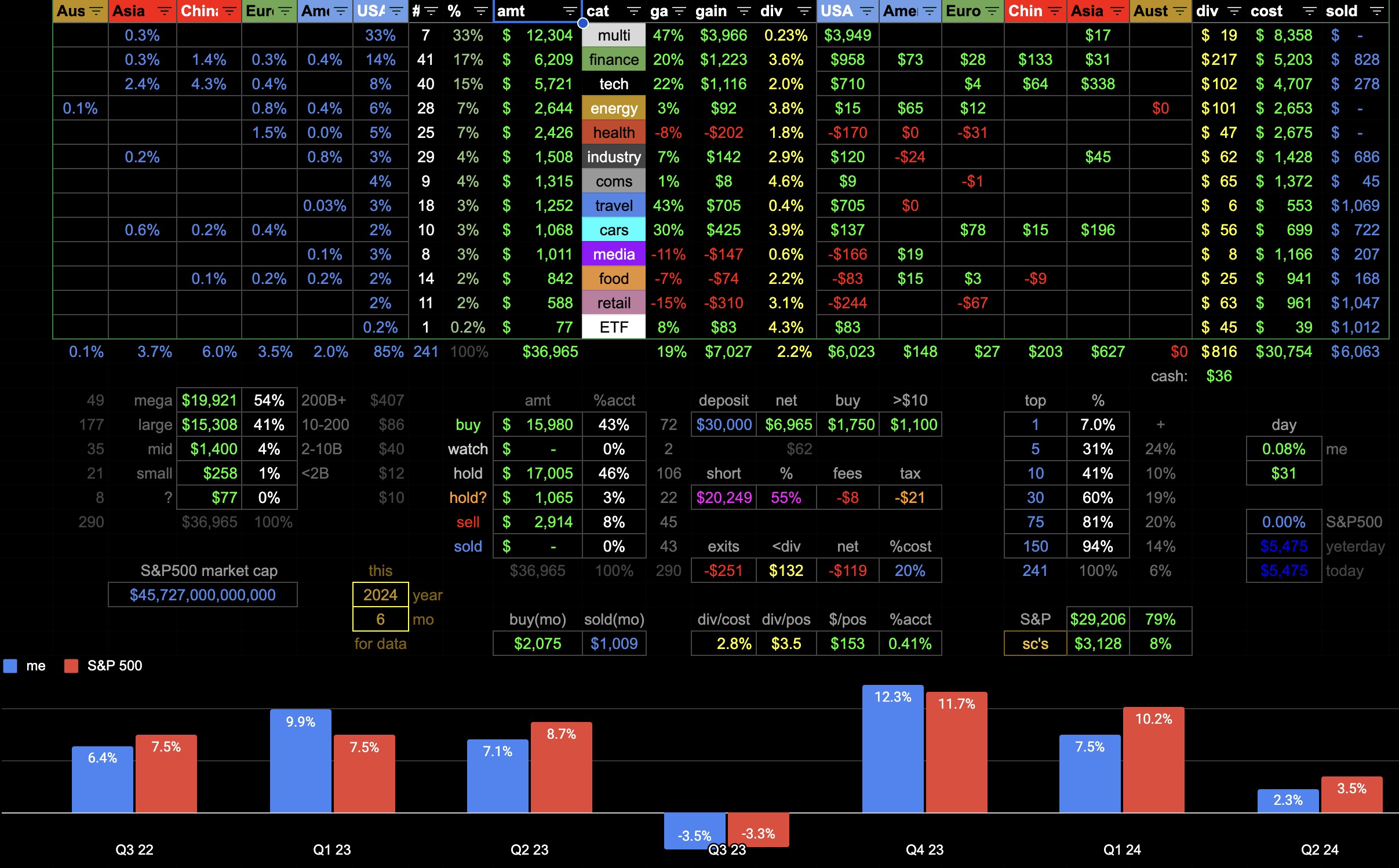

I deposit $1000/mo into a Fidelity investment account, $30,000 total since 2022. I try to pick stocks to hold until retirement.

| Fund | 1-month | 3-month | YTD | 1-year |

|---|---|---|---|---|

| My Fund | 2.3% | 2.9% | 10.7% | 19.9% |

| S&P 500 | 3.6% | 4.3% | 15.3% | 24.6% |

| Dow Jones | 3.1% | 3.2% | 13.6% | 23.2% |

We just finished our 7th quarter!

| QTR | MyFund | S&P 500* |

|---|---|---|

| Q3 22 | 6.4% | 7.5% |

| Q1 23 | 9.9% | 7.5% |

| Q2 23 | 7.1% | 8.7% |

| Q3 23 | -3.5% | -3.3% |

| Q4 23 | 12.3% | 11.7% |

| Q1 24 | 7.5% | 10.% |

| Q2 24 | 2.3% | 4.3% |

I thought I might beat the market this month, but no! Crushed. My Moderna MRNA went down -20%, just after I bragged about it being positive. Nike NKE also dropped -20%, along with some other companies I want to sell but haven’t gotten to yet. Rivian went up 20% (Volkswagen partnership announced) but I don’t like cars. My Tesla is a little positive.

Quarterly Overview

I recategorized some of my positions. Mostly I moved Meta, Apple, Microsoft, Google, and Amazon out “tech” and into “multi”, to recognize their size and scope and to differentiate the tech category in my stats. A third of my account is in these “multi” companies, and only 15% is in other tech. Almost 10% of my account is in “semiconductors”. Some of my tech I moved to industry.

You can see that over half my account is in companies with over 200 billion market cap. The positions I’m skeptical of (want to sell) make up about 10% of my account, otherwise I’m buying or holding. My top 10 positions are about 40% of my account. My bottom 91 positions (out of 241) are only about 6% of my account.

New

Starting some new small positions, in nuclear energy (where I’m late), Buffett’s latest new position , health, industry, foreign tech, and some hotels (that I already want to sell).

(The data in these charts below is from a few days before the end of the month.)

| thismo | shrs | value | %gain | tkr | description | cat | area | type |

|---|---|---|---|---|---|---|---|---|

| $10 | 0.05 | $ 11 | 8% | CEG | CONSTELLATI | energy | USA | nuclear |

| $11 | 0.2 | $ 10 | -8% | CCJ | CAMECO CORP | energy | USA | nuclear |

| $9 | 0.1 | $ 9 | -3% | VST | VISTRA CORP | energy | USA | nuclear |

| $7 | 0.1 | $ 7 | -2% | PEG | PUBLIC SVC | energy | USA | nuclear |

| $13 | 0.05 | $ 13 | -1% | CB | CHUBB LIMIT | finance | USA | insure |

| $10 | 0.02 | $ 10 | 0% | MSCI | MSCI INC | finance | USA | indices |

| $13 | 0.1 | $ 13 | 4% | MRK | MERCK &CO. | health | America | pharm |

| $10 | 0.03 | $ 10 | 0% | SYK | STRYKER COR | health | USA | tech |

| $14 | 0.01 | $ 14 | 2% | MTD | METTLER-TOL | industry | USA | science |

| $9 | 0.03 | $ 9 | -7% | WAT | WATERS CORP | industry | USA | science |

| $8 | 0.05 | $ 8 | 0% | GE | GE AEROSPAC | industry | America | aero |

| $11 | 0.5 | $ 11 | -6% | CPNG | COUPANG INC | tech | Asia | retail |

| $11 | 0.05 | $ 12 | 8% | MAR | MARRIOTT IN | travel | USA | hotel |

| $10 | 0.05 | $ 11 | 9% | HLT | HILTON WORL | travel | USA | hotel |

Most of these companies are small enough that I don’t want to build a large position anyway. I think if you’re investing heavily into a small-cap company, you really have to know something, and I don’t. (Maybe this is just a nonsense gambling system like any other. Dostoyevsky’s The Gambler had a system, written to pay a gambling debt. I’ve read a lot this month - I’m doing research for my book!)

Increased Positions

Mostly this month I was excited to buff my Apple, Microsoft, Google, Amazon, and Berkshire positions - they are now each proportional in my account to their market weight, and I will continue to grow them.

| %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 8% | $193 | 12 | $ 2,016 | $ 2,509 | $ 500 | 25% | AAPL | 0.3% | APPLE INC | 6.8% | multi | USA | tech |

| 25% | $478 | 5.25 | $ 1,897 | $ 2,367 | $ 478 | 25% | MSFT | 0.4% | MICROSOFT CO | 6.4% | multi | USA | tech |

| 5% | $104 | 11.6 | $ 1,356 | $ 2,153 | $ 799 | 59% | GOOG | 0.2% | ALPHABET INC | 5.8% | multi | USA | tech |

| 14% | $192 | 8.28 | $ 1,332 | $ 1,543 | $ 211 | 16% | AMZN | 0.0% | AMAZON.COM I | 4.2% | multi | USA | tech |

| 1% | $12 | 15.4 | $ 939 | $ 972 | $ 46 | 5% | OXY | 1.4% | OCCIDENTAL P | 2.6% | energy | USA | oil |

| 13% | $103 | 2.25 | $ 877 | $ 925 | $ 48 | 5% | BRK.B | 0.0% | BERKSHIRE HA | 2.5% | multi | USA | |

| 2% | $15 | 4.2 | $ 411 | $ 725 | $ 318 | 77% | TSM | 0.9% | TAIWAN SEMIC | 2.0% | tech | Asia | sc’s |

| 5% | $15 | 11 | $ 381 | $ 338 | $ (29) | -8% | INTC | 3.8% | INTEL CORP C | 0.9% | tech | USA | sc’s |

| 4% | $11 | 2.1 | $ 136 | $ 265 | $ 129 | 95% | NVDA | 0.0% | NVIDIA CORPO | 0.7% | tech | USA | sc’s |

| 21% | $44 | 0.55 | $ 251 | $ 251 | $ 0 | 0% | MA | 0.1% | MASTERCARD I | 0.7% | finance | USA | credit |

| 28% | $54 | 0.9 | $ 246 | $ 246 | $ 1 | 0% | V | 0.2% | VISA INC | 0.7% | finance | USA | credit |

| 4% | $9 | 4.7 | $ 231 | $ 223 | $ (6) | -3% | CSCO | 0.9% | CISCO SYSTEM | 0.6% | coms | USA | |

| 6% | $11 | 1.8 | $ 200 | $ 206 | $ 13 | 7% | XOM | 3.4% | EXXON MOBIL | 0.6% | energy | USA | oil |

| 5% | $8 | 0.66 | $ 229 | $ 192 | $ (37) | -16% | CHTR | 0.0% | CHARTER COMM | 0.5% | coms | USA | |

| 6% | $10 | 0.36 | $ 184 | $ 174 | $ (9) | -5% | UNH | 0.3% | UNITEDHEALTH | 0.5% | health | USA | insure |

| 8% | $12 | 0.37 | $ 142 | $ 158 | $ 17 | 12% | MCO | 0.3% | MOODYS CORP | 0.4% | finance | USA | rating |

| 8% | $12 | 0.65 | $ 126 | $ 150 | $ 24 | 19% | AXP | 0.4% | AMERICAN EXP | 0.4% | finance | USA | credit |

| 9% | $13 | 0.33 | $ 141 | $ 148 | $ 8 | 6% | SPGI | 0.3% | S&P GLOBAL I | 0.4% | finance | USA | rating |

| 6% | $9 | 0.28 | $ 157 | $ 148 | $ (10) | -6% | ADBE | 0.0% | ADOBE INC CO | 0.4% | tech | USA | sw |

| 9% | $12 | 0.95 | $ 151 | $ 140 | $ (9) | -6% | JNJ | 1.3% | JOHNSON &JOH | 0.4% | health | USA | retail |

| 9% | $12 | 0.83 | $ 128 | $ 138 | $ 12 | 9% | PG | 0.9% | PROCTER AND | 0.4% | retail | USA | health |

| 7% | $8 | 0.15 | $ 110 | $ 128 | $ 19 | 17% | COST | 0.1% | COSTCO WHOLE | 0.3% | retail | USA | value |

| 26% | $26 | 0.08 | $ 104 | $ 126 | $ 22 | 22% | AVGO | 0.1% | BROADCOM INC | 0.3% | tech | USA | sc’s |

| 8% | $9 | 1.95 | $ 120 | $ 124 | $ 6 | 5% | KO | 1.4% | COCA-COLA CO | 0.3% | food | USA | cola |

| 10% | $10 | 2.75 | $ 150 | $ 116 | $ (31) | -20% | BMY | 2.2% | BRISTOL-MYER | 0.3% | health | USA | pharm |

| 32% | $24 | 0.7 | $ 82 | $ 97 | $ 16 | 19% | ORCL | 0.1% | ORACLE CORP | 0.3% | tech | USA | cloud |

| 9% | $8 | 1.3 | $ 95 | $ 95 | $ 2 | 2% | NEE | 2.2% | NEXTERA ENER | 0.3% | energy | USA | util |

| 10% | $9 | 0.56 | $ 95 | $ 94 | $ (1) | -1% | PEP | 0.5% | PEPSICO INC | 0.3% | food | USA | cola |

| 38% | $24 | 0.55 | $ 90 | $ 88 | $ (1) | -2% | AMD | 0.0% | ADVANCED MIC | 0.2% | tech | USA | sc’s |

| 9% | $7 | 1.2 | $ 75 | $ 86 | $ 12 | 16% | SHEL | 2.7% | SHELL PLC SP | 0.2% | energy | Europe | oil |

| 16% | $11 | 0.13 | $ 82 | $ 82 | $ 0 | 0% | INTU | 0.1% | INTUIT INC | 0.2% | finance | USA | tech |

| 17% | $12 | 0.35 | $ 70 | $ 81 | $ 11 | 16% | ADI | 0.5% | ANALOG DEVIC | 0.2% | tech | USA | sc’s |

| 47% | $23 | 0.3 | $ 80 | $ 73 | $ (7) | -9% | CRM | 0.0% | SALESFORCE I | 0.2% | tech | USA | cloud |

| 13% | $8 | 0.9 | $ 79 | $ 71 | $ (7) | -9% | SBUX | 0.7% | STARBUCKS CO | 0.2% | food | USA | retail |

| 11% | $7 | 0.2 | $ 83 | $ 71 | $ (12) | -14% | HUM | 0.2% | HUMANA INC | 0.2% | health | USA | insure |

| 18% | $10 | 0.26 | $ 73 | $ 67 | $ (5) | -7% | MCD | 0.8% | MCDONALD S C | 0.2% | food | USA | retail |

| 19% | $10 | 0.26 | $ 65 | $ 66 | $ 1 | 2% | DHR | 0.1% | DANAHER CORP | 0.2% | industry | USA | health |

| 14% | $8 | 0.8 | $ 65 | $ 63 | $ (1) | -2% | CP | 0.1% | CANADIAN PAC | 0.2% | industry | America | rail |

| 18% | $10 | 0.7 | $ 75 | $ 62 | $ (13) | -17% | BIDU | 0.0% | BAIDU INC SP | 0.2% | tech | China | sw |

| 18% | $10 | 0.42 | $ 54 | $ 62 | $ 8 | 16% | NVO | 0.4% | NOVO NORDISK | 0.2% | health | Europe | pharm |

| 16% | $8 | 7 | $ 55 | $ 62 | $ 7 | 12% | UMC | 0.0% | UNITED MICR | 0.2% | tech | Asia | sc’s |

| 45% | $19 | 0.06 | $ 56 | $ 61 | $ 6 | 11% | ASML | 0.1% | ASML HOLDING | 0.2% | tech | Europe | sc’s |

| 16% | $8 | 1.5 | $ 63 | $ 60 | $ (3) | -5% | STM | 0.1% | STMICROELECT | 0.2% | tech | Europe | sc’s |

| 23% | $11 | 1.6 | $ 57 | $ 58 | $ 1 | 1% | BP | 0.8% | BP PLC SPONS | 0.2% | energy | Europe | oil |

| 11% | $6 | 2 | $ 56 | $ 56 | $ 4 | 7% | EQNR | 7.7% | EQUINOR ASA | 0.2% | energy | Europe | oil |

| 28% | $11 | 0.4 | $ 66 | $ 50 | $ (17) | -25% | SNOW | 0.0% | SNOWFLAKE IN | 0.1% | tech | USA | cloud |

| 30% | $11 | 0.22 | $ 53 | $ 49 | $ (4) | -7% | UNP | 0.1% | UNION PAC CO | 0.1% | industry | USA | rail |

| 40% | $13 | 0.06 | $ 42 | $ 45 | $ 3 | 8% | NOW | 0.0% | SERVICENOW I | 0.1% | tech | USA | cloud |

| 31% | $11 | 0.08 | $ 43 | $ 45 | $ 2 | 6% | ROP | 0.1% | ROPER TECHNO | 0.1% | industry | USA | science |

| 29% | $10 | 1.3 | $ 68 | $ 44 | $ (22) | -32% | BAX | 3.0% | BAXTER INTER | 0.1% | health | USA | pharm |

| 28% | $9 | 0.13 | $ 37 | $ 42 | $ 5 | 13% | AMGN | 0.6% | AMGEN INC | 0.1% | health | USA | pharm |

| 33% | $10 | 0.27 | $ 41 | $ 41 | $ (1) | -2% | ABNB | 0.0% | AIRBNB INC C | 0.1% | travel | USA | rent |

| 49% | $13 | 0.15 | $ 38 | $ 40 | $ 2 | 6% | NXPI | 0.0% | NXP SEMICON | 0.1% | tech | Europe | sc’s |

| 41% | $11 | 0.07 | $ 39 | $ 39 | $ (0) | -1% | TMO | 0.0% | THERMO FISHE | 0.1% | health | USA | tech |

| 32% | $9 | 2 | $ 39 | $ 37 | $ (1) | -2% | WDS | 1.6% | WOODSIDE ENE | 0.1% | energy | Australia | oil |

| 32% | $9 | 0.2 | $ 33 | $ 36 | $ 2 | 7% | TMUS | 0.3% | T-MOBILE US | 0.1% | coms | USA | |

| 90% | $16 | 0.2 | $ 33 | $ 35 | $ 2 | 5% | IBM | 0.5% | INTERNATION | 0.1% | tech | USA | cloud |

| 27% | $7 | 0.5 | $ 37 | $ 34 | $ (3) | -9% | ON | 0.0% | ON SEMICONDU | 0.1% | tech | USA | sc’s |

| 22% | $6 | 0.1 | $ 28 | $ 32 | $ 4 | 15% | PANW | 0.0% | PALO ALTO NE | 0.1% | tech | USA | secure |

| 51% | $11 | 0.06 | $ 31 | $ 32 | $ 1 | 3% | ELV | 0.1% | ELEVANCE HEA | 0.1% | health | USA | insure |

| 33% | $8 | 0.2 | $ 30 | $ 31 | $ 1 | 4% | VLO | 0.0% | VALERO ENERG | 0.1% | energy | USA | oil |

| 57% | $11 | 3 | $ 31 | $ 30 | $ (1) | -2% | ASX | 0.0% | ASE TECHNOL | 0.1% | tech | Asia | sc’s |

| 45% | $9 | 0.3 | $ 27 | $ 30 | $ 2 | 8% | CL | 0.2% | COLGATE-PALM | 0.1% | retail | USA | goods |

| 63% | $11 | 0.17 | $ 27 | $ 29 | $ 2 | 6% | ABBV | 0.0% | ABBVIE INC | 0.1% | health | USA | pharm |

| 44% | $8 | 0.03 | $ 24 | $ 27 | $ 3 | 15% | LLY | 0.1% | ELI LILLY &C | 0.1% | health | USA | pharm |

| 33% | $7 | 0.08 | $ 27 | $ 27 | $ (0) | -1% | CI | 0.5% | THE CIGNA GR | 0.1% | health | USA | insure |

| 55% | $9 | 0.3 | $ 27 | $ 27 | $ (1) | -2% | MCHP | 0.3% | MICROCHIP T | 0.1% | tech | USA | sc’s |

| 102% | $13 | 1 | $ 27 | $ 26 | $ (1) | -4% | GMAB | 0.0% | GENMAB AS SP | 0.1% | health | Europe | biotech |

| 41% | $7 | 0.03 | $ 20 | $ 25 | $ 4 | 21% | MPWR | 0.0% | MONOLITHIC | 0.1% | tech | USA | sc’s |

| 51% | $8 | 0.3 | $ 24 | $ 24 | $ (0) | 0% | MDT | 0.0% | MEDTRONIC PL | 0.1% | health | Europe | devices |

| 97% | $11 | 0.2 | $ 24 | $ 23 | $ (1) | -3% | COP | 0.3% | CONOCOPHILL | 0.1% | energy | USA | oil |

| 43% | $6 | 0.3 | $ 21 | $ 21 | $ 1 | 4% | UBER | 0.0% | UBER TECHNOL | 0.1% | travel | USA | ride |

| 96% | $10 | 0.2 | $ 21 | $ 21 | $ 0 | 2% | ABT | 0.0% | ABBOTT LABO | 0.1% | health | USA | tech |

| 106% | $10 | 0.2 | $ 20 | $ 20 | $ (0) | -1% | DUK | 0.5% | DUKE ENERGY | 0.1% | energy | Europe | util |

| 69% | $8 | 0.25 | $ 19 | $ 20 | $ 0 | 2% | SO | 0.6% | SOUTHERN CO | 0.1% | energy | USA | util |

| 100% | $7 | 0.2 | $ 14 | $ 14 | $ (0) | -3% | QSR | 0.0% | RESTAURANT | 0.0% | food | America | retail |

| 112% | $7 | 0.2 | $ 14 | $ 14 | $ (1) | -6% | TTE | 0.0% | TOTAL ENERG | 0.0% | energy | Europe | oil |

I’m still working on building my Visa and Mastercard positions. A lot of tech and healthcare and energy. Ten more dollars (a chip!) into Nvidia, and the stock went down a little finally, maybe. I’m filling some positions up to an even share amount, and then I’ll hold. Maybe superstition, maybe it makes stock events (like a split) simpler, or maybe it just bugs me less when I look at it.

Reduced Positions

I’m still holding myself to sell at the same pace I deposit, about $1k/month, to protect myself from rash moves and trying to time the market. No full exits this month, but that day is coming. Consolidation day, the crunch. My account is over 50% short (less than 1yr old) and I’m looking forward to getting that down.

| %pos> | thismo | shrs | cost | value | $gain | %gain | tkr | div | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -28% | -$90 | 5 | $ 128 | $ 232 | $ 110 | 31% | GM | 1.6% | GENERAL MTRS | 0.6% | cars | USA | |

| -24% | -$57 | 3 | $ 226 | $ 178 | $ (48) | -17% | PYPL | 0.0% | PAYPAL HLDGS | 0.5% | finance | USA | tech |

| -48% | -$148 | 1 | $ (251) | $ 161 | $ 412 | 251% | RCL | 0.0% | ROYAL CARIBB | 0.4% | travel | USA | cruise |

| -13% | -$22 | 7 | $ 200 | $ 147 | $ (54) | -24% | LSXMA | 0.0% | LIBERTY MEDI | 0.4% | media | USA | liberty |

| -29% | -$52 | 7 | $ 53 | $ 128 | $ 75 | 40% | NCLH | 0.0% | NORWEGIAN CR | 0.3% | travel | USA | cruise |

| -27% | -$47 | 7 | $ 23 | $ 125 | $ 102 | 71% | CCL | 0.0% | CARNIVAL COR | 0.3% | travel | USA | cruise |

| -33% | -$58 | 2 | $ 133 | $ 114 | $ (9) | -4% | TSN | 4.1% | TYSON FOODS | 0.3% | food | USA | meat |

| -28% | -$43 | 7 | $ 28 | $ 112 | $ 84 | 62% | CUK | 0.0% | CARNIVAL ADR | 0.3% | travel | USA | cruise |

| -28% | -$42 | 15 | $ 213 | $ 109 | $ (104) | -41% | WBD | 0.0% | WARNER BROS | 0.3% | media | USA | |

| -24% | -$26 | 8 | $ 191 | $ 81 | $ (103) | -48% | PARA | 3.3% | PARAMOUNT GL | 0.2% | media | USA | |

| -17% | -$14 | 1 | $ 64 | $ 72 | $ 8 | 10% | KMX | 0.0% | CARMAX INC | 0.2% | cars | USA | used |

| -35% | -$34 | 2 | $ 17 | $ 64 | $ 69 | 55% | BMWYY | 17.5% | BAYERISCHE M | 0.2% | cars | Europe | |

| -34% | -$33 | 1 | $ 68 | $ 64 | $ (3) | -3% | AAP | 1.4% | ADVANCE AUTO | 0.2% | cars | USA | parts |

| -36% | -$33 | 5 | $ 48 | $ 58 | $ 15 | 15% | JBSAY | 6.0% | JBS SA SPON | 0.2% | food | America | meat |

| -25% | -$16 | 4 | $ 100 | $ 48 | $ (52) | -45% | VSAT | 0.0% | VIASAT INC | 0.1% | coms | USA | |

| -38% | -$28 | 5 | $ 29 | $ 46 | $ 16 | 23% | LILA | 0.0% | LIBERTY LATI | 0.1% | media | America | liberty |

| -36% | -$19 | 2 | $ 159 | $ 34 | $ (125) | -70% | SATS | 0.0% | DISH NETWORK | 0.1% | media | USA | |

| -34% | -$16 | 2 | $ 102 | $ 31 | $ (61) | -51% | WBA | 8.6% | WALGREENS BO | 0.1% | retail | USA | health |

| -34% | -$12 | 2 | $ 20 | $ 24 | $ 9 | 16% | F | 7.7% | FORD MTR CO | 0.1% | cars | USA |

I’m not interested in a long-term hold of cruises, or meat (I don’t own GRND either). I’m skeptical of cars and aging media companies. I’m not sure about Paypal. Why did I buy Walgreens? Dish network?? I followed some rando into Viasat. (Klarman!)

Held Positions

Check out the attached PDF of all my holdings in full colorful glory. For the first time since I started, Meta is fighting for the top slot, with Apple. Alibaba and Pfizer are still negative.