2023 October ($21,500)

Performance

Rough 3 months!

| Fund | 1-month | 3-month | YTD | 1-year |

|---|---|---|---|---|

| My Fund | (-4.9%) | (-14.0%) | 8.0% | 9.3% |

| S&P 500 | (-2.0%) | (-8.3%) | 10.7% | 10.1% |

| Dow Jones | (-2.7%) | (-9.2%) | 9.4% | 8.4% |

Charts

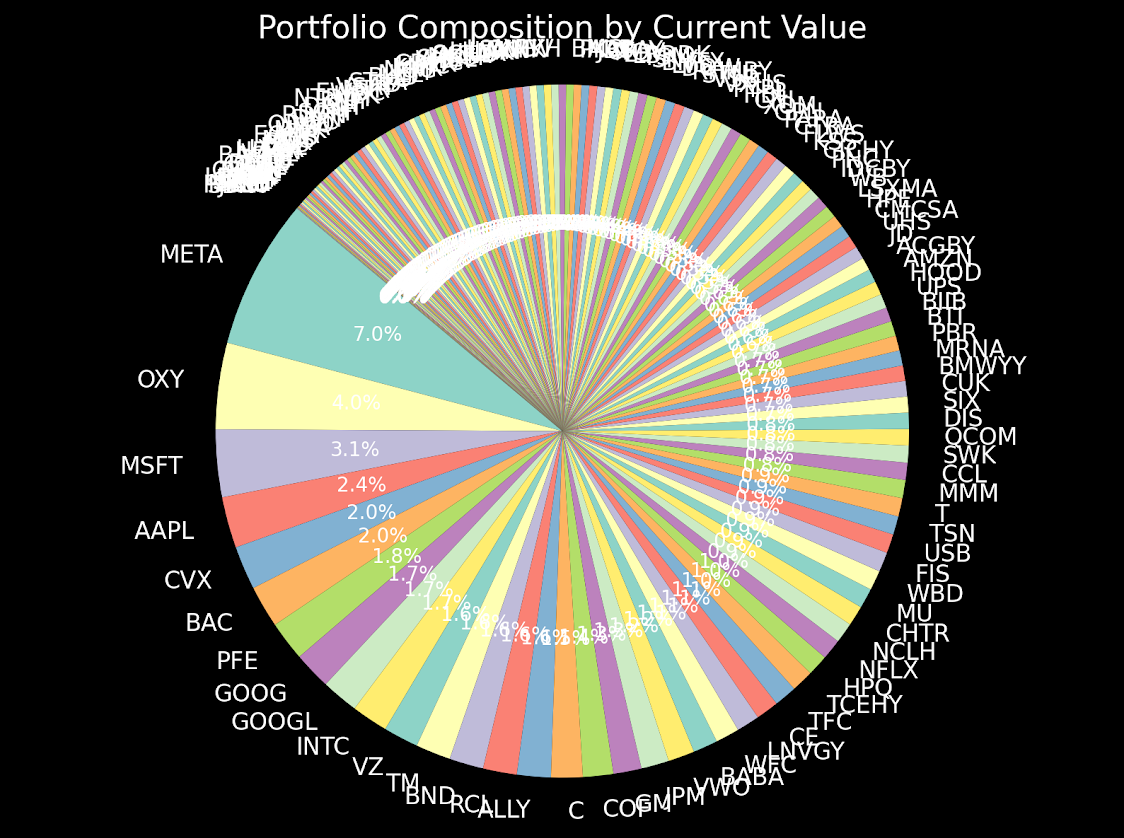

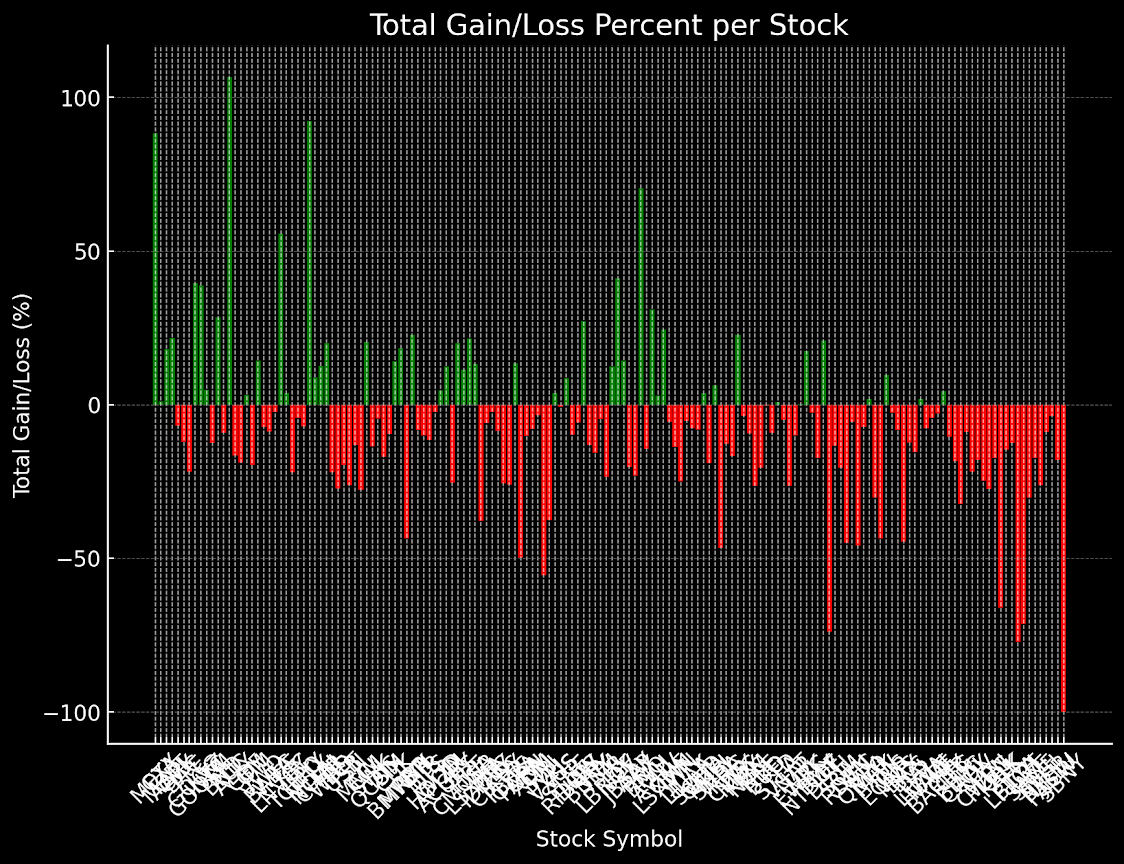

Let’s trust GPT-4: “Make me two interesting charts.”

…Interesting. Do I look diversified?

Buys

Everybody says Don’t Buy Airlines. I’m prepared to hurt myself on airlines, that’s why I started so slow, trawling the dip. (The last names in the notes are superinvestors.)

| Total $ | Symbol | Account % | Total $ Gain | Total % Gain | New Shares | Description | Total Shares | Avg $/Share | Last Price | Notes |

|---|---|---|---|---|---|---|---|---|---|---|

| $676.2 | MSFT | 3.1% | $103.5 | 18.1% | 0.5 | MICROSOFT CORP | 2.0 | $572.7 | $338.1 | MSFT bought us, better check policy |

| $421.4 | BAC | 2.0% | ($57.4) | (12.0%) | 1.0 | BANK AMERICA CORP COM | 16.0 | $478.8 | $26.3 | Munger |

| $351.3 | VZ | 1.6% | ($50.2) | (12.5%) | 1.0 | VERIZON COMMUNICATIONS IN | 10.0 | $401.6 | $35.1 | dip |

| $196.4 | FIS | 0.9% | ($73.2) | (27.1%) | 1.0 | FIDELITY NATL INFORMATION | 4.0 | $269.6 | $49.1 | Klarman |

| $163.5 | QCOM | 0.8% | ($7.7) | (4.5%) | 0.5 | QUALCOMM INC | 1.5 | $171.2 | $109.0 | Tepper |

| $149.3 | BTI | 0.7% | ($13.4) | (8.2%) | 1.0 | BRITISH AMERICAN TOBACCO | 5.0 | $162.6 | $29.9 | dip? |

| $142.5 | BIIB | 0.7% | ($15.8) | (10.0%) | 0.2 | BIOGEN INC COM USD0.0005 | 0.6 | $158.3 | $237.5 | medical |

| $141.2 | UPS | 0.7% | ($18.2) | (11.4%) | 0.5 | UNITED PARCEL SERVICE INC | 1.0 | $159.5 | $141.2 | Gates |

| $133.1 | AMZN* | 0.6% | $5.9 | 4.6% | 1.0* | AMAZON.COM INC | 1.0* | $127.2 | $133.1 | last gem for my infinity gauntlet |

| $105.8 | CNI | 0.5% | ($3.6) | (3.3%) | 0.5 | CANADIAN NATL RY CO COM I | 1.0 | $109.4 | $105.8 | Gates |

| $97.0 | RHHBY | 0.5% | ($10.5) | (9.8%) | 1.0 | ROCHE HOLDINGS ADR | 3.0 | $107.5 | $32.3 | medical |

| $86.3 | TSM | 0.4% | ($4.2) | (4.7%) | 0.5 | TAIWAN SEMICONDUCTOR MANU | 1.0 | $90.5 | $86.3 | semiconductors |

| $71.0 | TXN | 0.3% | ($11.3) | (13.7%) | 0.25 | TEXAS INSTRUMENTS INC COM | 0.5 | $82.3 | $142.0 | semiconductors |

| $56.0 | STLA | 0.3% | $0.5 | 0.8% | 1.0 | STELLANTIS N.V COM EUR0.0 | 3.0 | $55.6 | $18.7 | Burry |

| $55.3 | VSAT | 0.3% | ($19.8) | (26.4%) | 1.0 | VIASAT INC | 3.0 | $75.2 | $18.4 | Klarman |

| $53.6 | EWBC | 0.2% | $0.1 | 0.3% | 0.5 | EAST WEST BANCORP INC | 1.0 | $53.5 | $53.6 | Li Lu |

| $48.4 | SQM | 0.2% | ($12.5) | (20.5%) | 0.5 | SOCIEDAD QUIMICA Y MINERA | 1.0 | $60.9 | $48.4 | dip |

| $31.2 | DAL* | 0.1% | ($5.7) | (15.5%) | 1.0* | DELTA AIR LINES INC | 1.0* | $37.0 | $31.2 | airline |

| $26.0 | HE | 0.1% | $1.1 | 4.4% | 1.0 | HAWAIIAN ELECTRIC INDUSTR | 2.0 | $24.9 | $13.0 | dip |

| $22.2 | LUV* | 0.1% | ($4.9) | (18.0%) | 1.0* | SOUTHWEST AIRLINES CO | 1.0* | $27.1 | $22.2 | airline |

| $17.7 | PLUG | 0.1% | ($6.7) | (27.5%) | 1.0 | PLUG POWER INC | 3.0 | $24.4 | $5.9 | hydrogen fuel cells |

| $17.5 | UAL* | 0.1% | ($3.7) | (17.3%) | 0.5* | UNITED AIRLS HLDGS INC CO | 0.5* | $21.2 | $35.0 | airline |

| $15.8 | ALK* | 0.1% | ($2.7) | (14.6%) | 0.5* | ALASKA AIR GROUP INC COM | 0.5* | $18.5 | $31.6 | airline |

| $11.5 | SAVE* | 0.1% | ($4.9) | (30.1%) | 1.0* | SPIRIT AIRLINES INC | 1.0* | $16.4 | $11.5 | airline |

| $3.8 | JBLU* | 0.0% | ($0.8) | (17.9%) | 1.0* | JETBLUE AWYS CORP COM | 1.0* | $4.6 | $3.8 | airline |

*New positions.

Holds

Bed and Bath have gone to the Great Beyond. I was curious what would happen if I left it alone long enough. BBBY became BBBYQ became (some digits) became expired, $13.85 for 20 shares. I’ll have to find a way to track that.

| Total $ | Symbol | Account % | Total $ Gain | Total % Gain | Description | Total Shares | Avg $/Share | Last Price |

|---|---|---|---|---|---|---|---|---|

| 1506.3 | META | 7 | 706.4 | 88.3 | META PLATFORMS INC CLASS | 5 | 800 | 301.3 |

| 865.3 | OXY | 4 | 8.5 | 1 | OCCIDENTAL PETE CORP COM | 14 | 856.8 | 61.8 |

| 512.3 | AAPL | 2.4 | 91.1 | 21.6 | APPLE INC | 3 | 421.2 | 170.8 |

| 437.2 | CVX | 2 | -32 | -6.8 | CHEVRON CORP NEW COM | 3 | 469.2 | 145.7 |

| 397.3 | PFE | 1.8 | -111 | -21.8 | PFIZER INC | 13 | 508.2 | 30.6 |

| 375.9 | GOOG | 1.7 | 106.8 | 39.7 | ALPHABET INC CAP STK CL C | 3 | 269.1 | 125.3 |

| 372.2 | GOOGL | 1.7 | 104 | 38.8 | ALPHABET INC CAP STK CL A | 3 | 268.2 | 124.1 |

| 365 | INTC | 1.7 | 16.5 | 4.7 | INTEL CORP COM USD0.001 | 10 | 348.5 | 36.5 |

| 350.4 | TM | 1.6 | 77.6 | 28.4 | TOYOTA MOTOR CORP ADR-EAC | 2 | 272.8 | 175.2 |

| 342.6 | BND | 1.6 | -34 | -9.1 | VANGUARD BD INDEX FDS TOT | 5 | 376.9 | 68.5 |

| 338.9 | RCL | 1.6 | 174.8 | 106.5 | ROYAL CARIBBEAN GROUP COM | 4 | 164.1 | 84.7 |

| 338.7 | ALLY | 1.6 | -66 | -16.4 | ALLY FINANCIAL INC COM US | 14 | 405 | 24.2 |

| 315.9 | C | 1.5 | -73 | -18.8 | CITIGROUP INC | 8 | 389.2 | 39.5 |

| 303.9 | COF | 1.4 | 9.5 | 3.2 | CAPITAL ONE FINANCIAL COR | 3 | 294.4 | 101.3 |

| 282 | GM | 1.3 | -68 | -19.6 | GENERAL MTRS CO COM | 10 | 350.6 | 28.2 |

| 278.1 | JPM | 1.3 | 35 | 14.4 | JPMORGAN CHASE & CO | 2 | 243.1 | 139.1 |

| 265.6 | VWO | 1.2 | -20 | -7.1 | VANGUARD INTL EQUITY INDE | 7 | 285.9 | 37.9 |

| 247.6 | BABA | 1.2 | -23 | -8.7 | ALIBABA GROUP HOLDING LTD | 3 | 271.2 | 82.5 |

| 238.6 | WFC | 1.1 | -5 | -2.2 | WELLS FARGO CO NEW COM | 6 | 244.1 | 39.8 |

| 232 | LNVGY | 1.1 | 83 | 55.7 | LENOVO GROUP ADR | 10 | 149 | 23.2 |

| 229 | CE | 1.1 | 8.2 | 3.7 | CELANESE CORP DEL COM | 2 | 220.8 | 114.5 |

| 226.9 | TFC | 1.1 | -64 | -22 | TRUIST FINL CORP COM | 8 | 291.1 | 28.4 |

| 222.1 | TCEHY | 1 | -9 | -4.1 | TENCENT HOLDINGS LIMITED | 6 | 231.7 | 37 |

| 210.6 | HPQ | 1 | -15 | -6.9 | HP INC COM | 8 | 226.3 | 26.3 |

| 205.8 | NFLX | 1 | 98.8 | 92.3 | NETFLIX INC | 0.5 | 107.1 | 411.7 |

| 204 | NCLH | 0.9 | 16.4 | 8.8 | NORWEGIAN CRUISE LINE HLD | 15 | 187.6 | 13.6 |

| 201.4 | CHTR | 0.9 | 22.7 | 12.7 | CHARTER COMMUNICATIONS IN | 0.5 | 178.7 | 402.8 |

| 200.6 | MU | 0.9 | 33.5 | 20.1 | MICRON TECHNOLOGY INC | 3 | 167.1 | 66.9 |

| 198.8 | WBD | 0.9 | -56 | -22 | WARNER BROS DISCOVERY INC | 20 | 254.9 | 9.9 |

| 191.3 | USB | 0.9 | -46 | -19.7 | US BANCORP | 6 | 238.1 | 31.9 |

| 185.4 | TSN | 0.9 | -65 | -26.2 | TYSON FOODS INC | 4 | 251.2 | 46.4 |

| 184.8 | T | 0.9 | -28 | -13.2 | AT&T INC COM USD1 | 12 | 212.8 | 15.4 |

| 181.9 | MMM | 0.8 | -69 | -27.7 | 3M CO | 2 | 251.4 | 91 |

| 171.9 | CCL | 0.8 | 29.2 | 20.5 | CARNIVAL CORP COM USD0.01 | 15 | 142.7 | 11.5 |

| 170.1 | SWK | 0.8 | -26 | -13.5 | STANLEY BLACK & DECKER IN | 2 | 196.7 | 85 |

| 163.2 | DIS | 0.8 | -32 | -16.8 | DISNEY WALT CO COM | 2 | 196.1 | 81.6 |

| 159.2 | SIX | 0.7 | -16 | -9.6 | SIX FLAGS ENTERTAINMENT C | 8 | 176.1 | 19.9 |

| 155.4 | CUK | 0.7 | 19.1 | 14.1 | CARNIVAL ADR REP 1 ORD | 15 | 136.2 | 10.4 |

| 154.7 | BMWYY | 0.7 | 23.9 | 18.3 | BAYERISCHE MOTOREN WERKE | 5 | 130.8 | 30.9 |

| 151.9 | MRNA | 0.7 | -116 | -43.5 | MODERNA INC COM | 2 | 268.7 | 76 |

| 150 | PBR | 0.7 | 27.9 | 22.8 | PETROLEO BRASILEIRO SA PE | 10 | 122.1 | 15 |

| 137.1 | HOOD | 0.6 | -3 | -2.3 | ROBINHOOD MKTS INC COM CL | 15 | 140.3 | 9.1 |

| 129.2 | ACGBY | 0.6 | 14.3 | 12.5 | AGRICULTURAL BANK-UNSPON | 14 | 114.9 | 9.2 |

| 127.1 | JD | 0.6 | -43 | -25.3 | JD.COM INC SPON ADS EACH | 5 | 170.2 | 25.4 |

| 125.9 | UHS | 0.6 | 21 | 20 | UNIVERSAL HEALTH SERVICES | 1 | 104.9 | 125.9 |

| 123.9 | CMCSA | 0.6 | 12.5 | 11.3 | COMCAST CORP | 3 | 111.3 | 41.3 |

| 123 | HPE | 0.6 | 21.8 | 21.5 | HEWLETT PACKARD ENTERPRIS | 8 | 101.3 | 15.4 |

| 122.5 | LSXMA | 0.6 | 14.3 | 13.2 | LIBERTY MEDIA CORP DEL CO | 5 | 108.2 | 24.5 |

| 118.3 | WB | 0.6 | -71 | -37.7 | WEIBO ADR REP 1 CL A ORD | 10 | 189.8 | 11.8 |

| 115 | IDCBY | 0.5 | -7 | -5.9 | INDUSTRIAL &COMMERCIAL BK | 12 | 122.1 | 9.6 |

| 114.5 | PNC | 0.5 | -2 | -2.4 | PNC FINANCIAL SERVICES GR | 1 | 117.2 | 114.5 |

| 112.8 | CICHY | 0.5 | -10 | -8.4 | CHINA CONSTRUCTION BANK C | 10 | 123.2 | 11.3 |

| 112.8 | KSS | 0.5 | -38 | -25.5 | KOHLS CORP COM | 5 | 151.3 | 22.6 |

| 112.7 | FLWS | 0.5 | -39 | -25.9 | 1 800 FLOWERS COM INC CL | 15 | 152.1 | 7.5 |

| 110 | CTRA | 0.5 | 13 | 13.4 | COTERRA ENERGY INC COM | 4 | 97 | 27.5 |

| 108.8 | PARA | 0.5 | -107 | -49.8 | PARAMOUNT GLOBAL CLASS B | 10 | 216.5 | 10.9 |

| 106.2 | GPN | 0.5 | -11 | -10.1 | GLOBAL PAYMENTS INC | 1 | 118.1 | 106.2 |

| 105.8 | XOM | 0.5 | -8 | -7.7 | EXXON MOBIL CORP | 1 | 114.7 | 105.8 |

| 104.8 | HBI | 0.5 | -130 | -55.4 | HANESBRANDS INC COM USD0. | 25 | 235.1 | 4.2 |

| 103.6 | PYPL | 0.5 | -62 | -37.6 | PAYPAL HLDGS INC COM | 2 | 166 | 51.8 |

| 103.4 | VXUS | 0.5 | 3.8 | 3.8 | VANGUARD TOTAL INTERNATIO | 2 | 99.7 | 51.7 |

| 101 | VSS | 0.5 | -0 | -0.7 | VANGUARD INTL EQUITY INDE | 1 | 101.7 | 101 |

| 99.2 | STNE | 0.5 | 8 | 8.7 | STONECO LTD COM USD0.0000 | 10 | 91.2 | 9.9 |

| 96.7 | DOW | 0.4 | -5 | -5.8 | DOW INC COM | 2 | 102.6 | 48.3 |

| 94.9 | LVS | 0.4 | 20.3 | 27.2 | LAS VEGAS SANDS CORP COM | 2 | 74.6 | 47.5 |

| 93.5 | BNTX | 0.4 | -14 | -13.1 | BIONTECH SE SPON ADS EACH | 1 | 107.7 | 93.5 |

| 90.5 | SNY | 0.4 | -16 | -15.5 | SANOFI ADR REP 1 1/2 ORD | 2 | 107.1 | 45.2 |

| 83.3 | LBRDK | 0.4 | -25 | -23.4 | LIBERTY BROADBAND CORP CO | 1 | 108.8 | 83.3 |

| 82.8 | EB | 0.4 | 9.1 | 12.3 | EVENTBRITE INC COM CL A | 10 | 73.7 | 8.3 |

| 79.8 | NOV | 0.4 | 23.2 | 41.1 | NOV INC COM | 4 | 56.6 | 20 |

| 79.8 | CF | 0.4 | 10 | 14.3 | CF INDUSTRIES HOLDINGS IN | 1 | 69.8 | 79.8 |

| 79.2 | JBSAY | 0.4 | -20 | -20.3 | JBS SA SPON ADR EACH REP | 10 | 99.4 | 7.9 |

| 78 | AAP | 0.4 | -23 | -22.9 | ADVANCE AUTO PARTS INC | 1.5 | 101.2 | 52 |

| 76.5 | PKX | 0.4 | 31.6 | 70.5 | POSCO HOLDINGS INC ADR EA | 1 | 44.9 | 76.5 |

| 75.5 | BMO | 0.4 | -12 | -14.3 | BANK OF MONTREAL COM NPV | 1 | 88.2 | 75.5 |

| 74.3 | PVH | 0.3 | 17.6 | 31 | PVH CORPORATION COM | 1 | 56.7 | 74.3 |

| 74 | AVUV | 0.3 | 2.1 | 3 | AMERICAN CENTY ETF TR AVA | 1 | 71.9 | 74 |

| 73.7 | LSXMK | 0.3 | 14.5 | 24.5 | LIBERTY MEDIA CORP DEL CO | 3 | 59.1 | 24.6 |

| 71.9 | OMF | 0.3 | -4 | -5.4 | ONEMAIN HLDGS INC COM | 2 | 76 | 35.9 |

| 69.9 | JWN | 0.3 | -23 | -24.9 | NORDSTROM INC COM NPV | 5 | 93.1 | 14 |

| 68.5 | LILAK | 0.3 | -3 | -5.3 | LIBERTY LATIN AMERICA LTD | 10 | 72.3 | 6.8 |

| 68.3 | LILA | 0.3 | -5 | -7.6 | LIBERTY LATIN AMERICA LTD | 10 | 73.9 | 6.8 |

| 68.1 | SCHD | 0.3 | -5 | -8 | SCHWAB US DIVIDEND EQUITY | 1 | 74 | 68.1 |

| 67.4 | OKTA | 0.3 | 2.5 | 3.9 | OKTA INC CL A | 1 | 64.9 | 67.4 |

| 65.7 | MKSI | 0.3 | -15 | -18.9 | MKS INSTRS INC COM | 1 | 81 | 65.7 |

| 65.1 | SHEL | 0.3 | 3.9 | 6.4 | SHELL PLC SPON ADS EA REP | 1 | 61.2 | 65.1 |

| 63.2 | WBA | 0.3 | -55 | -46.6 | WALGREENS BOOTS ALLIANCE | 3 | 118.5 | 21.1 |

| 62.9 | KHC | 0.3 | -9 | -12.6 | KRAFT HEINZ CO COM | 2 | 72 | 31.5 |

| 62 | CDLX | 0.3 | -12 | -16.7 | CARDLYTICS INC COM | 5 | 74.3 | 12.4 |

| 61.5 | HMC | 0.3 | 11.4 | 22.8 | HONDA MOTOR CO ADR-EACH C | 2 | 50.1 | 30.8 |

| 61.1 | KMX | 0.3 | -2 | -3.6 | CARMAX INC | 1 | 63.4 | 61.1 |

| 60.1 | NGG | 0.3 | -6 | -9.3 | NATIONAL GRID SPON ADR EA | 1 | 66.3 | 60.1 |

| 60 | ZM | 0.3 | -21 | -26.4 | ZOOM VIDEO COMMUNICATIONS | 1 | 81.5 | 60 |

| 58.3 | NEE | 0.3 | -15 | -20.5 | NEXTERA ENERGY INC COM US | 1 | 73.3 | 58.3 |

| 56.9 | BUD | 0.3 | -0 | -0.2 | ANHEUSER-BUSCH INBEV SA/N | 1 | 57 | 56.9 |

| 56.5 | KO | 0.3 | -5 | -9.2 | COCA-COLA CO | 1 | 62.2 | 56.5 |

| 55.8 | TD | 0.3 | -2 | -4.8 | TORONTO DOMINION BANK ONT | 1 | 58.7 | 55.8 |

| 53.7 | NTR | 0.2 | -5 | -9.9 | NUTRIEN LTD COM NPV ISIN | 1 | 59.6 | 53.7 |

| 53.1 | HPK | 0.2 | 7.9 | 17.4 | HIGHPEAK ENERGY INC COM | 3 | 45.2 | 17.7 |

| 51.6 | NTDOY | 0.2 | -1 | -2.6 | NINTENDO CO LTD UNSP ADS | 5 | 53 | 10.3 |

| 51.5 | BMY | 0.2 | -10 | -17.3 | BRISTOL-MYERS SQUIBB CO C | 1 | 62.3 | 51.5 |

| 50.3 | CLF | 0.2 | 8.7 | 20.9 | CLEVELAND-CLIFFS INC NEW | 3 | 41.6 | 16.8 |

| 49 | DISH | 0.2 | -137 | -73.7 | DISH NETWORK CORPORATION | 10 | 186.6 | 4.9 |

| 48.8 | F | 0.2 | -7 | -13.3 | FORD MTR CO DEL COM | 5 | 56.2 | 9.8 |

| 46.6 | RDFN | 0.2 | -37 | -44.9 | REDFIN CORP COM | 10 | 84.5 | 4.7 |

| 46.6 | DVN | 0.2 | -2 | -5.5 | DEVON ENERGY CORP NEW | 1 | 49.3 | 46.6 |

| 44.2 | VFC | 0.2 | -37 | -45.8 | V F CORP COM NPV | 3 | 81.5 | 14.7 |

| 43.7 | QRVO | 0.2 | -3 | -7.1 | QORVO INC | 0.5 | 47 | 87.4 |

| 42.2 | VEA | 0.2 | 0.8 | 2 | VANGUARD DEVELOPED MARKET | 1 | 41.4 | 42.2 |

| 40.2 | MHK | 0.2 | -17 | -30.1 | MOHAWK INDUSTRIES COM USD | 0.5 | 57.5 | 80.4 |

| 35.8 | HIW | 0.2 | -27 | -43.5 | HIGHWOODS PROPERTIES INC | 2 | 63.3 | 17.9 |

| 33.4 | EQNR | 0.2 | 3 | 9.7 | EQUINOR ASA SPON ADR EACH | 1 | 30.4 | 33.4 |

| 32.6 | GIS | 0.2 | -0 | -2.5 | GENERAL MILLS INC COM USD | 0.5 | 33.4 | 65.2 |

| 32.5 | MOS | 0.2 | -2 | -8.2 | MOSAIC CO NEW COM | 1 | 35.4 | 32.5 |

| 32.4 | BAX | 0.2 | -25 | -44.4 | BAXTER INTERNATIONAL INC | 1 | 58.3 | 32.4 |

| 32.1 | BCS | 0.1 | -4 | -12.2 | BARCLAYS PLC ADR-EACH CV | 5 | 36.6 | 6.4 |

| 31.2 | LLYVA | 0.1 | 0.6 | 1.9 | LIBERTY MEDIA CORP DEL CO | 1 | 30.7 | 31.2 |

| 28.9 | HBAN | 0.1 | -2 | -7.7 | HUNTINGTON BANCSHARES INC | 3 | 31.4 | 9.7 |

| 27.4 | VALE | 0.1 | -1 | -4.3 | VALE S.A. SPONS ADS REPR | 2 | 28.7 | 13.7 |

| 26.2 | BACHY | 0.1 | -0 | -2.7 | BANK OF CHINA LTD ADR | 3 | 26.9 | 8.7 |

| 23.7 | FITB | 0.1 | -2 | -10.3 | FIFTH THIRD BANCORP | 1 | 26.4 | 23.7 |

| 23.4 | CFG | 0.1 | -5 | -18.4 | CITIZENS FINL GROUP INC C | 1 | 28.7 | 23.4 |

| 22.8 | BEPC | 0.1 | -10 | -32.3 | BROOKFIELD RENEWABLE CORP | 1 | 33.6 | 22.8 |

| 22.3 | CROX | 0.1 | -2 | -8.9 | CROCS INC | 0.25 | 24.5 | 89.3 |

| 22.3 | AAL | 0.1 | -6 | -21.7 | AMERICAN AIRLINES GROUP I | 2 | 28.5 | 11.2 |

| 21.7 | CWEN | 0.1 | -7 | -24.6 | CLEARWAY ENERGY INC CL C | 1 | 28.8 | 21.7 |

| 16 | KIRK | 0.1 | -30 | -65.9 | KIRKLANDS INC COM | 10 | 46.9 | 1.6 |

| 15.6 | LBTYA | 0.1 | -2 | -12.4 | LIBERTY GLOBAL PLC USD0.0 | 1 | 17.8 | 15.6 |

| 15 | FTCH | 0.1 | -50 | -77.2 | FARFETCH LTD COM USD0.04 | 10 | 65.8 | 1.5 |

| 12.5 | ILPT | 0.1 | -31 | -71.3 | INDUSTRIAL LOGISTICS PPTY | 5 | 43.6 | 2.5 |

| 11 | SHYF | 0.1 | -2 | -17.4 | SHYFT GROUP INC COM | 1 | 13.3 | 11 |

| 10.9 | SBGI | 0.1 | -3 | -26.2 | SINCLAIR INC CL A | 1 | 14.7 | 10.9 |

| 9.5 | NYCB | 0 | -0 | -8.8 | NEW YORK COMMUNITY BANCOR | 1 | 10.4 | 9.5 |

| 7.1 | PACW | 0 | -0 | -3.7 | PACWEST BANCORP DEL COM | 1 | 7.3 | 7.1 |

| 0 | SBNY | 0 | -242 | -100 | SIGNATURE BANK | 2 | 242.7 | 0 |