I recently saw the perspective that in Value Investing it takes about 5yrs to build your foundation. We’re still early.

Performance

| Fund | 1-month | 3-month | YTD | 1-year |

|---|---|---|---|---|

| My Fund | (-4.1%) | (-3.5%) | 13.6% | 20.8% |

| S&P 500 | (-4.77%) | (-3.3%) | 13.1% | 21.6% |

| Dow Jones | (-4.8%) | (-3.3%) | 12.4% | 20.5% |

I also have Quarterly performance for four full quarters now:

| Quarter | Return |

|---|---|

| Q3 ‘23 | (-3.5%) |

| Q2 ‘23 | 7.1% |

| Q1 ‘23 | 9.9% |

| Q4 ‘22 | 6.4% |

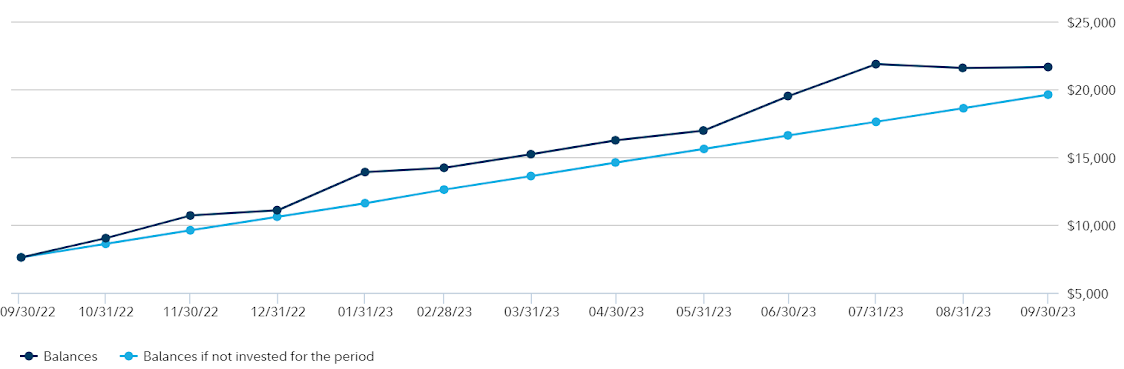

Here is my 12-month Fidelity performance chart.

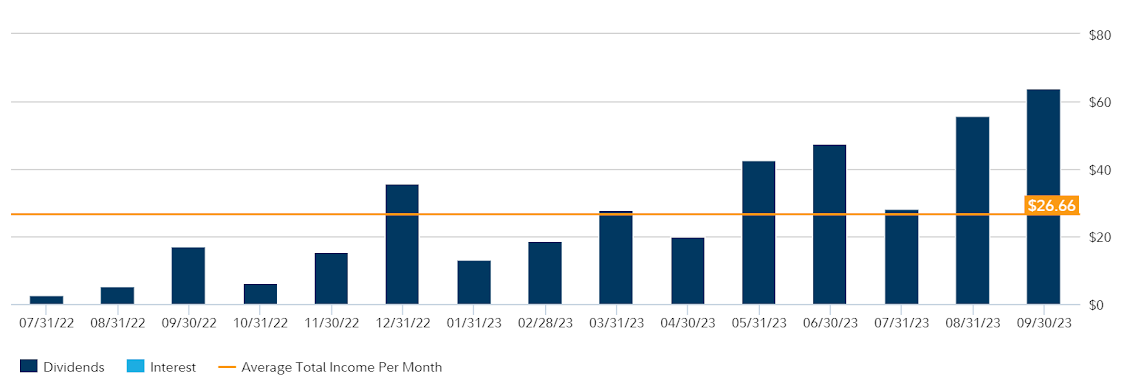

This is the all-time Fidelity chart for my dividends. I don’t think about dividends much, but it’s good to know they’re there.

ChatGPT

Much of the rest of this month’s email was created using the help of ChatGPT. Here is a link to that full long conversation., though you won’t be able to see the images or data.

I just turned on Settings > Beta features > Advanced Data Analysis, and started a GPT-4 conversation with ADA selected. I gave it a CSV from last month (see Buy section), this month, and my last markdown email as an example (that it probably didn’t need or use). It wrote a lot of python code to do these things, but I never had to read it, though maybe I could have helped it debug faster if I did.

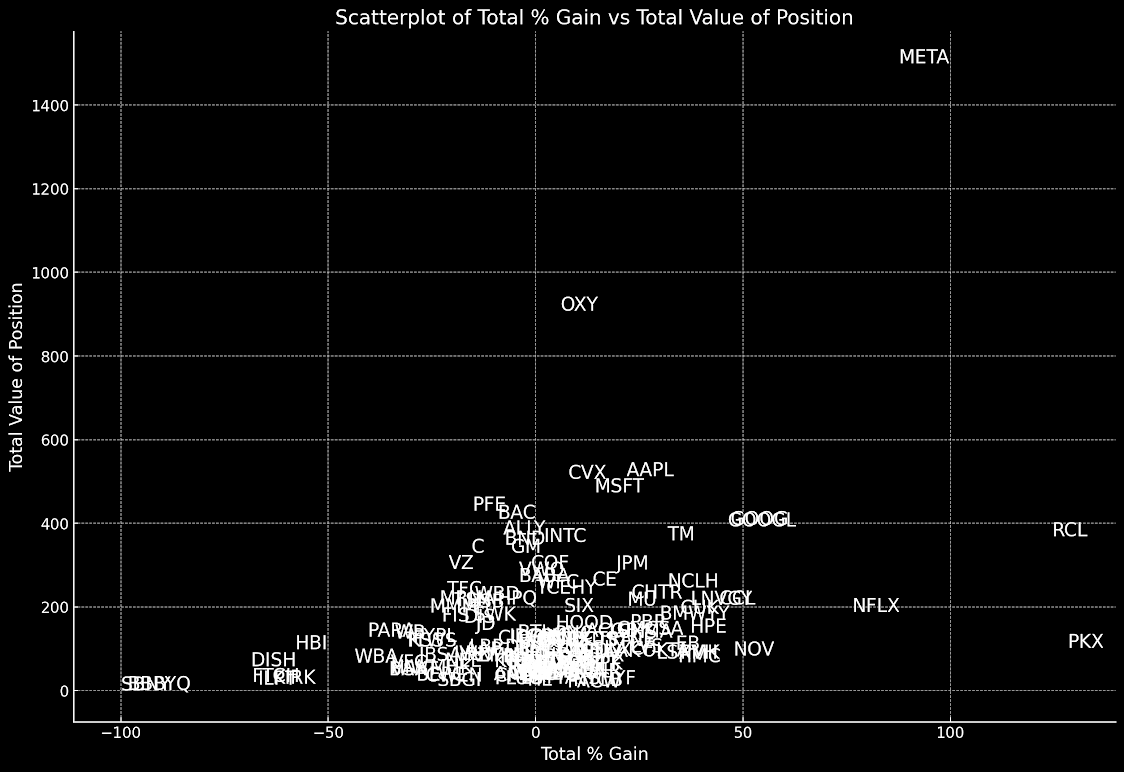

I asked ChatGPT to make some interesting charts for me. We came up with this one:

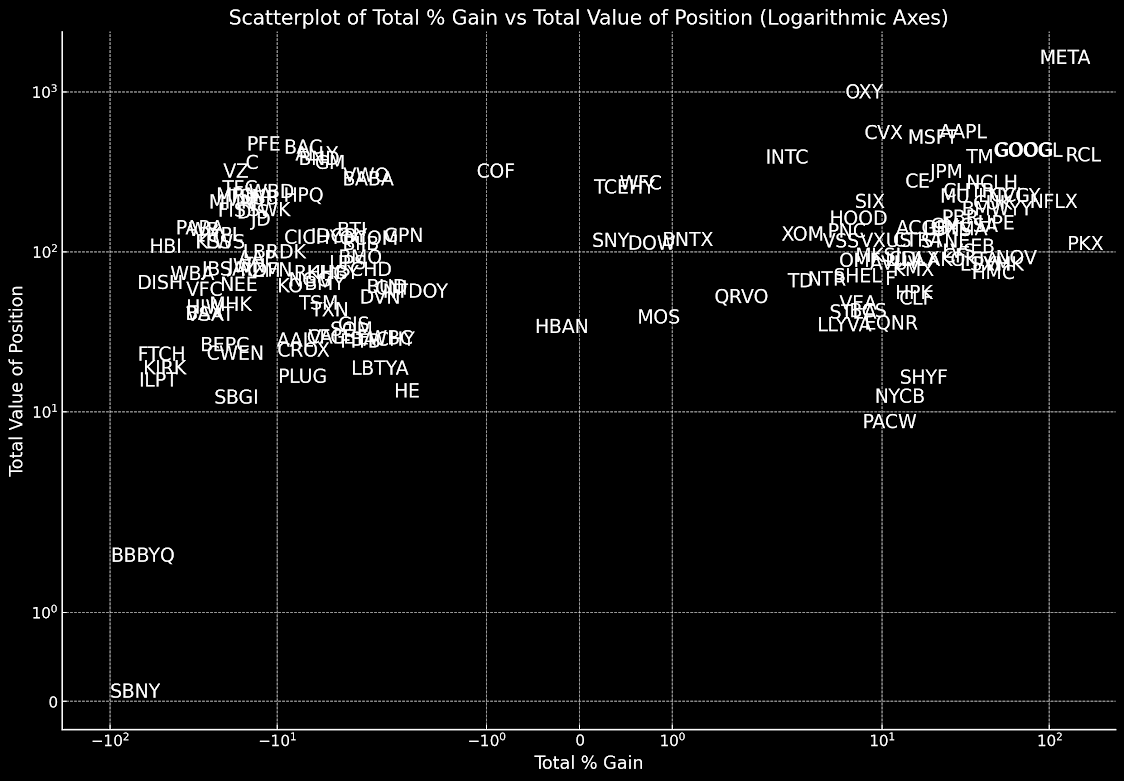

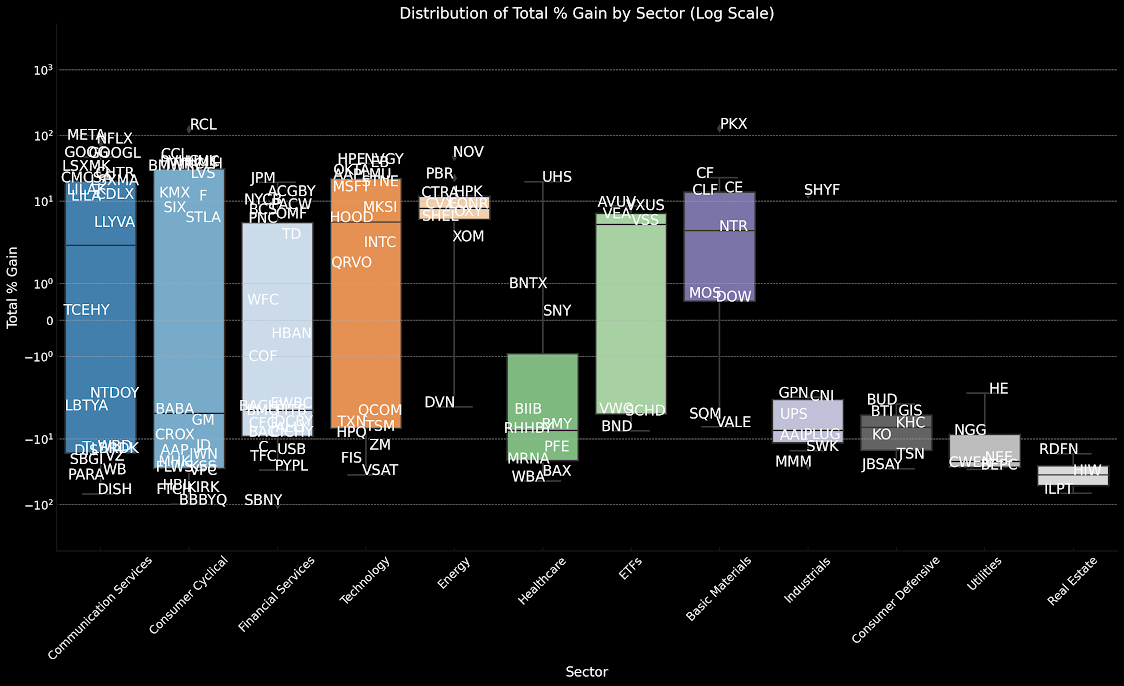

That’ a little tight…what about on a logarithmic scale?

That’ a little tight…what about on a logarithmic scale?

Why can’t I just pick the ones on the right??!!

Why can’t I just pick the ones on the right??!!

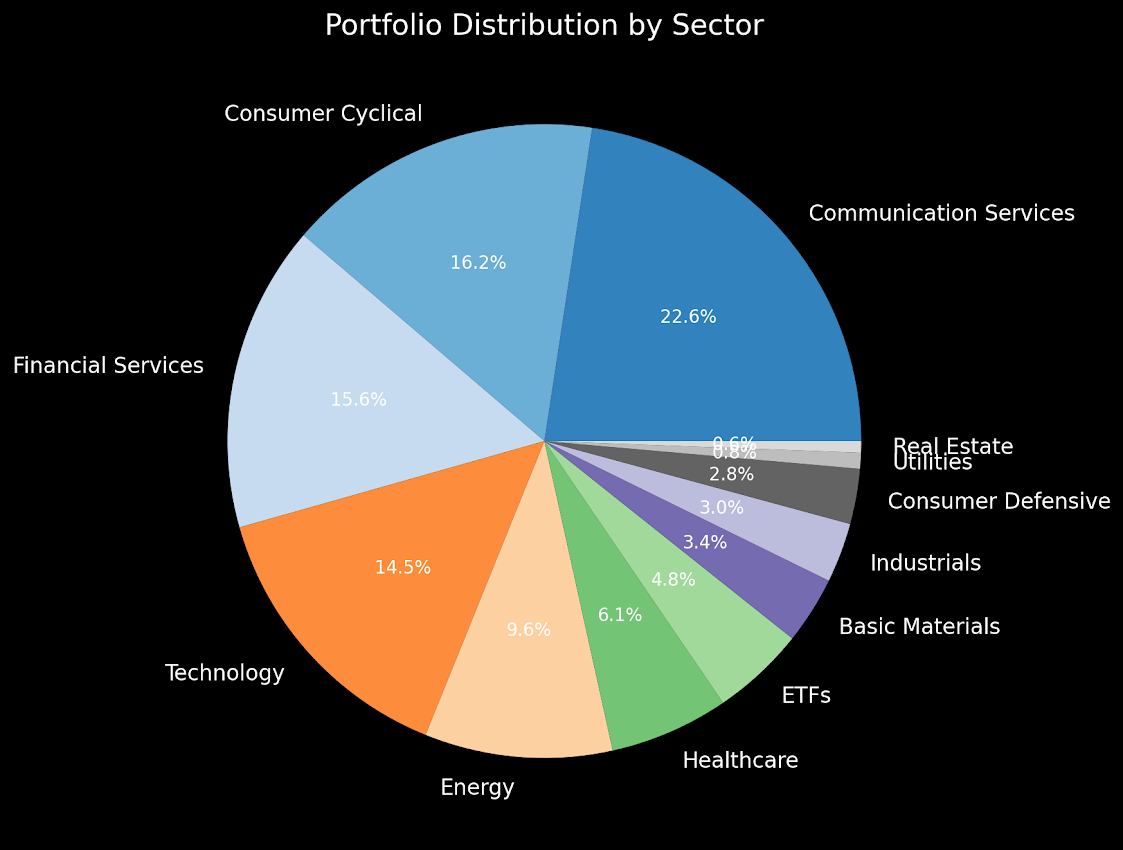

How about a pie chart by sector?

Notably, my CSV data download from Fidelity doesn’t include sector information! So I asked ChatGPT to write a python script that takes my CSV, looks up the sector data, and returns a CSV with that info added in a new column. And it worked. Then I gave it the new CSV.

Notably, my CSV data download from Fidelity doesn’t include sector information! So I asked ChatGPT to write a python script that takes my CSV, looks up the sector data, and returns a CSV with that info added in a new column. And it worked. Then I gave it the new CSV.

Lastly, here’s how each sector is performing in a boxplot (logarithmic scale) with added ticker symbols.

I asked it how to read a boxplot: the box contains the middle 50% of data, the black line is the median, and anything outside the whiskers is considered an outlier.

I asked it how to read a boxplot: the box contains the middle 50% of data, the black line is the median, and anything outside the whiskers is considered an outlier.

Let me know if there’s a chart you want to see in my next email!

Buys

We didn’t just make graphs, I also had it prepare my markdown tables! Usually I do this in excel, but I didn’t even open it this time.

Well, I did open excel to export my August data, which was in different format from the September CSV I exported from Fidelity. Most of our struggles in creating these tables were the result of that formatting difference. Next month we can compare two CSV exports in the same format, so I expect it’ll be a lot smoother. But I’m impressed it was able to do this much even with my wonky data.

| Total $ | Symbol | Account % | Total % Gain | Total $ Gain | New Shares | Description | Old Shares | Average $ Price | Last Price | Notes |

|---|---|---|---|---|---|---|---|---|---|---|

| 473.62 | MSFT | 2.09 | 14.2 | 59.0 | 0.5 | MICROSOFT CORP | 1 | 249.0 | 315.8 | |

| 291.69 | VZ | 1.29 | -21.0 | -77.4 | 1 | VERIZON COMMUNICATIONS IN | 8 | 42.0 | 32.4 | |

| 228.88 | TFC | 1.01 | -21.4 | -62.2 | 1 | TRUIST FINL CORP COM | 7 | 37.0 | 28.6 | |

| 165.81 | FIS | 0.73 | -22.6 | -48.5 | 1 | FIDELITY NATL INFORMATION | 2 | 80.0 | 55.3 | Klarman |

| 127.25 | LSXMA | 0.56 | 17.7 | 19.1 | 1 | LIBERTY MEDIA CORP DEL CO | 4 | 21.0 | 25.4 | Buffett, Klarman |

| 125.64 | BTI | 0.56 | -4.4 | -5.8 | 1 | BRITISH AMERICAN TOBACCO | 3 | 33.0 | 31.4 | |

| 102.80 | BIIB | 0.45 | -4.1 | -4.4 | 0.2 | BIOGEN INC COM USD0.0005 | 0.2 | 269.0 | 257.0 | high “buffett score” |

| 83.89 | AAP | 0.37 | -17.1 | -17.3 | 0.5 | ADVANCE AUTO PARTS INC | 1 | 68.0 | 55.9 | |

| 67.86 | RHHBY | 0.3 | -7.9 | -5.8 | 1 | ROCHE HOLDINGS ADR | 1 | 38.0 | 33.9 | |

| 36.92 | VSAT | 0.16 | -35.0 | -19.9 | 1 | VIASAT INC | 1 | 31.0 | 18.5 | Klarman |

| 25.95 | BACHY | 0.11 | -3.6 | -1.0 | 1 | BANK OF CHINA LTD ADR | 2 | 9.0 | 8.7 | |

| 15.20 | PLUG | 0.07 | -9.8 | -1.7 | 1 | PLUG POWER INC | 1 | 8.0 | 7.6 | |

| 111.06 | QCOM* | 0.49 | -4.3 | -4.9 | 1 | QUALCOMM INC | 0 | 116.0 | 111.1 | Tepper, high “buffett score” |

| 77.94 | UPS* | 0.34 | -4.9 | -4.0 | 0.5 | UNITED PARCEL SERVICE INC | 0 | 163.9 | 155.9 | Bill Gates etc. |

| 54.16 | CNI* | 0.24 | -2.6 | -1.4 | 0.5 | CANADIAN NATL RY CO COM I | 0 | 111.2 | 108.3 | Hohn |

| 43.45 | TSM* | 0.19 | -7.4 | -3.5 | 0.5 | TAIWAN SEMICONDUCTOR MANU | 0 | 93.9 | 86.9 | Tepper |

| 39.75 | TXN* | 0.18 | -6.3 | -2.7 | 0.25 | TEXAS INSTRUMENTS INC COM | 0 | 169.7 | 159.0 | high “buffett score” |

| 38.26 | STLA* | 0.17 | 4.8 | 1.8 | 2 | STELLANTIS N.V COM EUR0.0 | 0 | 18.2 | 19.1 | Burry |

| 35.60 | MOS* | 0.16 | 0.6 | 0.2 | 1 | MOSAIC CO NEW COM | 0 | 35.4 | 35.6 | |

| 32.00 | GIS* | 0.14 | -4.3 | -1.4 | 0.5 | GENERAL MILLS INC COM USD | 0 | 66.9 | 64.0 | |

| 29.84 | SQM* | 0.13 | -4.8 | -1.5 | 0.5 | SOCIEDAD QUIMICA Y MINERA | 0 | 62.7 | 59.7 | Marks |

| 26.36 | EWBC* | 0.12 | -3.3 | -0.9 | 0.5 | EAST WEST BANCORP INC | 0 | 54.5 | 52.7 | Li Lu |

| 25.62 | AAL* | 0.11 | -10.1 | -2.9 | 2 | AMERICAN AIRLINES GROUP I | 0 | 14.2 | 12.8 | Buffett (sold!) |

| 22.06 | CROX* | 0.1 | -10.0 | -2.5 | 0.25 | CROCS INC | 0 | 98.0 | 88.2 | |

| 17.12 | LBTYA* | 0.08 | -3.6 | -0.6 | 1 | LIBERTY GLOBAL PLC USD0.0 | 0 | 17.8 | 17.1 | Klarman |

| 12.31 | HE* | 0.05 | -2.0 | -0.2 | 1 | HAWAIIAN ELECTRIC INDUSTR | 0 | 12.6 | 12.3 |

*New positions

Holds

Again sorted by Total % Gain, with my new-long positions marked. Normally I add the asterisks by hand, but I just had the bot do it this time.

| Total $ | Symbol | Account % | Total % Gain | Total $ Gain | Description | Old Shares | Average $ Price | Last Price |

|---|---|---|---|---|---|---|---|---|

| 102.50 | PKX | 0.45 | 128.4 | 57.6 | POSCO HOLDINGS INC ADR EA | 1 | 44.9 | 102.5 |

| 368.56 | RCL | 1.63 | 124.6 | 204.5 | ROYAL CARIBBEAN GROUP COM | 4 | 41.0 | 92.1 |

| 1501.05 | META | 6.63 | 87.6 | 701.0 | META PLATFORMS INC CLASS | 5 | 160.0 | 300.2 |

| 188.80 | NFLX | 0.83 | 76.3 | 81.7 | NETFLIX INC | 0.5 | 214.1 | 377.6 |

| 83.60 | NOV | 0.37 | 47.7 | 27.0 | NOV INC COM | 4 | 14.2 | 20.9 |

| 395.55 | GOOG | 1.75 | 47.0 | 126.5 | ALPHABET INC CAP STK CL C | 3 | 89.7 | 131.8 |

| 392.58 | GOOGL | 1.73 | 46.3 | 124.3 | ALPHABET INC CAP STK CL A | 3 | 89.4 | 130.9 |

| 205.80 | CCL | 0.91 | 44.3 | 63.1 | CARNIVAL CORP COM USD0.01 | 15 | 9.5 | 13.7 |

| 204.70 | LNVGY | 0.9 | 37.4 | 55.7 | LENOVO GROUP ADR | 10 | 14.9 | 20.5 |

| 138.96 | HPE | 0.61 | 37.2 | 37.7 | HEWLETT PACKARD ENTERPRIS | 8 | 12.7 | 17.4 |

| 183.75 | CUK | 0.81 | 34.9 | 47.5 | CARNIVAL ADR REP 1 ORD | 15 | 9.1 | 12.2 |

| 76.51 | PVH** | 0.34 | 34.8 | 19.8 | PVH CORPORATION COM | 1 | 56.7 | 76.5 |

| 67.28 | HMC | 0.3 | 34.3 | 17.2 | HONDA MOTOR LTD AMERN SHS | 2 | 25.0 | 33.6 |

| 98.60 | EB | 0.44 | 33.8 | 24.9 | EVENTBRITE INC COM CL A | 10 | 7.4 | 9.9 |

| 359.50 | TM | 1.59 | 31.8 | 86.7 | TOYOTA MOTOR CORP ADR-EAC | 2 | 136.4 | 179.8 |

| 247.20 | NCLH | 1.09 | 31.8 | 59.6 | NORWEGIAN CRUISE LINE HLD | 15 | 12.5 | 16.5 |

| 169.85 | BMWYY | 0.75 | 29.9 | 39.1 | BAYERISCHE MOTOREN WERKE | 5 | 26.2 | 34.0 |

| 76.38 | LSXMK | 0.34 | 29.1 | 17.2 | LIBERTY MEDIA CORP DEL CO | 3 | 19.7 | 25.5 |

| 81.51 | OKTA** | 0.36 | 25.6 | 16.6 | OKTA INC CL A | 1 | 64.9 | 81.5 |

| 219.91 | CHTR** | 0.97 | 23.1 | 41.2 | CHARTER COMMUNICATIONS IN | 0.5 | 357.3 | 439.8 |

| 85.74 | CF | 0.38 | 22.9 | 16.0 | CF INDUSTRIES HOLDINGS IN | 1 | 69.8 | 85.7 |

| 91.68 | LVS | 0.41 | 22.9 | 17.1 | LAS VEGAS SANDS CORP COM | 2 | 37.3 | 45.8 |

| 149.90 | PBR | 0.66 | 22.7 | 27.8 | PETROLEO BRASILEIRO SA PE | 10 | 12.2 | 15.0 |

| 204.09 | MU** | 0.9 | 22.1 | 37.0 | MICRON TECHNOLOGY INC | 3 | 55.7 | 68.0 |

| 513.63 | AAPL | 2.27 | 21.9 | 92.4 | APPLE INC | 3 | 140.4 | 171.2 |

| 125.73 | UHS | 0.56 | 19.8 | 20.8 | UNIVERSAL HEALTH SERVICES | 1 | 104.9 | 125.7 |

| 133.02 | CMCSA | 0.59 | 19.5 | 21.7 | COMCAST CORP | 3 | 37.1 | 44.3 |

| 290.04 | JPM | 1.28 | 19.3 | 46.9 | JPMORGAN CHASE & CO | 2 | 121.6 | 145.0 |

| 106.70 | STNE | 0.47 | 17.0 | 15.5 | STONECO LTD COM USD0.0000 | 10 | 9.1 | 10.7 |

| 251.04 | CE | 1.11 | 13.7 | 30.2 | CELANESE CORP DEL COM | 2 | 110.4 | 125.5 |

| 81.60 | LILAK | 0.36 | 12.9 | 9.3 | LIBERTY LATIN AMERICA LTD | 10 | 7.2 | 8.2 |

| 14.97 | SHYF | 0.07 | 12.6 | 1.7 | SHYFT GROUP INC COM | 1 | 13.3 | 15.0 |

| 46.89 | CLF | 0.21 | 12.6 | 5.2 | CLEVELAND-CLIFFS INC NEW | 3 | 13.9 | 15.6 |

| 128.80 | ACGBY | 0.57 | 12.1 | 13.9 | AGRICULTURAL BANK-UNSPON | 14 | 8.2 | 9.2 |

| 50.64 | HPK | 0.22 | 11.9 | 5.4 | HIGHPEAK ENERGY INC COM | 3 | 15.1 | 16.9 |

| 70.73 | KMX | 0.31 | 11.6 | 7.3 | CARMAX INC | 1 | 63.4 | 70.7 |

| 108.20 | CTRA | 0.48 | 11.6 | 11.2 | COTERRA ENERGY INC COM | 4 | 24.2 | 27.1 |

| 82.50 | CDLX | 0.36 | 11.0 | 8.2 | CARDLYTICS INC COM | 5 | 14.9 | 16.5 |

| 81.60 | LILA | 0.36 | 10.4 | 7.7 | LIBERTY LATIN AMERICA LTD | 10 | 7.4 | 8.2 |

| 62.10 | F | 0.27 | 10.4 | 5.8 | FORD MTR CO DEL COM | 5 | 11.2 | 12.4 |

| 11.34 | NYCB | 0.05 | 9.0 | 0.9 | NEW YORK COMMUNITY BANCOR | 1 | 10.4 | 11.3 |

| 77.95 | AVUV | 0.34 | 8.4 | 6.1 | AMERICAN CENTY ETF TR AVA | 1 | 71.9 | 78.0 |

| 32.79 | EQNR | 0.14 | 7.8 | 2.4 | EQUINOR ASA SPON ADR EACH | 1 | 30.4 | 32.8 |

| 505.86 | CVX | 2.24 | 7.8 | 36.6 | CHEVRON CORP NEW COM | 3 | 156.4 | 168.6 |

| 7.91 | PACW | 0.04 | 7.6 | 0.6 | PACWEST BANCORP DEL COM | 1 | 7.3 | 7.9 |

| 107.04 | VXUS** | 0.47 | 7.4 | 7.4 | VANGUARD TOTAL INTERNATIO | 2 | 49.8 | 53.5 |

| 86.54 | MKSI | 0.38 | 6.9 | 5.6 | MKS INSTRS INC COM | 1 | 81.0 | 86.5 |

| 188.08 | SIX | 0.83 | 6.8 | 12.0 | SIX FLAGS ENTERTAINMENT C | 8 | 22.0 | 23.5 |

| 38.95 | BCS | 0.17 | 6.4 | 2.3 | BARCLAYS PLC ADR-EACH CV | 5 | 7.3 | 7.8 |

| 908.32 | OXY | 4.01 | 6.0 | 51.5 | OCCIDENTAL PETE CORP COM | 14 | 61.2 | 64.9 |

| 43.72 | VEA** | 0.19 | 5.5 | 2.3 | VANGUARD DEVELOPED MARKET | 1 | 41.4 | 43.7 |

| 80.18 | OMF** | 0.35 | 5.5 | 4.2 | ONEMAIN HLDGS INC COM | 2 | 38.0 | 40.1 |

| 64.38 | SHEL | 0.28 | 5.1 | 3.1 | SHELL PLC SPON ADS EA REP | 1 | 61.2 | 64.4 |

| 147.15 | HOOD | 0.65 | 4.8 | 6.8 | ROBINHOOD MKTS INC COM CL | 15 | 9.4 | 9.8 |

| 122.77 | PNC | 0.54 | 4.7 | 5.5 | PNC FINANCIAL SERVICES GR | 1 | 117.2 | 122.8 |

| 106.20 | VSS** | 0.47 | 4.4 | 4.5 | VANGUARD INTL EQUITY INDE | 1 | 101.7 | 106.2 |

| 31.92 | LLYVA | 0.14 | 4.1 | 1.3 | LIBERTY MEDIA CORP DEL CO | 1 | 30.7 | 31.9 |

| 61.76 | NTR | 0.27 | 3.6 | 2.1 | NUTRIEN LTD COM NPV ISIN | 1 | 59.6 | 61.8 |

| 60.26 | TD | 0.27 | 2.7 | 1.6 | TORONTO DOMINION BANK ONT | 1 | 58.7 | 60.3 |

| 117.58 | XOM | 0.52 | 2.5 | 2.9 | EXXON MOBIL CORP | 1 | 114.7 | 117.6 |

| 355.50 | INTC | 1.57 | 2.0 | 7.0 | INTEL CORP COM USD0.001 | 10 | 34.9 | 35.5 |

| 47.73 | QRVO** | 0.21 | 1.4 | 0.7 | QORVO INC | 0.5 | 94.1 | 95.5 |

| 108.64 | BNTX | 0.48 | 0.9 | 1.0 | BIONTECH SE SPON ADS EACH | 1 | 107.7 | 108.6 |

| 103.12 | DOW** | 0.46 | 0.5 | 0.5 | DOW INC COM | 2 | 51.3 | 51.6 |

| 245.16 | WFC | 1.08 | 0.4 | 1.1 | WELLS FARGO CO NEW COM | 6 | 40.7 | 40.9 |

| 232.02 | TCEHY | 1.03 | 0.1 | 0.4 | TENCENT HOLDINGS LIMITED | 6 | 38.6 | 38.7 |

| 107.28 | SNY | 0.47 | 0.1 | 0.1 | SANOFI ADR REP 1 1/2 ORD | 2 | 53.6 | 53.6 |

| 31.20 | HBAN | 0.14 | -0.5 | -0.1 | HUNTINGTON BANCSHARES INC | 3 | 10.4 | 10.4 |

| 291.15 | COF | 1.29 | -1.1 | -3.2 | CAPITAL ONE FINANCIAL COR | 3 | 98.1 | 97.0 |

| 115.39 | GPN | 0.51 | -2.3 | -2.7 | GLOBAL PAYMENTS INC | 1 | 118.1 | 115.4 |

| 51.75 | NTDOY | 0.23 | -2.3 | -1.2 | NINTENDO CO LTD UNSP ADS | 5 | 10.6 | 10.3 |

| 55.30 | BUD | 0.24 | -2.9 | -1.7 | ANHEUSER-BUSCH INBEV SA/N | 1 | 57.0 | 55.3 |

| 47.70 | DVN | 0.21 | -3.2 | -1.6 | DEVON ENERGY CORP NEW | 1 | 49.3 | 47.7 |

| 274.47 | VWO | 1.21 | -4.0 | -11.5 | VANGUARD INTL EQUITY INDE | 7 | 40.9 | 39.2 |

| 260.22 | BABA | 1.15 | -4.0 | -11.0 | ALIBABA GROUP HOLDING LTD | 3 | 90.4 | 86.7 |

| 25.33 | FITB | 0.11 | -4.2 | -1.1 | FIFTH THIRD BANCORP | 1 | 26.4 | 25.3 |

| 84.37 | BMO | 0.37 | -4.3 | -3.8 | BANK OF MONTREAL COM NPV | 1 | 88.2 | 84.4 |

| 70.76 | SCHD | 0.31 | -4.3 | -3.2 | SCHWAB US DIVIDEND EQUITY | 1 | 74.0 | 70.8 |

| 329.70 | GM | 1.46 | -6.0 | -20.9 | GENERAL MTRS CO COM | 10 | 35.1 | 33.0 |

| 114.48 | IDCBY | 0.51 | -6.3 | -7.7 | INDUSTRIAL &COMMERCIAL BK | 12 | 10.2 | 9.5 |

| 26.80 | VALE | 0.12 | -6.5 | -1.9 | VALE S.A. SPONS ADS REPR | 2 | 14.3 | 13.4 |

| 67.28 | KHC | 0.3 | -6.6 | -4.8 | KRAFT HEINZ CO COM | 2 | 36.0 | 33.6 |

| 26.80 | CFG | 0.12 | -6.7 | -1.9 | CITIZENS FINL GROUP INC C | 1 | 28.7 | 26.8 |

| 58.04 | BMY | 0.26 | -6.9 | -4.3 | BRISTOL-MYERS SQUIBB CO C | 1 | 62.3 | 58.0 |

| 348.90 | BND | 1.54 | -7.4 | -28.0 | VANGUARD BD INDEX FDS TOT | 5 | 75.4 | 69.8 |

| 373.52 | ALLY | 1.65 | -7.8 | -31.5 | ALLY FINANCIAL INC COM US | 14 | 28.9 | 26.7 |

| 60.63 | NGG | 0.27 | -8.5 | -5.7 | NATIONAL GRID SPON ADR EA | 1 | 66.3 | 60.6 |

| 410.70 | BAC | 1.81 | -9.1 | -40.9 | BANK AMERICA CORP COM | 15 | 30.1 | 27.4 |

| 112.00 | CICHY | 0.49 | -9.1 | -11.2 | CHINA CONSTRUCTION BANK C | 10 | 12.3 | 11.2 |

| 205.60 | HPQ | 0.91 | -9.2 | -20.7 | HP INC COM | 8 | 28.3 | 25.7 |

| 55.98 | KO | 0.25 | -10.0 | -6.2 | COCA-COLA CO | 1 | 62.2 | 56.0 |

| 69.94 | ZM | 0.31 | -14.2 | -11.6 | ZOOM VIDEO COMMUNICATIONS | 1 | 81.5 | 69.9 |

| 145.65 | JD | 0.64 | -14.4 | -24.6 | JD.COM INC SPON ADS EACH | 5 | 34.0 | 29.1 |

| 217.20 | WBD | 0.96 | -14.8 | -37.7 | WARNER BROS DISCOVERY INC | 20 | 12.7 | 10.9 |

| 167.16 | SWK | 0.74 | -15.0 | -29.5 | STANLEY BLACK & DECKER IN | 2 | 98.3 | 83.6 |

| 431.21 | PFE | 1.91 | -15.2 | -77.0 | PFIZER INC | 13 | 39.1 | 33.2 |

| 180.24 | T | 0.8 | -15.3 | -32.6 | AT&T INC COM USD1 | 12 | 17.7 | 15.0 |

| 329.04 | C | 1.45 | -15.5 | -60.1 | CITIGROUP INC | 8 | 48.6 | 41.1 |

| 91.32 | LBRDK | 0.4 | -16.0 | -17.4 | LIBERTY BROADBAND CORP CO | 1 | 108.8 | 91.3 |

| 70.40 | RDFN | 0.31 | -16.7 | -14.1 | REDFIN CORP COM | 10 | 8.4 | 7.0 |

| 198.36 | USB | 0.88 | -16.7 | -39.8 | US BANCORP | 6 | 39.7 | 33.1 |

| 162.10 | DIS | 0.72 | -17.4 | -34.0 | DISNEY WALT CO COM | 2 | 98.1 | 81.0 |

| 201.96 | TSN | 0.89 | -19.6 | -49.2 | TYSON FOODS INC | 4 | 62.8 | 50.5 |

| 74.70 | JWN | 0.33 | -19.8 | -18.4 | NORDSTROM INC COM NPV | 5 | 18.6 | 14.9 |

| 57.29 | NEE | 0.25 | -21.9 | -16.0 | NEXTERA ENERGY INC COM US | 1 | 73.3 | 57.3 |

| 206.58 | MRNA** | 0.91 | -23.1 | -62.1 | MODERNA INC COM | 2 | 134.4 | 103.3 |

| 11.22 | SBGI | 0.05 | -23.8 | -3.5 | SINCLAIR INC CL A | 1 | 14.7 | 11.2 |

| 42.91 | MHK** | 0.19 | -25.4 | -14.6 | MOHAWK INDUSTRIES COM USD | 0.5 | 115.0 | 85.8 |

| 187.24 | MMM | 0.83 | -25.5 | -64.2 | 3M CO | 2 | 125.7 | 93.6 |

| 21.16 | CWEN | 0.09 | -26.5 | -7.6 | CLEARWAY ENERGY INC CL C | 1 | 28.8 | 21.2 |

| 71.40 | JBSAY** | 0.32 | -28.2 | -28.0 | JBS SA SPON ADR EACH REP | 10 | 9.9 | 7.1 |

| 23.94 | BEPC | 0.11 | -28.8 | -9.7 | BROOKFIELD RENEWABLE CORP | 1 | 33.6 | 23.9 |

| 116.92 | PYPL | 0.52 | -29.6 | -49.1 | PAYPAL HLDGS INC COM | 2 | 83.0 | 58.5 |

| 104.80 | KSS | 0.46 | -30.7 | -46.5 | KOHLS CORP COM | 5 | 30.2 | 21.0 |

| 105.00 | FLWS | 0.46 | -30.9 | -47.0 | 1 800 FLOWERS COM INC CL | 15 | 10.1 | 7.0 |

| 125.40 | WB | 0.55 | -33.9 | -64.4 | WEIBO ADR REP 1 CL A ORD | 10 | 19.0 | 12.5 |

| 41.22 | HIW** | 0.18 | -34.9 | -22.1 | HIGHWOODS PROPERTIES INC | 2 | 31.6 | 20.6 |

| 53.01 | VFC | 0.23 | -34.9 | -28.5 | V F CORP COM NPV | 3 | 27.2 | 17.7 |

| 37.74 | BAX | 0.17 | -35.3 | -20.6 | BAXTER INTERNATIONAL INC | 1 | 58.3 | 37.7 |

| 129.00 | PARA | 0.57 | -40.4 | -87.5 | PARAMOUNT GLOBAL CLASS B | 10 | 21.6 | 12.9 |

| 66.72 | WBA | 0.29 | -43.7 | -51.8 | WALGREENS BOOTS ALLIANCE | 3 | 39.5 | 22.2 |

| 99.00 | HBI | 0.44 | -57.9 | -136.1 | HANESBRANDS INC COM USD0. | 25 | 9.4 | 4.0 |

| 17.20 | KIRK | 0.08 | -63.3 | -29.7 | KIRKLANDS INC COM | 10 | 4.7 | 1.7 |

| 14.45 | ILPT | 0.06 | -66.9 | -29.1 | INDUSTRIAL LOGISTICS PPTY | 5 | 8.7 | 2.9 |

| 20.90 | FTCH | 0.09 | -68.3 | -45.0 | FARFETCH LTD COM USD0.04 | 10 | 6.6 | 2.1 |

| 58.60 | DISH | 0.26 | -68.6 | -128.0 | DISH NETWORK CORPORATION | 10 | 18.7 | 5.9 |

| 1.58 | BBBYQ | 0.01 | -98.4 | -95.0 | BED BATH AND BEYOND COM U | 20 | 4.8 | 0.1 |

| 0.05 | SBNY | 0.0 | -100.0 | -242.7 | SIGNATURE BANK | 2 | 121.4 | 0.0 |

*Became long this month