I deposit $1000/mo into a Fidelity investment account, $31,000 total since 2022. I try to pick stocks to hold until retirement.

| Fund | 1-month | 3-month | YTD | 1-year |

|---|---|---|---|---|

| My Fund | 0.7% | 7.7% | 11.4% | 13.2% |

| S&P 500 | 1.2% | 10.1% | 16.7% | 22.1% |

| Dow Jones | 1.8% | 10.0% | 15.7% | 21.1% |

Looks like I’ve been getting wrecked by the market over the last year, at least thanks to Nvidia (+135%).

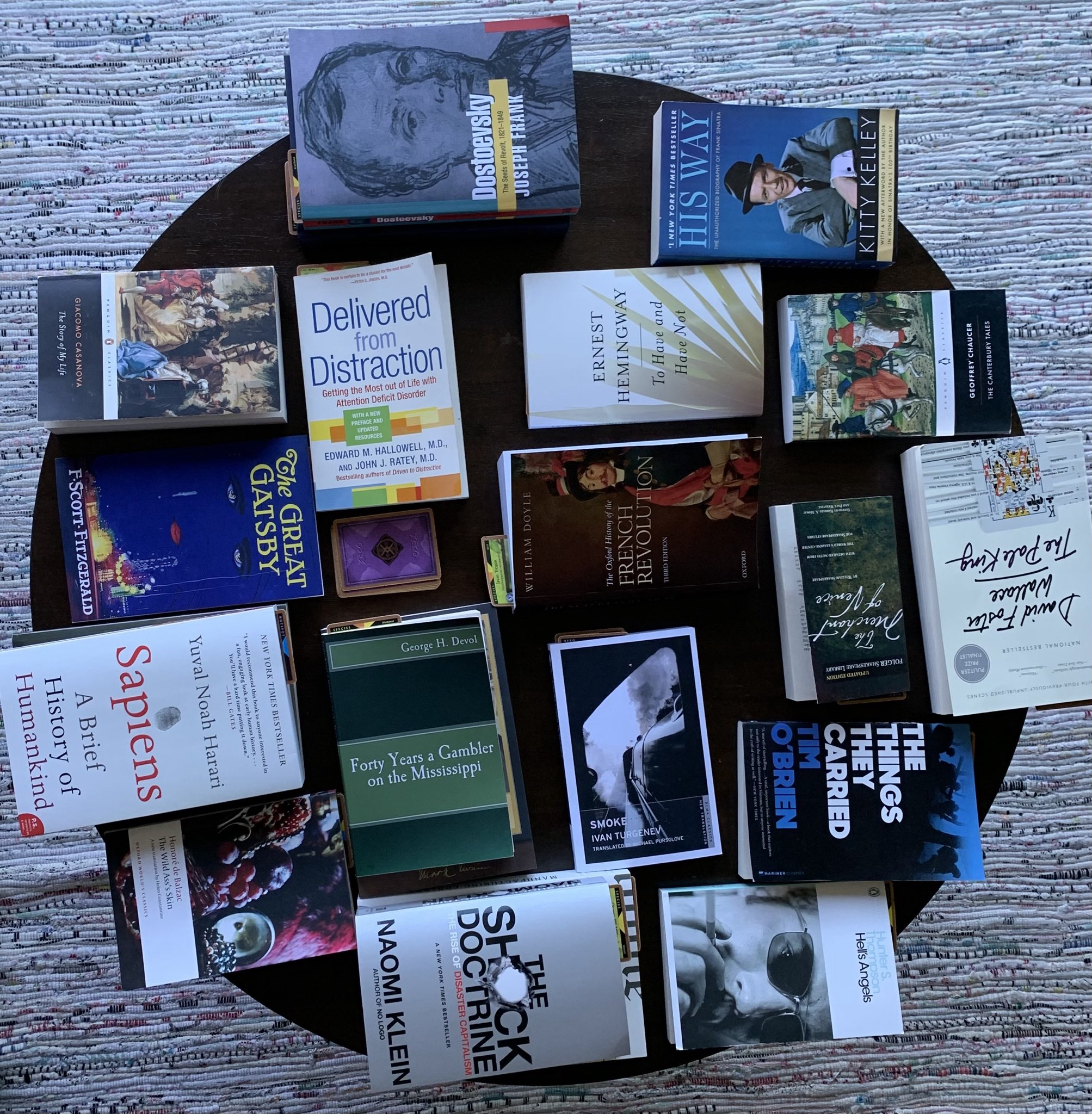

Reading

I’m writing a book! It’s my favorite thing to talk about, so questions are welcome.

I’ve been reading a lot. This month I finished:

- Debt: The First 5000 Years (Graeber 2013)

- Really good, if you like dense nonfiction.

- Roll the Bones: The History of Gambling (Schwartz 2013)

- The Havana Mob (English 2007)

- The Gambler (Dostoevsky 1887)

I go through these books with a highlighter and pen, to build up my sources.

Top 30

Let’s take a walk through my Top 30 positions, as of July 4th 🎆🇺🇸🦅 . These stocks are 62% of my total portfolio, out of 242 total stocks.

(WOW, a lot has happened since then, the least of which is Nvidia falling out of my top 30, but I’m sticking to the July 4th snapshot. I’m still recovering from the 13th to be honest, totally bonkers.)

1. AAPL $2,880 (7.5%), 2. MSFT $2,860 (7.5%), 3. META $2,550 (6.7%), 4. GOOG $ 2,340 (6.1%), 5. AMZN $1,860 (4.8%).

Apple (I’m +29%), Microsoft (+23%), Meta (+219%), Google (+54%), and Amazon (+20%).

My top 5, Big Tech. Together, they’re about 25% of the S&P 500. I think some investors pick just one or two, but underweight the whole sector. I did at first, when I bought just META in 2022. I want them all, they’ll all play a role in the future.

6. BRK.B $970 (2.5%), 7. OXY $970 (2.5%), 13. CVX $480 (1.2%)

I like Berkshire (+4%). Buffett says in his 2023 letter (letters that inspired this blog) “Berkshire is built to last.” Apple is 40% of Berkshire’s publicly traded companies, noice.

I also own Berkshire’s fifth and sixth-largest holdings, Chevron (+5%) and Occidental Petroleum (+4%). Energy companies will be crucial to our future. My OXY ($55bil market cap) is heavily weighed at 21x it’s S&P500 weight. (My CVX has a 2x weight.)

8. TSM $790 (2%), 17. MU $410 (1.1%), 22. INTC $340 (0.9%), 25. QCOM $306 (0.8%), 29. NVDA $280 (0.7%)

Taiwan Semiconductor (+84%). An independent semiconductor foundry, with customers like AMD and Apple and Nvidia. They’re a critical part of a critical industry. We hope for a stable Taiwan.

I bought Micron Technology (+147%) in 2022, they make computer memory. I probably heard about it on Reddit. It has more than doubled, not sure why.

I also bought Intel (-6%) in 2022, they apparently make semiconductors. My Intel stake doubled for a moment in 2023, but is now down. (Down 25% on August 2nd! At least I didn’t put $700k into it yesterday.)

Qualcomm (+81%), another semiconductor company. I’m hoping semiconductor demand overflows from Nvidia.

I missed Nvidia (+90%) back in 2022 AND 2023. That stings. I started to buy in January, and continue to (cautiously) buy. It only has a 0.1x weight in my account :(

9. BAC $740 (1.9%), 10. ALLY $570 (1.5%), 11. C $520 (1.3%), 14. JPM $420 (1.1%), 15. COF $420 (1.1%), 19. WFC $360 (0.9%), 24. TFC $310 (0.8%)

Bank of America (+41%). Ally Financial (+46%). Citigroup (+39%). JP Morgan Chase (+76%). Capitol One (+45%). Wells Fargo (+54%). Truist Financial (+14%).

These seven banks form a wall of finance that my other stocks have to climb to be at the top. I bought a lot of these in the 2022 dip, when banks looked undervalued. Two of these are owned by Munger and four by Buffett.

My ALLY ($12bil market cap) is at a x55 weight (of what it would be if it was in the S&P 500 but it’s not). Back in 2022 I wasn’t thinking about sizing my holding relative to company size. I think a high weight like this just makes the position more volatile.

12. TCEHY $490 (1.3%), 18. BABA $380 (1%), 28. LNVGY $280 (0.7%)

Tencent (+34%). Alibaba (-9%). Lenovo (+99%). Three Chinese tech companies.

As a Riot employee, I was impressed by and scared of TCEHY. I like that BABA supposedly has a lot of cash. LNVGY is small (26x weight) but has done well.

I’m a skeptical of these, but I like to own some non-US stocks if I can.

16. VZ $410 (1.1%), 30. HPQ $280 (0.7%)

Verizon (+11%). HP INC (+28%). Bought in 2022 thinking they seemed stable. I don’t know much about them.

20. PFE $360 (0.9%), 27. MRNA $290 (0.6%).

Pfizer (-17%) and Moderna (-8%), two pharmaceutical biotech companies. I believe in the future of healthcare, but it’s a tough industry to pick and time, so I’m just trying to be early. (August 2nd: My Moderna is -33%.)

21. NFLX $355 (%0.9)

Netflix (+199%). I bought half of a share for $119, in my first month of investing. I intended to buy more, but the price went up and I got scared.

23. MA $310 (0.8%), 26. V $300 (0.8%)

Mastercard (-1%). Visa (-1%), a credit duopoly that’s popular with superinvestors.

I’ve been steadily building them up and will continue to do so (they’re big companies).

Sold

No exits this month, but I plan to exit a lot of these over the next two months. I’ve been looking forward to this “big crunch” of consolidation. About 17 of these companies are small (<$10bil market cap) and I prefer larger companies.

| %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -41% | -$93 | 3 | $ 34 | $ 134 | $ 105 | 30% | GM | 1.6% | GENERAL MTRS | 0.4% | cars | USA | |

| -51% | -$98 | 1 | $ 98 | $ 94 | $ (4) | -2% | DIS | 0.3% | DISNEY WALT | 0.2% | media | USA | |

| -41% | -$53 | 4 | $ (0) | $ 76 | $ 76 | 40% | NCLH | 0.0% | NORWEGIAN CR | 0.2% | travel | USA | cruise |

| -42% | -$50 | 8 | $ 163 | $ 69 | $ (94) | -37% | WBD | 0.0% | WARNER BROS | 0.2% | media | USA | |

| -44% | -$53 | 4 | $ (30) | $ 67 | $ 97 | 68% | CCL | 0.0% | CARNIVAL COR | 0.2% | travel | USA | cruise |

| -44% | -$49 | 4 | $ (21) | $ 62 | $ 82 | 61% | CUK | 0.0% | CARNIVAL ADR | 0.2% | travel | USA | cruise |

| -48% | -$57 | 1 | $ 76 | $ 61 | $ (4) | -2% | TSN | 4.1% | TYSON FOODS | 0.2% | food | USA | meat |

| -27% | -$23 | 1 | $ 75 | $ 61 | $ (12) | -12% | CVS | 1.6% | CVS HEALTH C | 0.2% | retail | USA | health |

| -8% | -$5 | 1 | $ 76 | $ 56 | $ (18) | -23% | ALGT | 1.9% | ALLEGIANT TR | 0.1% | travel | USA | air |

| -42% | -$39 | 7 | $ 167 | $ 54 | $ (94) | -46% | WB | 8.9% | WEIBO ADR RE | 0.1% | tech | China | sw |

| -48% | -$48 | 1 | $ 28 | $ 53 | $ 39 | 51% | OMF | 18.4% | ONEMAIN HLDG | 0.1% | finance | USA | insure |

| -48% | -$42 | 4 | $ 149 | $ 46 | $ (96) | -44% | PARA | 3.4% | PARAMOUNT GL | 0.1% | media | USA | |

| -50% | -$45 | 2 | $ 156 | $ 45 | $ (110) | -50% | LSXMA | 0.0% | LIBERTY MEDI | 0.1% | media | USA | liberty |

| -47% | -$37 | 2 | $ 19 | $ 41 | $ 23 | 41% | NOV | 1.9% | NOV INC COM | 0.1% | industry | USA | oil |

| -51% | -$33 | 3 | $ 49 | $ 32 | $ (17) | -21% | AAL | 0.0% | AMERICAN AIR | 0.1% | travel | USA | air |

| -50% | -$31 | 1 | $ (14) | $ 31 | $ 67 | 54% | BMWYY | 17.5% | BAYERISCHE M | 0.1% | cars | Europe | |

| -59% | -$35 | 2 | $ 14 | $ 24 | $ 16 | 16% | JBSAY | 6.0% | JBS SA SPON | 0.1% | food | America | meat |

| -58% | -$29 | 2 | $ 1 | $ 21 | $ 20 | 28% | LILA | 0.0% | LIBERTY LATI | 0.1% | media | America | liberty |

| -47% | -$18 | 1 | $ 142 | $ 20 | $ (121) | -68% | SATS | 0.0% | DISH NETWORK | 0.1% | media | USA | |

| -67% | -$40 | 1 | $ 61 | $ 20 | $ (41) | -35% | VSAT | 0.0% | VIASAT INC | 0.1% | coms | USA | |

| -33% | -$8 | 1 | $ 17 | $ 17 | $ 0 | 0% | HE | 0.0% | HAWAIIAN ELE | 0.0% | energy | USA | util |

| -67% | -$28 | 1 | $ 17 | $ 14 | $ (2) | -5% | HPK | 0.9% | HIGHPEAK ENE | 0.0% | energy | USA | oil |

| -49% | -$12 | 1 | $ 91 | $ 12 | $ (69) | -58% | WBA | 8.6% | WALGREENS BO | 0.0% | retail | USA | health |

| -54% | -$13 | 1 | $ 7 | $ 11 | $ 8 | 15% | F | 7.7% | FORD MTR CO | 0.0% | cars | USA | |

| -83% | -$14 | 1 | $ 30 | $ 3 | $ (26) | -59% | SAVE | 2.2% | SPIRIT AIRLI | 0.0% | travel | USA | air |

| -79% | -$9 | 1 | $ 29 | $ 2 | $ (26) | -69% | PLUG | 0.0% | PLUG POWER I | 0.0% | energy | USA | H |

Bought

Most of my chips are still going to Big Tech, and the credit card companies, with a spread of semiconductors and cloud and health and energy.

| %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 8% | $219 | 13 | $ 2,235 | $ 2,903 | $ 674 | 30% | AAPL | 0.3% | APPLE INC | 7.6% | multi | USA | tech |

| 20% | $433 | 6.2 | $ 2,329 | $ 2,607 | $ 285 | 12% | MSFT | 0.3% | MICROSOFT CO | 6.8% | multi | USA | tech |

| 8% | $166 | 12.5 | $ 1,522 | $ 2,150 | $ 630 | 41% | GOOG | 0.2% | ALPHABET INC | 5.6% | multi | USA | tech |

| 22% | $341 | 10 | $ 1,673 | $ 1,880 | $ 207 | 12% | AMZN | 0.0% | AMAZON.COM I | 4.9% | multi | USA | tech |

| 6% | $61 | 2.4 | $ 938 | $ 1,055 | $ 117 | 12% | BRK.B | 0.0% | BERKSHIRE HA | 2.8% | multi | USA | |

| 1% | $12 | 15.6 | $ 951 | $ 948 | $ 12 | 1% | OXY | 1.7% | OCCIDENTAL P | 2.5% | energy | USA | oil |

| 3% | $17 | 4.3 | $ 428 | $ 706 | $ 285 | 67% | TSM | 1.4% | TAIWAN SEMIC | 1.8% | tech | Asia | sc’s |

| 25% | $66 | 0.7 | $ 317 | $ 326 | $ 10 | 3% | MA | 0.1% | MASTERCARD I | 0.9% | finance | USA | credit |

| 22% | $53 | 1.1 | $ 299 | $ 293 | $ (5) | -2% | V | 0.1% | VISA INC | 0.8% | finance | USA | credit |

| 5% | $12 | 0.7 | $ 241 | $ 267 | $ 27 | 11% | CHTR | 0.0% | CHARTER COMM | 0.7% | coms | USA | |

| 5% | $12 | 2.2 | $ 148 | $ 261 | $ 113 | 76% | NVDA | 0.0% | NVIDIA CORPO | 0.7% | tech | USA | sc’s |

| 6% | $14 | 5 | $ 245 | $ 243 | $ 1 | 0% | CSCO | 0.9% | CISCO SYSTEM | 0.6% | coms | USA | |

| 5% | $11 | 1.9 | $ 211 | $ 226 | $ 22 | 10% | XOM | 3.2% | EXXON MOBIL | 0.6% | energy | USA | oil |

| 5% | $10 | 0.38 | $ 194 | $ 221 | $ 28 | 15% | UNH | 0.6% | UNITEDHEALTH | 0.6% | health | USA | insure |

| 7% | $13 | 0.4 | $ 155 | $ 183 | $ 29 | 19% | MCO | 0.3% | MOODYS CORP | 0.5% | finance | USA | rating |

| 7% | $12 | 0.7 | $ 138 | $ 178 | $ 41 | 29% | AXP | 0.4% | AMERICAN EXP | 0.5% | finance | USA | credit |

| 6% | $9 | 0.35 | $ 150 | $ 171 | $ 22 | 14% | SPGI | 0.3% | S&P GLOBAL I | 0.4% | finance | USA | rating |

| 5% | $7 | 1 | $ 158 | $ 159 | $ 3 | 2% | JNJ | 1.2% | JOHNSON &JOH | 0.4% | health | USA | retail |

| 9% | $11 | 0.9 | $ 139 | $ 145 | $ 7 | 5% | PG | 0.8% | PROCTER AND | 0.4% | retail | USA | health |

| 8% | $10 | 3 | $ 160 | $ 143 | $ (14) | -8% | BMY | 2.0% | BRISTOL-MYER | 0.4% | health | USA | pharm |

| 13% | $16 | 0.9 | $ 121 | $ 142 | $ 22 | 18% | AVGO | 0.4% | BROADCOM INC | 0.4% | tech | USA | sc’s |

| 7% | $9 | 2.1 | $ 129 | $ 140 | $ 14 | 10% | KO | 2.0% | COCA-COLA CO | 0.4% | food | USA | cola |

| 7% | $9 | 0.16 | $ 118 | $ 132 | $ 13 | 11% | COST | 0.1% | COSTCO WHOLE | 0.3% | retail | USA | value |

| 15% | $14 | 0.8 | $ 96 | $ 111 | $ 15 | 16% | ORCL | 0.1% | ORACLE CORP | 0.3% | tech | USA | cloud |

| 12% | $11 | 0.63 | $ 106 | $ 109 | $ 4 | 4% | PEP | 1.1% | PEPSICO INC | 0.3% | food | USA | cola |

| 7% | $7 | 1.4 | $ 102 | $ 106 | $ 7 | 7% | NEE | 2.0% | NEXTERA ENER | 0.3% | energy | USA | util |

| 15% | $13 | 0.15 | $ 95 | $ 97 | $ 3 | 3% | INTU | 0.1% | INTUIT INC | 0.3% | finance | USA | tech |

| 8% | $7 | 1.3 | $ 83 | $ 97 | $ 17 | 20% | SHEL | 3.3% | SHELL PLC SP | 0.3% | energy | Europe | oil |

| 16% | $13 | 0.35 | $ 93 | $ 91 | $ (2) | -2% | CRM | 0.0% | SALESFORCE I | 0.2% | tech | USA | cloud |

| 10% | $8 | 0.6 | $ 98 | $ 88 | $ (10) | -10% | AMD | 0.0% | ADVANCED MIC | 0.2% | tech | USA | sc’s |

| 13% | $10 | 0.3 | $ 74 | $ 84 | $ 10 | 13% | DHR | 0.1% | DANAHER CORP | 0.2% | industry | USA | health |

| 14% | $10 | 0.3 | $ 83 | $ 80 | $ (2) | -2% | MCD | 0.7% | MCDONALD S C | 0.2% | food | USA | retail |

| 11% | $8 | 1 | $ 86 | $ 77 | $ (9) | -10% | SBUX | 0.7% | STARBUCKS CO | 0.2% | food | USA | retail |

| 12% | $8 | 0.9 | $ 73 | $ 75 | $ 2 | 3% | CP | 0.1% | CANADIAN PAC | 0.2% | industry | America | rail |

| 21% | $11 | 0.5 | $ 65 | $ 66 | $ 2 | 2% | NVO | 0.3% | NOVO NORDISK | 0.2% | health | Europe | pharm |

| 19% | $10 | 0.07 | $ 66 | $ 64 | $ (1) | -2% | ASML | 0.1% | ASML HOLDING | 0.2% | tech | Europe | sc’s |

| 28% | $14 | 0.5 | $ 81 | $ 64 | $ (16) | -20% | SNOW | 0.0% | SNOWFLAKE IN | 0.2% | tech | USA | cloud |

| 13% | $7 | 1.8 | $ 65 | $ 64 | $ (0) | 0% | BP | 1.6% | BP PLC SPONS | 0.2% | energy | Europe | oil |

| 16% | $8 | 0.07 | $ 50 | $ 58 | $ 8 | 15% | NOW | 0.0% | SERVICENOW I | 0.2% | tech | USA | cloud |

| 21% | $10 | 1.75 | $ 73 | $ 57 | $ (16) | -22% | STM | 0.2% | STMICROELECT | 0.1% | tech | Europe | sc’s |

| 24% | $11 | 0.09 | $ 50 | $ 56 | $ 6 | 12% | TMO | 0.1% | THERMO FISHE | 0.1% | health | USA | tech |

| 48% | $18 | 0.3 | $ 51 | $ 55 | $ 4 | 7% | TMUS | 0.2% | T-MOBILE US | 0.1% | coms | USA | |

| 21% | $9 | 0.16 | $ 46 | $ 54 | $ 8 | 17% | AMGN | 0.5% | AMGEN INC | 0.1% | health | USA | pharm |

| 35% | $14 | 0.1 | $ 44 | $ 54 | $ 10 | 23% | LMT | 0.9% | LOCKHEED MAR | 0.1% | industry | USA | aero |

| 13% | $6 | 0.8 | $ 53 | $ 54 | $ 2 | 4% | GIS | 1.9% | GENERAL MILL | 0.1% | food | USA | grocery |

| 48% | $16 | 0.3 | $ 45 | $ 49 | $ 4 | 8% | VLO | 0.4% | VALERO ENERG | 0.1% | energy | USA | oil |

| 22% | $9 | 0.25 | $ 42 | $ 48 | $ 7 | 16% | IBM | 0.4% | INTERNATION | 0.1% | tech | USA | cloud |

| 39% | $13 | 0.25 | $ 41 | $ 47 | $ 7 | 16% | ABBV | 0.0% | ABBVIE INC | 0.1% | health | USA | pharm |

| 34% | $11 | 0.08 | $ 42 | $ 43 | $ 1 | 2% | ELV | 0.3% | ELEVANCE HEA | 0.1% | health | USA | insure |

| 32% | $10 | 0.4 | $ 37 | $ 40 | $ 3 | 8% | CL | 0.1% | COLGATE-PALM | 0.1% | retail | USA | goods |

| 36% | $10 | 0.11 | $ 37 | $ 37 | $ (0) | -1% | CI | 0.4% | THE CIGNA GR | 0.1% | health | USA | insure |

| 35% | $9 | 0.4 | $ 36 | $ 35 | $ (1) | -2% | MCHP | 0.2% | MICROCHIP T | 0.1% | tech | USA | sc’s |

| 53% | $12 | 0.4 | $ 31 | $ 34 | $ 3 | 10% | SO | 0.4% | SOUTHERN CO | 0.1% | energy | USA | util |

| 51% | $11 | 0.3 | $ 35 | $ 34 | $ (1) | -4% | COP | 0.2% | CONOCOPHILL | 0.1% | energy | USA | oil |

| 37% | $9 | 0.04 | $ 33 | $ 33 | $ 0 | 1% | LLY | 0.1% | ELI LILLY &C | 0.1% | health | USA | pharm |

| 43% | $10 | 0.3 | $ 30 | $ 33 | $ 3 | 9% | DUK | 0.3% | DUKE ENERGY | 0.1% | energy | Europe | util |

| 31% | $8 | 0.4 | $ 32 | $ 32 | $ 1 | 2% | MDT | 0.7% | MEDTRONIC PL | 0.1% | health | Europe | devices |

| 47% | $10 | 0.3 | $ 31 | $ 32 | $ 1 | 3% | ABT | 0.0% | ABBOTT LABO | 0.1% | health | USA | tech |

| 86% | $13 | 0.1 | $ 26 | $ 28 | $ 2 | 6% | CB | 0.2% | CHUBB LIMIT | 0.1% | finance | USA | insure |

| 115% | $15 | 0.05 | $ 24 | $ 27 | $ 3 | 12% | MSCI | 0.0% | MSCI INC | 0.1% | finance | USA | indices |

| 129% | $13 | 0.2 | $ 26 | $ 23 | $ (3) | -11% | MRK | 0.3% | MERCK &CO. | 0.1% | health | America | pharm |

| 103% | $10 | 1 | $ 22 | $ 21 | $ (1) | -5% | CPNG | 0.0% | COUPANG INC | 0.1% | tech | Asia | retail |

| 51% | $7 | 0.3 | $ 21 | $ 20 | $ (1) | -4% | TTE | 0.8% | TOTAL ENERG | 0.1% | energy | Europe | oil |

| 99% | $10 | 0.06 | $ 20 | $ 20 | $ (0) | -1% | SYK | 0.0% | STRYKER COR | 0.1% | health | USA | tech |

| 118% | $10 | 0.1 | $ 21 | $ 19 | $ (2) | -8% | CEG | 0.0% | CONSTELLATI | 0.0% | energy | USA | nuclear |

| 127% | $10 | 0.4 | $ 21 | $ 18 | $ (3) | -15% | CCJ | 0.0% | CAMECO CORP | 0.0% | energy | USA | nuclear |

| 89% | $8 | 0.1 | $ 16 | $ 17 | $ 1 | 7% | GE | 0.0% | GE AEROSPAC | 0.0% | industry | America | aero |

| 117% | $9 | 0.2 | $ 18 | $ 16 | $ (2) | -10% | VST | 0.1% | VISTRA CORP | 0.0% | energy | USA | nuclear |

| 85% | $7 | 0.2 | $ 15 | $ 16 | $ 1 | 8% | PEG | 0.4% | PUBLIC SVC | 0.0% | energy | USA | nuclear |

| new | $12 | 0.003 | $ 12 | $ 11 | $ (1) | -11% | BKNG | 0.0% | BOOKING HOL | 0.0% | travel | USA | sw |

All Stocks

See the attached PDF of my holdings. It’s colorful.