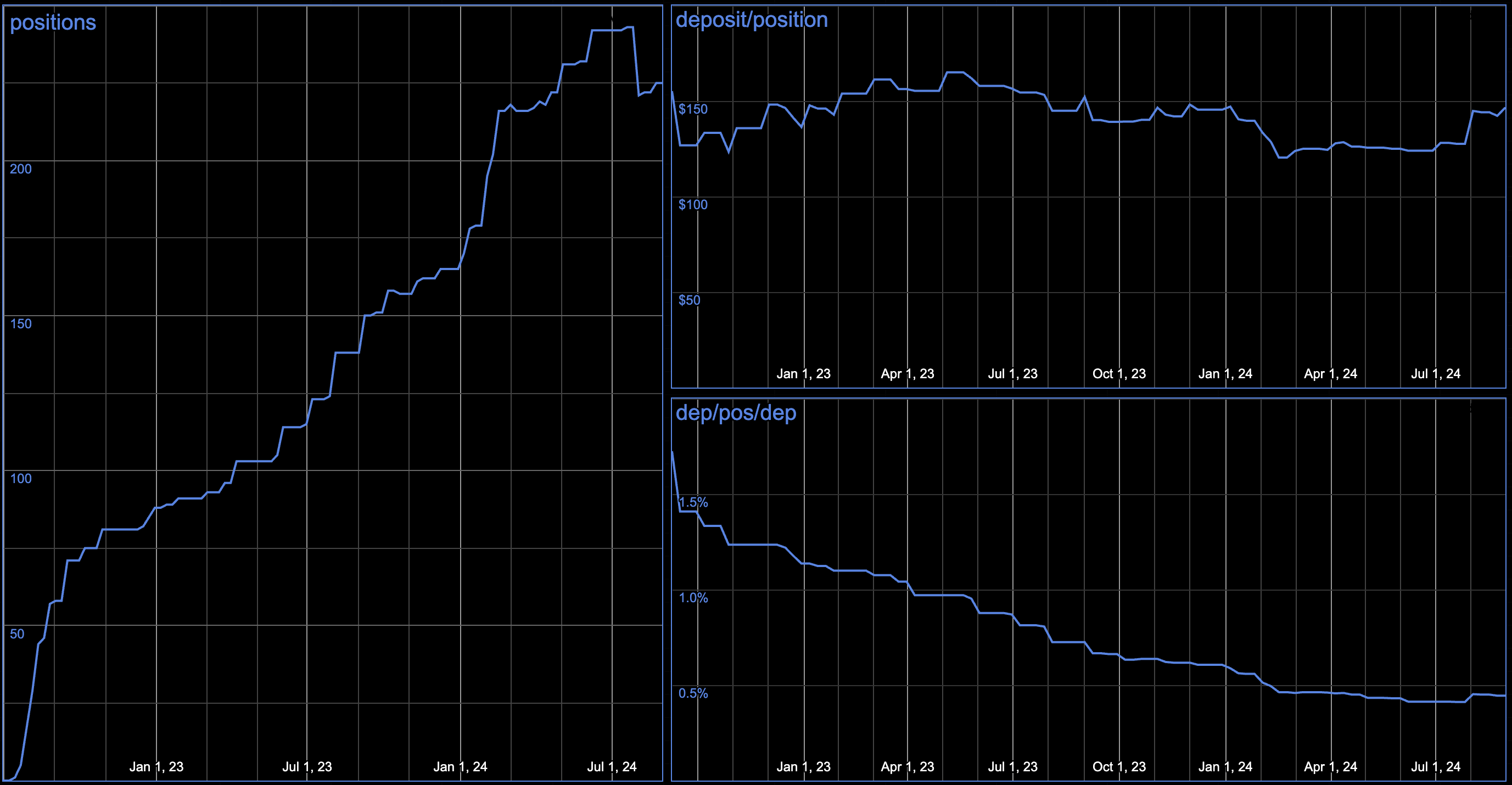

I went down to 224 positions (I bought a few), so my average position is $147, which is only 0.4% of the total I’ve deposited. There will be more consolidation in the coming months.

Reductions

Preparing more companies for the chopping block, soon we’ll say bon voyage to cruises.

| %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type | S&P | MCbil |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -18% | -$13 | 2 | $ 54 | $ 58 | $ 5 | 8% | LUV | 1.9% | SOUTHWEST AI | 0.1% | travel | USA | air | 1994 | 17 |

| -24% | -$16 | 3 | $ 61 | $ 50 | $ (4) | -5% | STLA | 8.6% | STELLANTIS N | 0.1% | cars | Europe | 45 | ||

| -26% | -$16 | 6 | $ 146 | $ 47 | $ (99) | -39% | WBD | 0.0% | WARNER BROS | 0.1% | media | USA | 2022 | 19 | |

| -47% | -$32 | 2 | $ (32) | $ 36 | $ 68 | 36% | NCLH | 0.0% | NORWEGIAN CR | 0.1% | travel | USA | cruise | 2017 | 8 |

| -22% | -$10 | 1 | $ 36 | $ 36 | $ 0 | 1% | ALK | 0.0% | ALASKA AIR G | 0.1% | travel | USA | air | 5 | |

| -47% | -$30 | 2 | $ (60) | $ 33 | $ 93 | 65% | CCL | 0.0% | CARNIVAL COR | 0.1% | travel | USA | cruise | 21 | |

| -15% | -$6 | 1 | $ 40 | $ 34 | $ (6) | -12% | YUMC | 0.8% | YUM CHINA HL | 0.1% | food | China | retail | 13 | |

| -48% | -$27 | 2 | $ (48) | $ 30 | $ 78 | 57% | CUK | 0.0% | CARNIVAL ADR | 0.1% | travel | USA | cruise | 21 | |

| -43% | -$22 | 4 | $ 145 | $ 30 | $ (96) | -47% | WB | 8.9% | WEIBO ADR RE | 0.1% | tech | China | sw | 2 | |

| -47% | -$21 | 1 | $ 134 | $ 24 | $ (111) | -50% | LSXMA | 0.0% | LIBERTY MEDI | 0.1% | media | USA | liberty | 10 | |

| -51% | -$22 | 2 | $ 127 | $ 21 | $ (99) | -46% | PARA | 3.4% | PARAMOUNT GL | 0.1% | media | USA | 1994 | 7 | |

| -31% | -$10 | 2 | $ 39 | $ 21 | $ (18) | -22% | AAL | 0.0% | AMERICAN AIR | 0.1% | travel | USA | air | 2015 | 7 |

| -53% | -$17 | 3 | $ 12 | $ 15 | $ 3 | 10% | JBLU | 0.0% | JETBLUE AWYS | 0.0% | travel | USA | air | 2 |

Buys

I increased 44 positions and started 4 new ones (like Door Dash).

| # | %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type | /s&p | S&P | MCbil |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 7% | $222 | 14 | $ 2,458 | $ 3,206 | $ 759 | 31% | AAPL | 0.4% | APPLE INC | 8.2% | multi | USA | tech | 1.1 | 1982 | 3,482 |

| 2 | 13% | $326 | 7 | $ 2,655 | $ 2,920 | $ 272 | 10% | MSFT | 0.3% | MICROSOFT CO | 7.4% | multi | USA | tech | 1.1 | 1994 | 3,101 |

| 4 | 11% | $218 | 13.8 | $ 1,740 | $ 2,279 | $ 541 | 31% | GOOG | 0.1% | ALPHABET INC | 5.8% | multi | USA | tech | 1.3 | 2006 | 2,020 |

| 5 | 12% | $222 | 11.3 | $ 1,895 | $ 2,017 | $ 122 | 6% | AMZN | 0.0% | AMAZON.COM I | 5.1% | multi | USA | tech | 1.3 | 2005 | 1,873 |

| 6 | 4% | $43 | 2.5 | $ 981 | $ 1,190 | $ 209 | 21% | BRK.B | 0.0% | BERKSHIRE HA | 3.0% | multi | USA | 1.4 | 2010 | 1,021 | |

| 7 | 3% | $22 | 16 | $ 974 | $ 912 | $ (46) | -5% | OXY | 1.6% | OCCIDENTAL P | 2.3% | energy | USA | oil | 19.9 | 1957 | 53 |

| 8 | 2% | $14 | 4.4 | $ 441 | $ 755 | $ 321 | 73% | TSM | 1.4% | TAIWAN SEMIC | 1.9% | tech | Asia | sc’s | 1.3 | 690 | |

| 18 | 14% | $46 | 0.8 | $ 363 | $ 387 | $ 25 | 7% | MA | 0.2% | MASTERCARD I | 1.0% | finance | USA | credit | 1.0 | 2008 | 447 |

| 21 | 17% | $53 | 1.3 | $ 352 | $ 359 | $ 8 | 2% | V | 0.1% | VISA INC | 0.9% | finance | USA | credit | 0.8 | 2009 | 546 |

| 25 | 20% | $53 | 2.7 | $ 201 | $ 322 | $ 121 | 60% | NVDA | 0.0% | NVIDIA CORPO | 0.8% | tech | USA | sc’s | 0.1 | 2001 | 2,928 |

| 31 | 4% | $11 | 0.73 | $ 251 | $ 254 | $ 2 | 1% | CHTR | 0.0% | CHARTER COM | 0.6% | coms | USA | 6.0 | 2016 | 50 | |

| 37 | 5% | $12 | 0.4 | $ 206 | $ 236 | $ 32 | 15% | UNH | 0.6% | UNITEDHEALTH | 0.6% | health | USA | insure | 0.5 | 1994 | 545 |

| 38 | 5% | $12 | 2 | $ 223 | $ 236 | $ 20 | 9% | XOM | 3.0% | EXXON MOBIL | 0.6% | energy | USA | oil | 0.5 | 1957 | 524 |

| 44 | 7% | $12 | 0.75 | $ 151 | $ 194 | $ 44 | 29% | AXP | 0.7% | AMERICAN EXP | 0.5% | finance | USA | credit | 1.2 | 1976 | 184 |

| 50 | 11% | $17 | 1 | $ 156 | $ 172 | $ 18 | 11% | PG | 1.3% | PROCTER AND | 0.4% | retail | USA | health | 0.5 | 1957 | 403 |

| 52 | 9% | $14 | 2.3 | $ 143 | $ 167 | $ 26 | 18% | KO | 1.8% | COCA-COLA C | 0.4% | food | USA | cola | 0.6 | 1957 | 312 |

| 55 | 9% | $13 | 1 | $ 133 | $ 163 | $ 30 | 22% | AVGO | 0.4% | BROADCOM IN | 0.4% | tech | USA | sc’s | 0.3 | 2014 | 758 |

| 68 | 14% | $16 | 1.6 | $ 117 | $ 129 | $ 14 | 12% | NEE | 1.8% | NEXTERA ENER | 0.3% | energy | USA | util | 0.9 | 1976 | 165 |

| 69 | 12% | $14 | 0.9 | $ 110 | $ 127 | $ 18 | 16% | ORCL | 0.4% | ORACLE CORP | 0.3% | tech | USA | cloud | 0.4 | 1989 | 389 |

| 71 | 11% | $12 | 0.7 | $ 118 | $ 121 | $ 4 | 3% | PEP | 1.0% | PEPSICO INC | 0.3% | food | USA | cola | 0.6 | 1957 | 237 |

| 75 | 16% | $14 | 1.5 | $ 97 | $ 107 | $ 13 | 13% | SHEL | 2.8% | SHELL PLC SP | 0.3% | energy | Europe | oil | 0.6 | 221 | |

| 79 | 15% | $13 | 0.4 | $ 106 | $ 101 | $ (5) | -4% | CRM | 0.1% | SALESFORCE I | 0.3% | tech | USA | cloud | 0.5 | 2008 | 245 |

| 78 | 16% | $15 | 0.7 | $ 112 | $ 104 | $ (8) | -7% | AMD | 0.0% | ADVANCED MIC | 0.3% | tech | USA | sc’s | 0.5 | 2017 | 240 |

| 85 | 17% | $13 | 0.35 | $ 88 | $ 94 | $ 7 | 8% | DHR | 0.1% | DANAHER COR | 0.2% | industry | USA | health | 0.6 | 1998 | 194 |

| 86 | 12% | $10 | 0.4 | $ 80 | $ 94 | $ 14 | 18% | ADI | 0.5% | ANALOG DEVIC | 0.2% | tech | USA | sc’s | 0.9 | 1999 | 117 |

| 94 | 11% | $8 | 1 | $ 80 | $ 83 | $ 3 | 3% | CP | 0.2% | CANADIAN PAC | 0.2% | industry | America | rail | 0.9 | 104 | |

| 92 | 20% | $14 | 0.6 | $ 79 | $ 83 | $ 5 | 7% | NVO | 0.6% | NOVO NORDISK | 0.2% | health | Europe | pharm | 0.2 | 472 | |

| 97 | 24% | $14 | 1 | $ 67 | $ 72 | $ 7 | 11% | GIS | 2.2% | GENERAL MILL | 0.2% | food | USA | grocery | 2.1 | 1957 | 40 |

| 99 | 16% | $10 | 0.35 | $ 61 | $ 70 | $ 9 | 14% | TMUS | 0.2% | T-MOBILE US | 0.2% | coms | USA | 0.3 | 2019 | 232 | |

| 103 | 11% | $7 | 2 | $ 71 | $ 68 | $ (3) | -4% | BP | 1.4% | BP PLC SPONS | 0.2% | energy | Europe | oil | 0.9 | 92 | |

| 101 | 20% | $11 | 0.12 | $ 56 | $ 68 | $ 13 | 23% | LMT | 0.7% | LOCKHEED MA | 0.2% | industry | USA | aero | 0.6 | 1957 | 135 |

| 104 | 22% | $12 | 0.11 | $ 62 | $ 68 | $ 5 | 9% | TMO | 0.1% | THERMO FISHE | 0.2% | health | USA | tech | 0.3 | 2004 | 235 |

| 105 | 25% | $13 | 0.2 | $ 59 | $ 67 | $ 8 | 13% | AMGN | 0.4% | AMGEN INC | 0.2% | health | USA | pharm | 0.4 | 1992 | 179 |

| 114 | 19% | $10 | 0.3 | $ 52 | $ 61 | $ 9 | 18% | IBM | 0.3% | INTERNATION | 0.2% | tech | USA | cloud | 0.4 | 1957 | 186 |

| 124 | 24% | $11 | 0.1 | $ 53 | $ 56 | $ 3 | 5% | ELV | 0.2% | ELEVANCE HEA | 0.1% | health | USA | insure | 0.5 | 2002 | 128 |

| 127 | 46% | $17 | 0.6 | $ 49 | $ 53 | $ 5 | 10% | MDT | 0.4% | MEDTRONIC PL | 0.1% | health | Europe | devices | 0.5 | 1986 | 114 |

| 128 | 33% | $13 | 0.45 | $ 65 | $ 53 | $ (12) | -19% | ABNB | 0.0% | AIRBNB INC C | 0.1% | travel | USA | rent | 0.8 | 2023 | 74 |

| 130 | 26% | $10 | 0.14 | $ 47 | $ 51 | $ 3 | 7% | CI | 0.3% | THE CIGNA GR | 0.1% | health | USA | insure | 0.6 | 101 | |

| 138 | 57% | $17 | 0.08 | $ 41 | $ 46 | $ 5 | 13% | MSCI | 0.2% | MSCI INC | 0.1% | finance | USA | indices | 1.2 | 2018 | 46 |

| 139 | 33% | $11 | 0.4 | $ 42 | $ 45 | $ 3 | 8% | ABT | 0.4% | ABBOTT LABO | 0.1% | health | USA | tech | 0.3 | 1957 | 197 |

| 149 | 47% | $14 | 0.15 | $ 40 | $ 43 | $ 3 | 8% | CB | 0.1% | CHUBB LIMIT | 0.1% | finance | USA | insure | 0.4 | 2010 | 115 |

| 159 | 68% | $15 | 0.5 | $ 35 | $ 37 | $ 1 | 4% | UBER | 0.0% | UBER TECHNO | 0.1% | travel | USA | ride | 0.3 | 2023 | 154 |

| 174 | 46% | $10 | 0.15 | $ 30 | $ 31 | $ 1 | 5% | HON | 0.4% | HONEYWELL IN | 0.1% | industry | USA | aero | 0.3 | 1957 | 135 |

| 189 | 86% | $11 | 0.006 | $ 23 | $ 23 | $ 0 | 1% | BKNG | 0.0% | BOOKING HOL | 0.1% | travel | USA | sw | 0.2 | 2009 | 131 |

| 204 | new | $17 | 0.1 | $ 17 | $ 18 | $ 1 | 3% | MPC | 0.0% | MARATHON PE | 0.0% | energy | USA | oil | 0.3 | 2011 | 59 |

| 215 | new | $13 | 0.1 | $ 13 | $ 13 | $ (0) | -1% | DASH | 0.0% | DOORDASH IN | 0.0% | food | USA | deliver | 0.3 | 53 | |

| 214 | new | $10 | 0.1 | $ 10 | $ 13 | $ 4 | 37% | ARM | 0.0% | ARM HOLDING | 0.0% | tech | Europe | hw | 0.1 | 139 | |

| 217 | new | $12 | 0.1 | $ 12 | $ 12 | $ 1 | 5% | RTX | 0.0% | RTX CORPORA | 0.0% | industry | USA | aero | 0.1 | 1957 | 164 |

You can see on the right that I prefer larger companies than the ones I’m selling.

All Stocks

See the attached PDF of my holdings, it’s colorful.

[There’s missing data from trades on August 20th.]