Since 2022 I’ve put $1000 a month into a Fidelity investment account. I try to pick stocks to hold to retirement.

Welcome to 2024! I imagine my first year (a short 2022) as onboarding, my second year was exploration, and this third year is sculpting. I’m excited to get my account into shape.

I was laid off last week, but I’m going to try to keep this fund active while I can.

Performance

I got beat this month.

| Fund | 1-month | 3-month | 1-year |

|---|---|---|---|

| My Fund | -1.1% | 16.8% | 9.7% |

| S&P 500 | 1.7% | 16.0% | 20.8% |

| Dow Jones | 1.1% | 16.5% | 19.1% |

Wealthfront Account

Each month I invest a matching $1000 into a Wealthfront Individual Investment Account, which auto-splits my investments into ETFs, which is mostly how I think people should invest. I do this to hedge against the gamble of picking stocks, so it leans low-risk, with a healthy Bonds slice.

| Funds | Description | Split | Performance 2023 |

|---|---|---|---|

| VTI, ITOT | US | 48% | 22.87% |

| VWO, IEMG | Emerging Markets | 14% | 6.95% |

| VEA, SCHF | Foreign Developed | 14% | 24.18% |

| VXUS | Global | 10% | 11.69% |

| VTEB, MUB | Municipal Bonds | 10% | 6.38% |

| VIG, DGRO | Dividend Growth | 4% | 18.35% |

Overall, this account was up +17.8% in 2023, less than The S&P 500 last year (+26.3%) and my fund (+27.5%). That’s the cost of these diversified funds, but they should be more stable.

Exits

I’ve been hiding my Exits at the end, but there are five (!) new ones this month.

| Invested | Total Sold | Symbol | Description | Total % Gain | Total $ Gain | Total Shares |

|---|---|---|---|---|---|---|

| $ 96.60 | $ 13.85 | BBBY | Bed Bath & Beyond | -85.7% | $ (83) | 20 |

| $ 376.93 | $ 364.90 | BND* | Vanguard Total International | -3.2% | $ (12) | 5 |

| $ 285.94 | $ 280.63 | VWO* | Vanguard INTL Equity Index | -1.9% | $ (5) | 7 |

| $ 99.66 | $ 114.18 | VXUS* | Vanguard Total Bond | 14.6% | $ 15 | 2 |

| $ 101.71 | $ 113.00 | VSS* | Vanguard FTSE Emerging | 11.1% | $ 11 | 1 |

| $ 41.42 | $ 47.52 | VEA* | Vanguard Developed Markets | 14.7% | $ 6 | 1 |

*New exits

I’m a little surprised myself, I thought I might never find a reason to sell early. But these are ETFS, which I’ve got covered in my Wealthfront account, so I don’t need the redundancy here. They’re against the spirit of the account.

Net gains from the sale are $14.57. I’m annoyed if I have to pay taxes and annoyed my Exits data is getting more complicated, but I’m happy to clean things up, and focus on my picks. I’ll sell AVUV and SCHD once they’re a year old. I bought these ETFs when I wasn’t sure where else to put my money, so they did their job by not losing money. Now I’m feeling more confident in my analysis, and have more ideas.

Buys

I picked up a lot this month with the extra cash in my pocket! I spent $1994 on stocks this month.

In previous emails, it was difficult to see how much I spent on each buy. I finally added a “New Cost” column, so you can see the amount I spent in January. (I got ChatGPT to one-shot the task with two CSVs.)

This month I labelled my stocks by sector and type and location. You can see I bought 5 of the Magnificent 7 (mag7). I doubled my stake in Berkshire Hathaway. I’m still building up my health sector, and China, and a taste of airlines. I bought some semiconductors (sc’s), both in Other Asia (not China), looking for good deals in Nvidia competitors. I finally bought into Tesla (which promptly dropped 25%) and NVDA (which promptly rose 30%).

| Current Value | Total Cost | Total $ Gain | Total % Gain | Symbol | Description | % of Account | Type | Subtype | Area | New Cost | New Shares | Shares |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $307 | $289 | $18 | 6% | BRKB | BERKSHIRE HATHAWAY INC CO | 1.1% | multi | BRKB | USA | $ 146 | 0.4 | 0.8 |

| $709 | $539 | $170 | 32% | GOOG | ALPHABET INC CAP STK CL C | 2.4% | tech | mag7 | USA | $ 139 | 1 | 5 |

| $124 | $117 | $7 | 6% | ADBE* | ADOBE INC COM | 0.4% | tech | USA | $ 117 | 0.2 | 0.2 | |

| $102 | $106 | -$4 | -4% | UNH* | UNITEDHEALTH GROUP INC | 0.4% | health | insurance | USA | $ 106 | 0.2 | 0.2 |

| $452 | $383 | $69 | 18% | TSM | TAIWAN SEMICONDUCTOR MANU | 1.5% | tech | sc’s | O. Asia | $ 101 | 1 | 4 |

| $830 | $690 | $140 | 20% | AAPL | APPLE INC | 2.8% | tech | mag7 | USA | $ 92 | 0.5 | 4.5 |

| $79 | $81 | -$1 | -2% | JNJ* | JOHNSON &JOHNSON COM USD1 | 0.3% | health | USA | $ 81 | 0.5 | 0.5 | |

| $91 | $81 | $10 | 13% | ITOCY* | ITOCHU ADR REP 2 ORD | 0.3% | multi | O. Asia | $ 81 | 1 | 1 | |

| $543 | $487 | $56 | 12% | AMZN | AMAZON.COM INC | 1.9% | tech | mag7 | USA | $ 76 | 0.5 | 3.5 |

| $279 | $307 | -$28 | -9% | TCEHY | TENCENT HOLDINGS LIMITED | 1.0% | tech | games | China | $ 75 | 2 | 8 |

| $79 | $75 | $4 | 5% | PG* | PROCTER AND GAMBLE CO COM | 0.3% | retail | health | USA | $ 75 | 0.5 | 0.5 |

| $289 | $345 | -$57 | -16% | BABA | ALIBABA GROUP HOLDING LTD | 1.0% | tech | China | $ 74 | 1 | 4 | |

| $253 | $325 | -$72 | -22% | MRNA | MODERNA INC COM | 0.9% | health | USA | $ 56 | 0.5 | 2.5 | |

| $143 | $163 | -$20 | -13% | BNTX | BIONTECH SE SPON ADS EACH | 0.5% | health | Europe | $ 55 | 0.5 | 1.5 | |

| $154 | $166 | -$12 | -7% | XOM | EXXON MOBIL CORP | 0.5% | energy | USA | $ 51 | 0.5 | 1.5 | |

| $100 | $98 | $2 | 2% | CSCO* | CISCO SYSTEMS INC | 0.3% | coms | USA | $ 50 | 2 | 2 | |

| $37 | $49 | -$12 | -24% | TSLA* | TESLA INC COM | 0.1% | cars | mag7 | USA | $ 49 | 0.2 | 0.2 |

| $62 | $47 | $14 | 30% | NVDA* | NVIDIA CORPORATION COM | 0.2% | tech | mag7 | USA | $ 47 | 0.1 | 0.1 |

| $38 | $46 | -$8 | -18% | HUM* | HUMANA INC | 0.1% | health | insurance | USA | $ 46 | 0.1 | 0.1 |

| $35 | $35 | $0 | 0% | BP* | BP PLC SPONSORED ADR | 0.1% | energy | Europe | $ 35 | 1 | 1 | |

| $34 | $33 | $0 | 1% | PEP* | PEPSICO INC | 0.1% | food | USA | $ 33 | 0.2 | 0.2 | |

| $27 | $32 | -$6 | -17% | SEDG* | SOLAREDGE TECHNOLOGIES IN | 0.1% | energy | solar | USA | $ 32 | 0.4 | 0.4 |

| $170 | $191 | -$21 | -11% | UPS | UNITED PARCEL SERVICE INC | 0.6% | industry | postal | USA | $ 32 | 0.2 | 1.2 |

| $78 | $73 | $5 | 7% | ALGT | ALLEGIANT TRAVEL COMPANY | 0.3% | travel | air | USA | $ 32 | 0.4 | 1 |

| $30 | $32 | -$1 | -5% | VICI* | VICI PPTYS INC COM | 0.1% | travel | vegas | USA | $ 32 | 1 | 1 |

| $30 | $31 | $0 | -1% | NKE* | NIKE INC CLASS B COM NPV | 0.1% | retail | clothes | USA | $ 31 | 0.3 | 0.3 |

| $184 | $226 | -$42 | -19% | PYPL | PAYPAL HLDGS INC COM | 0.6% | finance | tech | USA | $ 30 | 0.5 | 3 |

| $158 | $224 | -$66 | -29% | JD | JD.COM INC SPON ADS EACH | 0.5% | tech | China | $ 27 | 1 | 7 | |

| $122 | $140 | -$17 | -12% | BMY | BRISTOL-MYERS SQUIBB CO C | 0.4% | health | USA | $ 26 | 0.5 | 2.5 | |

| $24 | $24 | $0 | 2% | CP* | CANADIAN PAC KANS CITY LT | 0.1% | travel | rail | O. America | $ 24 | 0.3 | 0.3 |

| $21 | $23 | -$2 | -9% | BIDU* | BAIDU INC SPON ADS EACH R | 0.1% | tech | China | $ 23 | 0.2 | 0.2 | |

| $23 | $22 | $1 | 6% | SSUMY* | SUMITOMO ADR | 0.1% | multi | O. Asia | $ 22 | 1 | 1 | |

| $21 | $21 | $0 | 0% | WDS* | WOODSIDE ENERGY GROUP LTD | 0.1% | energy | Australia | $ 21 | 1 | 1 | |

| $83 | $80 | $3 | 3% | UAL | UNITED AIRLS HLDGS INC CO | 0.3% | travel | air | USA | $ 20 | 0.5 | 2 |

| $17 | $19 | -$2 | -11% | YUMC* | YUM CHINA HLDGS INC COM | 0.1% | food | China | $ 19 | 0.5 | 0.5 | |

| $71 | $67 | $4 | 7% | AAL | AMERICAN AIRLINES GROUP I | 0.2% | travel | air | USA | $ 13 | 1 | 5 |

| $56 | $54 | $2 | 3% | BACHY | BANK OF CHINA LTD ADR | 0.2% | finance | China | $ 9 | 1 | 6 | |

| $89 | $199 | -$110 | -55% | WB | WEIBO ADR REP 1 CL A ORD | 0.3% | tech | China | $ 9 | 1 | 11 | |

| $8 | $8 | $0 | -1% | UMC* | UNITED MICR ELCTRNS ADR | 0.0% | tech | sc’s | O. Asia | $ 8 | 1 | 1 |

*__New Shares

I’ve started paying more attention to Cash on Hand. Companies with cash are poised to invest in new technology, and are protected in a recession. Google has a lot of cash.

Holds

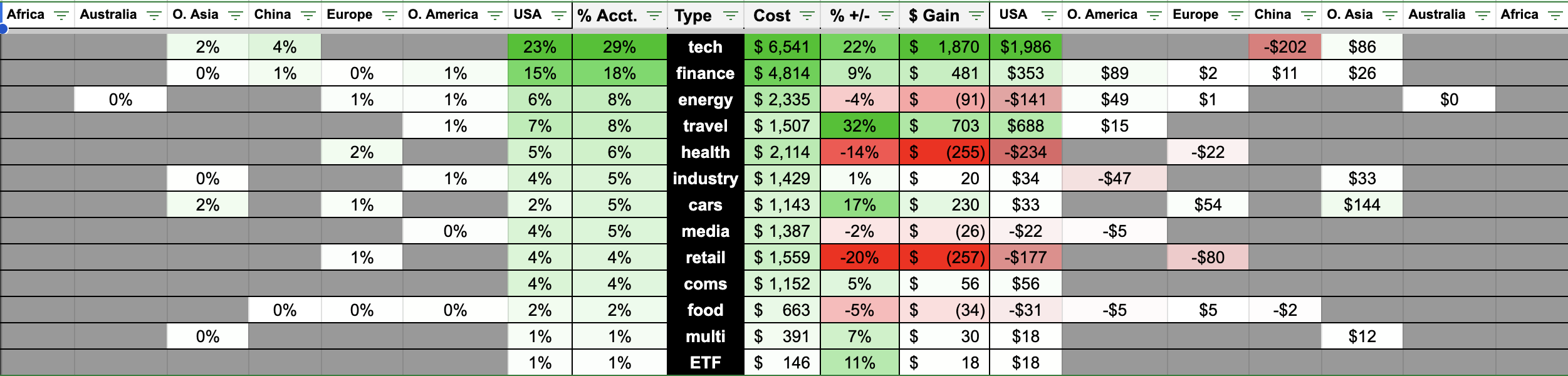

Now that we’ve got type and location data, I can make better charts, like this one. On the left, you can see how my holdings are spread by country and type. On the right, you can see how my gains are spread, with wounds in health and retail and energy and China tech.

However, in all these charts, the ‘% Gain’ and ‘$ Gain’ values are misleading. They’re just the stock price changes, which doesn’t included dividend gains. I’m up about $3600 total, which is about $3000 in price increases, and about $560 in dividends (which I invest). About 16% of my earnings are dividends, which isn’t shown in these charts! And dividends are at least real money, the price earnings can always disappear - or go negative! I’ll have to figure out how to track my dividends.

DISH is now SATS after a merger. I’m annoyed whenever a stock name changes - my data! This was an old buy (2022) where I bought too much of a dip I didn’t understand and got hammered, and I’m still getting hammered.

This month I include columns for the 1mo % change in price, and 1mo $ change for my account, for January. You can see I took the biggest hits on Intel and Lenovo, but it’s hard to see at-a-glance where the market beat me.

| Current Value | Total Cost | Total $ Gain | Total % Gain | Symbol | Description | % of Account | Type | Subtype | Area | 1mo % Gain | 1mo $ Gain | Shares |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $1,951 | $800 | $1,151 | 144% | META | META PLATFORMS INC CLASS | 6.7% | tech | mag7 | USA | 10% | $181 | 5 |

| $864 | $915 | -$52 | -6% | OXY | OCCIDENTAL PETE CORP COM | 2.9% | energy | USA | -4% | -$32 | 15 | |

| $795 | $573 | $222 | 39% | MSFT | MICROSOFT CORP | 2.7% | tech | mag7 | USA | 6% | $43 | 2 |

| $612 | $538 | $74 | 14% | BAC | BANK AMERICA CORP COM | 2.1% | finance | USA | 0% | $6 | 18 | |

| $514 | $405 | $109 | 27% | ALLY | ALLY FINANCIAL INC COM US | 1.8% | finance | USA | 5% | $25 | 14 | |

| $510 | $164 | $346 | 211% | RCL | ROYAL CARIBBEAN GROUP COM | 1.7% | travel | cruise | USA | -1% | -$8 | 4 |

| $449 | $389 | $60 | 15% | C | CITIGROUP INC | 1.5% | finance | USA | 10% | $37 | 8 | |

| $442 | $469 | -$27 | -6% | CVX | CHEVRON CORP NEW COM | 1.5% | energy | USA | -1% | -$5 | 3 | |

| $431 | $348 | $82 | 24% | INTC | INTEL CORP COM USD0.001 | 1.5% | tech | sc’s | USA | -14% | -$72 | 10 |

| $424 | $402 | $22 | 5% | VZ | VERIZON COMMUNICATIONS IN | 1.4% | coms | USA | 11% | $47 | 10 | |

| $420 | $268 | $152 | 57% | GOOGL | ALPHABET INC CAP STK CL A | 1.4% | tech | mag7 | USA | 0% | $1 | 3 |

| $406 | $294 | $112 | 38% | COF | CAPITAL ONE FINANCIAL COR | 1.4% | finance | USA | 3% | $13 | 3 | |

| $399 | $273 | $127 | 46% | TM | TOYOTA MOTOR CORP ADR-EAC | 1.4% | cars | O. Asia | 9% | $32 | 2 | |

| $388 | $351 | $37 | 11% | GM | GENERAL MTRS CO COM | 1.3% | cars | USA | 8% | $29 | 10 | |

| $352 | $508 | -$156 | -31% | PFE | PFIZER INC | 1.2% | health | USA | -7% | -$22 | 13 | |

| $349 | $243 | $106 | 43% | JPM | JPMORGAN CHASE & CO | 1.2% | finance | USA | 3% | $9 | 2 | |

| $301 | $244 | $57 | 23% | WFC | WELLS FARGO CO NEW COM | 1.0% | finance | USA | 2% | $6 | 6 | |

| $296 | $291 | $5 | 2% | TFC | TRUIST FINL CORP COM | 1.0% | finance | USA | 0% | $1 | 8 | |

| $293 | $221 | $72 | 33% | CE | CELANESE CORP DEL COM | 1.0% | industry | USA | -6% | -$18 | 2 | |

| $291 | $274 | $17 | 6% | USB | US BANCORP | 1.0% | finance | USA | -3% | -$12 | 7 | |

| $282 | $107 | $175 | 163% | NFLX | NETFLIX INC | 1.0% | media | USA | 16% | $39 | 0.5 | |

| $267 | $188 | $79 | 42% | NCLH | NORWEGIAN CRUISE LINE HLD | 0.9% | travel | cruise | USA | -11% | -$34 | 15 |

| $257 | $167 | $90 | 54% | MU | MICRON TECHNOLOGY INC | 0.9% | tech | sc’s | USA | 1% | $1 | 3 |

| $249 | $143 | $106 | 74% | CCL | CARNIVAL CORP COM USD0.01 | 0.9% | travel | cruise | USA | -13% | -$29 | 15 |

| $249 | $270 | -$21 | -8% | FIS | FIDELITY NATL INFORMATION | 0.9% | finance | USA | 4% | $9 | 4 | |

| $247 | $255 | -$8 | -3% | BIIB | BIOGEN INC COM USD0.0005 | 0.8% | health | USA | -5% | -$12 | 1 | |

| $230 | $226 | $3 | 1% | HPQ | HP INC COM | 0.8% | tech | USA | -4% | -$11 | 8 | |

| $227 | $136 | $91 | 67% | CUK | CARNIVAL ADR REP 1 ORD | 0.8% | travel | cruise | USA | -11% | -$26 | 15 |

| $223 | $171 | $52 | 30% | QCOM | QUALCOMM INC | 0.8% | tech | sc’s | USA | 2% | $6 | 1.5 |

| $219 | $251 | -$32 | -13% | TSN | TYSON FOODS INC | 0.8% | food | USA | 1% | $4 | 4 | |

| $212 | $213 | -$1 | 0% | T | AT&T INC COM USD1 | 0.7% | coms | USA | 4% | $11 | 12 | |

| $209 | $149 | $60 | 41% | LNVGY | LENOVO GROUP ADR | 0.7% | tech | China | -25% | -$71 | 10 | |

| $202 | $176 | $26 | 15% | SIX | SIX FLAGS ENTERTAINMENT C | 0.7% | travel | park | USA | 1% | $1 | 8 |

| $200 | $255 | -$54 | -21% | WBD | WARNER BROS DISCOVERY INC | 0.7% | media | USA | -9% | -$28 | 20 | |

| $192 | $196 | -$4 | -2% | DIS | DISNEY WALT CO COM | 0.7% | media | USA | 7% | $11 | 2 | |

| $189 | $251 | -$63 | -25% | MMM | 3M CO | 0.6% | industry | USA | -13% | -$30 | 2 | |

| $187 | $197 | -$10 | -5% | SWK | STANLEY BLACK & DECKER IN | 0.6% | retail | tools | USA | -5% | -$9 | 2 |

| $185 | $179 | $7 | 4% | CHTR | CHARTER COMMUNICATIONS IN | 0.6% | coms | USA | -5% | -$9 | 0.5 | |

| $176 | $173 | $2 | 1% | RHHBY | ROCHE HOLDINGS ADR | 0.6% | health | Europe | -2% | -$5 | 5 | |

| $174 | $131 | $43 | 33% | BMWYY | BAYERISCHE MOTOREN WERKE | 0.6% | cars | Europe | -6% | -$12 | 5 | |

| $172 | $91 | $81 | 88% | STNE | STONECO LTD COM USD0.0000 | 0.6% | finance | O. America | -4% | -$8 | 10 | |

| $171 | $122 | $49 | 40% | PBR | PETROLEO BRASILEIRO SA PE | 0.6% | energy | O. America | 7% | $11 | 10 | |

| $161 | $140 | $21 | 15% | HOOD | ROBINHOOD MKTS INC COM CL | 0.6% | finance | tech | USA | -17% | -$30 | 15 |

| $160 | $157 | $3 | 2% | TXN | TEXAS INSTRUMENTS INC COM | 0.6% | tech | sc’s | USA | -6% | -$10 | 1 |

| $159 | $105 | $54 | 51% | UHS | UNIVERSAL HEALTH SERVICES | 0.5% | health | USA | 4% | $7 | 1 | |

| $156 | $152 | $4 | 3% | FLWS | 1 800 FLOWERS COM INC CL | 0.5% | retail | gifts | USA | -5% | -$6 | 15 |

| $151 | $117 | $34 | 29% | PNC | PNC FINANCIAL SERVICES GR | 0.5% | finance | USA | -2% | -$4 | 1 | |

| $152 | $108 | $44 | 40% | LSXMA | LIBERTY MEDIA CORP DEL CO | 0.5% | media | liberty | USA | 5% | $8 | 5 |

| $150 | $154 | -$4 | -2% | SNY | SANOFI ADR REP 1 1/2 ORD | 0.5% | health | Europe | 0% | $1 | 3 | |

| $146 | $217 | -$71 | -33% | PARA | PARAMOUNT GLOBAL CLASS B | 0.5% | media | USA | -3% | -$2 | 10 | |

| $148 | $163 | -$15 | -9% | BTI | BRITISH AMERICAN TOBACCO | 0.5% | retail | sin | Europe | 2% | $2 | 5 |

| $140 | $111 | $28 | 25% | CMCSA | COMCAST CORP | 0.5% | coms | USA | 6% | $8 | 3 | |

| $135 | $115 | $20 | 17% | ACGBY | AGRICULTURAL BANK-UNSPON | 0.5% | finance | China | -4% | $1 | 14 | |

| $133 | $118 | $15 | 13% | GPN | GLOBAL PAYMENTS INC | 0.5% | finance | USA | 5% | $6 | 1 | |

| $129 | $151 | -$22 | -15% | KSS | KOHLS CORP COM | 0.4% | retail | USA | -11% | -$14 | 5 | |

| $122 | $101 | $21 | 21% | HPE | HEWLETT PACKARD ENTERPRIS | 0.4% | tech | USA | -10% | -$14 | 8 | |

| $124 | $109 | $15 | 13% | CNI | CANADIAN NATL RY CO COM I | 0.4% | travel | rail | O. America | -2% | -$2 | 1 |

| $120 | $57 | $64 | 112% | PVH | PVH CORPORATION COM | 0.4% | retail | clothes | USA | -1% | -$2 | 1 |

| $117 | $109 | $9 | 8% | DAL | DELTA AIR LINES INC | 0.4% | travel | air | USA | -2% | -$4 | 3 |

| $117 | $122 | -$6 | -5% | IDCBY | INDUSTRIAL &COMMERCIAL BK | 0.4% | finance | China | -3% | $0 | 12 | |

| $119 | $123 | -$5 | -4% | CICHY | CHINA CONSTRUCTION BANK C | 0.4% | finance | China | -1% | $0 | 10 | |

| $111 | $117 | -$6 | -5% | VSAT | VIASAT INC | 0.4% | coms | USA | -21% | -$29 | 5 | |

| $111 | $107 | $4 | 4% | KHC | KRAFT HEINZ CO COM | 0.4% | food | USA | 0% | $0 | 3 | |

| $113 | $235 | -$123 | -52% | HBI | HANESBRANDS INC COM USD0. | 0.4% | retail | clothes | USA | 13% | $1 | 25 |

| $107 | $103 | $5 | 5% | DOW | DOW INC COM | 0.4% | industry | USA | -3% | -$3 | 2 | |

| $109 | $83 | $26 | 32% | EWBC | EAST WEST BANCORP INC | 0.4% | finance | O. Asia | 1% | $1 | 1.5 | |

| $106 | $81 | $26 | 32% | MKSI | MKS INSTRS INC COM | 0.4% | industry | sc’s | USA | 3% | $3 | 1 |

| $100 | $97 | $3 | 3% | CTRA | COTERRA ENERGY INC COM | 0.3% | energy | USA | -4% | -$2 | 4 | |

| $100 | $101 | -$1 | -1% | AAP | ADVANCE AUTO PARTS INC | 0.3% | cars | parts | USA | 10% | $8 | 1.5 |

| $98 | $75 | $23 | 31% | LVS | LAS VEGAS SANDS CORP COM | 0.3% | travel | vegas | USA | 0% | $0 | 2 |

| $94 | $99 | -$5 | -5% | JBSAY | JBS SA SPON ADR EACH REP | 0.3% | food | O. America | -6% | -$7 | 10 | |

| $94 | $88 | $6 | 7% | BMO | BANK OF MONTREAL COM NPV | 0.3% | finance | O. America | -5% | -$5 | 1 | |

| $95 | $76 | $19 | 25% | OMF | ONEMAIN HLDGS INC COM | 0.3% | finance | USA | -3% | -$3 | 2 | |

| $91 | $93 | -$2 | -3% | JWN | NORDSTROM INC COM NPV | 0.3% | retail | clothes | USA | 1% | -$1 | 5 |

| $91 | $59 | $32 | 54% | LSXMK | LIBERTY MEDIA CORP DEL CO | 0.3% | media | liberty | USA | 5% | $5 | 3 |

| $87 | $72 | $15 | 21% | AVUV | AMERICAN CENTY ETF TR AVA | 0.3% | ETF | USA | -3% | -$3 | 1 | |

| $84 | $74 | $10 | 14% | EB | EVENTBRITE INC COM CL A | 0.3% | tech | USA | 5% | $0 | 10 | |

| $82 | $85 | -$3 | -3% | RDFN | REDFIN CORP COM | 0.3% | tech | USA | -18% | -$21 | 10 | |

| $83 | $65 | $18 | 27% | OKTA | OKTA INC CL A | 0.3% | tech | USA | -9% | -$8 | 1 | |

| $78 | $45 | $33 | 74% | PKX | POSCO HOLDINGS INC ADR EA | 0.3% | industry | O. Asia | -18% | -$17 | 1 | |

| $78 | $57 | $21 | 38% | NOV | NOV INC COM | 0.3% | industry | USA | -2% | -$3 | 4 | |

| $78 | $109 | -$30 | -28% | LBRDK | LIBERTY BROADBAND CORP CO | 0.3% | media | liberty | USA | -3% | -$3 | 1 |

| $76 | $70 | $6 | 8% | CF | CF INDUSTRIES HOLDINGS IN | 0.3% | industry | fertalizer | USA | -6% | -$4 | 1 |

| $76 | $74 | $2 | 3% | SCHD | SCHWAB US DIVIDEND EQUITY | 0.3% | ETF | USA | 0% | $0 | 1 | |

| $74 | $68 | $6 | 9% | CVS | CVS HEALTH CORPORATION CO | 0.3% | retail | health | USA | 1 | ||

| $71 | $63 | $8 | 12% | KMX | CARMAX INC | 0.2% | cars | used | USA | -8% | -$6 | 1 |

| $70 | $74 | -$4 | -5% | LILA | LIBERTY LATIN AMERICA LTD | 0.2% | media | liberty | O. America | 1% | -$3 | 10 |

| $71 | $72 | -$1 | -2% | LILAK | LIBERTY LATIN AMERICA LTD | 0.2% | media | liberty | O. America | 2% | -$2 | 10 |

| $69 | $53 | $16 | 31% | NTDOY | NINTENDO CO LTD UNSP ADS | 0.2% | tech | games | O. Asia | 7% | $4 | 5 |

| $68 | $119 | -$51 | -43% | WBA | WALGREENS BOOTS ALLIANCE | 0.2% | retail | health | USA | -13% | -$10 | 3 |

| $68 | $66 | $1 | 2% | NGG | NATIONAL GRID SPON ADR EA | 0.2% | energy | Europe | -1% | $0 | 1 | |

| $67 | $50 | $17 | 34% | HMC | HONDA MOTOR CO ADR-EACH C | 0.2% | cars | O. Asia | 8% | $5 | 2 | |

| $65 | $82 | -$17 | -21% | ZM | ZOOM VIDEO COMMUNICATIONS | 0.2% | tech | USA | -10% | -$7 | 1 | |

| $66 | $56 | $10 | 19% | STLA | STELLANTIS N.V COM EUR0.0 | 0.2% | cars | Europe | -5% | -$4 | 3 | |

| $61 | $59 | $2 | 4% | TD | TORONTO DOMINION BANK ONT | 0.2% | finance | O. America | -7% | -$4 | 1 | |

| $62 | $57 | $5 | 8% | BUD | ANHEUSER-BUSCH INBEV SA/N | 0.2% | food | Europe | -5% | -$3 | 1 | |

| $63 | $61 | $2 | 3% | SHEL | SHELL PLC SPON ADS EA REP | 0.2% | energy | Europe | -5% | -$3 | 1 | |

| $59 | $56 | $2 | 4% | F | FORD MTR CO DEL COM | 0.2% | cars | USA | -2% | -$2 | 5 | |

| $59 | $73 | -$15 | -20% | NEE | NEXTERA ENERGY INC COM US | 0.2% | energy | USA | -4% | -$2 | 1 | |

| $60 | $42 | $19 | 44% | CLF | CLEVELAND-CLIFFS INC NEW | 0.2% | industry | USA | 0% | -$1 | 3 | |

| $59 | $62 | -$3 | -4% | KO | COCA-COLA CO | 0.2% | food | USA | 1% | $0 | 1 | |

| $60 | $51 | $9 | 17% | LUV | SOUTHWEST AIRLINES CO | 0.2% | travel | air | USA | 3% | $2 | 2 |

| $52 | $57 | -$5 | -9% | MHK | MOHAWK INDUSTRIES COM USD | 0.2% | industry | USA | 0% | $0 | 0.5 | |

| $49 | $81 | -$32 | -39% | VFC | V F CORP COM NPV | 0.2% | retail | clothes | USA | -13% | -$7 | 3 |

| $50 | $60 | -$10 | -16% | NTR | NUTRIEN LTD COM NPV ISIN | 0.2% | industry | fertalizer | O. America | -11% | -$6 | 1 |

| $50 | $47 | $3 | 6% | QRVO | QORVO INC | 0.2% | tech | USA | -12% | -$6 | 0.5 | |

| $50 | $38 | $12 | 32% | AXP | AMERICAN EXPRESS CO COM U | 0.2% | finance | USA | 7% | $3 | 0.25 | |

| $46 | $63 | -$17 | -27% | HIW | HIGHWOODS PROPERTIES INC | 0.2% | industry | O. America | 0% | $0 | 2 | |

| $42 | $61 | -$19 | -31% | SQM | SOCIEDAD QUIMICA Y MINERA | 0.1% | industry | lithium | O. America | -30% | -$18 | 1 |

| $42 | $49 | -$7 | -15% | DVN | DEVON ENERGY CORP NEW | 0.1% | energy | USA | -7% | -$3 | 1 | |

| $41 | $45 | -$4 | -9% | HPK | HIGHPEAK ENERGY INC COM | 0.1% | energy | USA | -3% | -$2 | 3 | |

| $40 | $160 | -$119 | -75% | SATS | ECHOSTAR CORPORATION COM | 0.1% | media | USA | 3 | |||

| $38 | $74 | -$36 | -49% | CDLX | CARDLYTICS INC COM | 0.1% | tech | USA | -15% | -$8 | 5 | |

| $38 | $37 | $1 | 3% | BCS | BARCLAYS PLC ADR-EACH CV | 0.1% | finance | Europe | -6% | -$1 | 5 | |

| $39 | $58 | -$20 | -34% | BAX | BAXTER INTERNATIONAL INC | 0.1% | health | USA | -1% | $0 | 1 | |

| $37 | $31 | $6 | 20% | LLYVA | LIBERTY MEDIA CORP DEL CO | 0.1% | media | liberty | USA | 0% | $0 | 1 |

| $38 | $31 | $7 | 22% | HBAN | HUNTINGTON BANCSHARES INC | 0.1% | finance | USA | -2% | $0 | 3 | |

| $39 | $38 | $1 | 3% | HSBC | HSBC HLDGS PLC SPON ADR N | 0.1% | finance | Europe | 1 | |||

| $36 | $35 | $1 | 1% | ALK | ALASKA AIR GROUP INC COM | 0.1% | travel | air | USA | -8% | -$3 | 1 |

| $34 | $26 | $8 | 30% | FITB | FIFTH THIRD BANCORP | 0.1% | finance | USA | 1% | $0 | 1 | |

| $32 | $33 | -$1 | -3% | GIS | GENERAL MILLS INC COM USD | 0.1% | food | USA | 0% | -$1 | 0.5 | |

| $33 | $29 | $4 | 14% | CFG | CITIZENS FINL GROUP INC C | 0.1% | finance | USA | -1% | $0 | 1 | |

| $33 | $47 | -$14 | -30% | KIRK | KIRKLANDS INC COM | 0.1% | retail | home | USA | 10% | $3 | 10 |

| $31 | $35 | -$5 | -13% | MOS | MOSAIC CO NEW COM | 0.1% | industry | fertalizer | USA | -15% | -$5 | 1 |

| $29 | $30 | -$2 | -6% | EQNR | EQUINOR ASA SPON ADR EACH | 0.1% | energy | Europe | -10% | -$3 | 1 | |

| $28 | $34 | -$6 | -17% | BEPC | BROOKFIELD RENEWABLE CORP | 0.1% | energy | USA | -4% | -$1 | 1 | |

| $30 | $28 | $2 | 7% | NEP | NEXTERA ENERGY PARTNERS L | 0.1% | energy | USA | 0% | $0 | 1 | |

| $27 | $29 | -$1 | -4% | VALE | VALE S.A. SPONS ADS REPR | 0.1% | industry | O. America | -14% | -$5 | 2 | |

| $26 | $25 | $1 | 4% | HE | HAWAIIAN ELECTRIC INDUSTR | 0.1% | energy | USA | -7% | -$2 | 2 | |

| $25 | $25 | $1 | 4% | CROX | CROCS INC | 0.1% | retail | clothes | USA | 9% | $2 | 0.25 |

| $24 | $28 | -$4 | -13% | CWEN | CLEARWAY ENERGY INC CL C | 0.1% | energy | USA | -10% | -$3 | 1 | |

| $22 | $38 | -$16 | -41% | PLUG | PLUG POWER INC | 0.1% | energy | hydrogen | USA | -11% | -$1 | 5 |

| $24 | $20 | $4 | 20% | MLI | MUELLER INDUSTRIES INC | 0.1% | industry | USA | 2% | $0 | 0.5 | |

| $20 | $43 | -$24 | -54% | ILPT | INDUSTRIAL LOGISTICS PPTY | 0.1% | industry | USA | -20% | -$4 | 5 | |

| $21 | $18 | $3 | 18% | JBLU | JETBLUE AWYS CORP COM | 0.1% | travel | air | USA | -12% | -$1 | 4 |

| $20 | $18 | $2 | 11% | LBTYA | LIBERTY GLOBAL LTD. COM U | 0.1% | coms | liberty | USA | 9% | $2 | 1 |

| $16 | $15 | $1 | 7% | SBGI | SINCLAIR INC CL A | 0.1% | coms | USA | 21% | $3 | 1 | |

| $13 | $28 | -$15 | -55% | SAVE | SPIRIT AIRLINES INC | 0.0% | travel | air | USA | -61% | -$20 | 2 |

| $11 | $13 | -$2 | -19% | SHYF | SHYFT GROUP INC COM | 0.0% | cars | USA | -10% | -$1 | 1 | |

| $6 | $10 | -$4 | -38% | NYCB | NEW YORK COMMUNITY BANCOR | 0.0% | finance | USA | -35% | -$4 | 1 | |

| $3 | $243 | -$240 | -99% | SBNY | SIGNATURE BANK | 0.0% | finance | USA | -25% | $0 | 2 | |

| $0 | $66 | -$66 | -100% | FTCHF | FARFETCH LTD COM USD0.04 | 0.0% | retail | clothes | Europe | 0% | $0 | 10 |