There are still two trading days left in the month, but let’s call it here. I’m at -0.72% lifetime, down about -1% from last month. [Doesn't include dividends.]

NVIDIA

NVIDIA jumped 25% last week, and is up 172% over the last year. Is this the first AI stock bubble?

NVIDIA’s PE ratio is over 200 at this point - too big! Apple and Microsoft and Google and Meta are up this week as well, but they have PE ratios around 30. A high PE means the business is overvalued relative to its earnings, so you’re paying a premium to own the stock with the expectation that earnings will go up substantially. NVIDIA looks like a bubble to me, too optimistic.

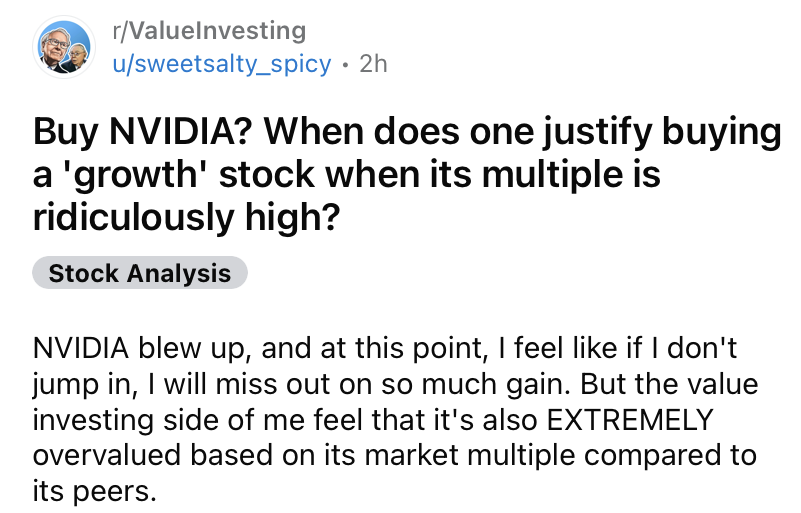

Last Thursday, on r/ValueInvesting, a place where I expected people to think more like me, I saw this thread.

I feel like if I don’t jump in, I will miss out on so much gain. Wow. Said with the stock at an all time high. The investing books warn you about this thinking - they say typical investors paradoxically buy high and sell low. Hard to believe, but here we see it. At least they thought to ask. [Not that buying would have been the worst idea!]

Banks

The 13-F filings have become a holiday for me - that’s when we get to see how the Superinvestors played last quarter. We got Q1’s filings this month.

Last month I mentioned my SBNY position of about $250 went bankrupt. Turns out I’m not the only one: these are Michael Burry’s Q1 trades. (Of The Big Short fame, I mentioned him previously buying prison stocks.) We can see that, among buying chinese tech and Zoom and a jeweler (and selling some prison) he also bought a spread of discounted banks - including over $2mil in FRCB, who also went bankrupt. Nice to know I’m not the only one that doesn’t know which banks will make it.

I think I agree with the general approach to buy a spread of good deals in banks during the dip, and the ones that survive should pay for the ones that don’t in the long run. (I imagine a little insider trading in banks would do very well right now.)

New

| Description | Old Shares | New Shares | Symbol | Percent Of Account | Total Gain/Loss Percent | Total Gain/Loss Dollar | Average Cost Basis | Notes |

|---|---|---|---|---|---|---|---|---|

| HUNTINGTON BANCSHARES INC COM USD0.01 | 1 | HBAN | 0.06% | -0.48% | -$0.05 | $10.57 | Burry | |

| PACWEST BANCORP DEL COM | 1 | PACW | 0.04% | -3.27% | -$0.24 | $7.35 | Burry |

Very small new purchases this month, under $30, just using my loose change to play along with Burry. I might increase these positions next month (along with some of that chinese tech).

Increased

| Description | Old Shares | New Shares | Symbol | Percent Of Account | Total Gain/Loss Percent | Total Gain/Loss Dollar | Average Cost Basis | Notes |

|---|---|---|---|---|---|---|---|---|

| BANK AMERICA CORP COM | 11 | 4 | BAC | 2.49% | -5.97% | -$26.92 | $30.10 | Munger, Buffett |

| HP INC COM | 4 | 4 | HPQ | 1.47% | +10.63% | +$24.08 | $28.29 | Buffett |

| GENERAL MTRS CO COM | 7 | 3 | GM | 1.95% | -5.06% | -$17.73 | $35.06 | *Buffett |

| PFIZER INC | 5 | 3 | PFE | 1.76% | -7.89% | -$25.74 | $40.82 | good pe ratio |

| OCCIDENTAL PETE CORP COM | 8 | 2 | OXY | 3.45% | -5.32% | -$33.10 | $62.25 | Buffett |

| ALLY FINANCIAL INC COM USD0.01 | 12 | 2 | ALLY | 2.18% | -7.99% | -$32.33 | $28.93 | Buffett |

| CITIGROUP INC | 7 | 1 | C | 2.09% | -8.33% | -$32.39 | $48.65 | Buffett |

| CAPITAL ONE FINANCIAL CORP COM USD0.01 | 2 | 1 | COF | 1.81% | +4.80% | +$14.15 | $98.13 | Burry, Buffett |

| CHEVRON CORP NEW COM | 1 | 1 | CVX | 1.80% | -3.08% | -$9.78 | $158.97 | Buffett |

| WELLS FARGO CO NEW COM | 5 | 1 | WFC | 1.45% | +1.33% | +$3.27 | $40.69 | Munger |

| VANGUARD INTL EQUITY INDEX FDS FTSE EMR MKT ETF | 5 | 1 | VWO | 1.40% | -2.68% | -$6.57 | $40.95 | ETF |

| US BANCORP | 5 | 1 | USB | 1.08% | -22.73% | -$54.12 | $39.69 | Munger |

Buying more banks, which is a little uncomfortable, but I’m trusting Buffett and Munger to pick stable businesses. Buying more OXY and CVX oil stocks (like Buffett) but I do wonder how the oil industry will adapt to renewables in my lifetime.

*General Motors is an interesting one. I also bought some in August, December, and March. It’s got a nice PE ratio of 5 in a market that seems inflated, and Buffett likes it, but when I looked closer I see Buffett has been selling GM recently. At the recent Berkshire Hathaway annual meeting, Buffett said “I think I know where Apple is going to be in 5 or 10 years, but I don’t know where the car companies are going to be in 5 or 10 years.” Another aging industry to ponder.

Held

| Description | Old Shares | New Shares | Symbol | Percent Of Account | Total Gain/Loss Percent | Total Gain/Loss Dollar | Average Cost Basis |

|---|---|---|---|---|---|---|---|

| META PLATFORMS INC CLASS A COMMON STOCK | 5 | 0 | META | 7.67% | +63.77% | +$510.20 | $160.00 |

| APPLE INC | 3 | 0 | AAPL | 3.08% | +24.93% | +$105.04 | $140.42 |

| ALPHABET INC CAP STK CL C | 3 | 0 | GOOG | 2.20% | +39.84% | +$107.21 | $89.69 |

| ALPHABET INC CAP STK CL A | 3 | 0 | GOOGL | 2.19% | +39.35% | +$105.58 | $89.42 |

| VANGUARD BD INDEX FDS TOTAL BND MRKT | 5 | 0 | BND | 2.12% | -4.07% | -$15.33 | $75.39 |

| MICROSOFT CORP | 1 | 0 | MSFT | 1.95% | +33.75% | +$84.01 | $248.88 |

| ROYAL CARIBBEAN GROUP COM USD0.01 | 4 | 0 | RCL | 1.85% | +92.57% | +$151.91 | $41.02 |

| INTEL CORP COM USD0.001 | 10 | 0 | INTC | 1.70% | -16.78% | -$58.47 | $34.85 |

| TOYOTA MOTOR CORP ADR-EACH REP 10 ORD NPV LVL | 2 | 0 | TM | 1.64% | +2.71% | +$7.40 | $136.38 |

| JPMORGAN CHASE & CO | 2 | 0 | JPM | 1.60% | +12.65% | +$30.77 | $121.56 |

| VERIZON COMMUNICATIONS INC | 7 | 0 | VZ | 1.43% | -18.53% | -$55.71 | $42.96 |

| WARNER BROS DISCOVERY INC COM SER A | 20 | 0 | WBD | 1.34% | -10.23% | -$26.06 | $12.74 |

| MICRON TECHNOLOGY INC | 3 | 0 | MU | 1.30% | +32.73% | +$54.70 | $55.70 |

| NORWEGIAN CRUISE LINE HLDG LTD SHS | 15 | 0 | NCLH | 1.27% | +15.80% | +$29.65 | $12.50 |

| CELANESE CORP DEL COM | 2 | 0 | CE | 1.26% | -2.70% | -$5.95 | $110.40 |

| TENCENT HOLDINGS LIMITED UNSPON ADR | 5 | 0 | TCEHY | 1.20% | +8.07% | +$15.38 | $38.07 |

| SIX FLAGS ENTERTAINMENT CORP | 8 | 0 | SIX | 1.19% | +15.77% | +$27.77 | $22.01 |

| 3M CO | 2 | 0 | MMM | 1.14% | -22.90% | -$57.56 | $125.72 |

| NETFLIX INC | 0.5 | 0 | NFLX | 1.11% | +76.94% | +$82.38 | $214.12 |

| BAYERISCHE MOTOREN WERKE AG ADR EACH REPR 0.33333 SHS SPONSORED | 5 | 0 | BMWYY | 1.09% | +42.50% | +$55.59 | $26.16 |

| TRUIST FINL CORP COM | 6 | 0 | TFC | 1.08% | -19.87% | -$45.66 | $38.31 |

| LENOVO GROUP ADR | 10 | 0 | LNVGY | 1.07% | +22.31% | +$33.25 | $14.90 |

| CARNIVAL CORP COM USD0.01 | 15 | 0 | CCL | 0.99% | +18.61% | +$26.55 | $9.51 |

| CHARTER COMMUNICATIONS INC NEW CL A | 0.5 | 0 | CHTR | 0.97% | -7.59% | -$13.55 | $357.34 |

| ALIBABA GROUP HOLDING LTD SPON ADS EACH REP 8 ORD SHS | 2 | 0 | BABA | 0.95% | -15.30% | -$29.25 | $95.60 |

| STANLEY BLACK & DECKER INC | 2 | 0 | SWK | 0.92% | -19.97% | -$39.26 | $98.33 |

| AT&T INC COM USD1 | 10 | 0 | T | 0.91% | -15.65% | -$28.75 | $18.38 |

| TYSON FOODS INC | 3 | 0 | TSN | 0.91% | -20.19% | -$39.45 | $65.16 |

| WEIBO ADR REP 1 CL A ORD | 10 | 0 | WB | 0.90% | -19.45% | -$36.90 | $18.98 |

| CARNIVAL ADR REP 1 ORD | 15 | 0 | CUK | 0.88% | +10.20% | +$13.90 | $9.08 |

| PARAMOUNT GLOBAL CLASS B COM | 10 | 0 | PARA | 0.87% | -31.15% | -$67.43 | $21.65 |

| ROBINHOOD MKTS INC COM CL A | 15 | 0 | HOOD | 0.77% | -5.74% | -$8.05 | $9.36 |

| 1 800 FLOWERS COM INC CL A | 15 | 0 | FLWS | 0.76% | -14.47% | -$22.00 | $10.14 |

| UNIVERSAL HEALTH SERVICES INC | 1 | 0 | UHS | 0.75% | +21.96% | +$23.05 | $104.93 |

| MODERNA INC COM | 1 | 0 | MRNA | 0.74% | -13.44% | -$19.60 | $145.84 |

| STONECO LTD COM USD0.000079365 CLASS A | 10 | 0 | STNE | 0.72% | +34.42% | +$31.40 | $9.12 |

| HEWLETT PACKARD ENTERPRISE CO COM | 8 | 0 | HPE | 0.72% | +21.16% | +$21.44 | $12.66 |

| PAYPAL HLDGS INC COM | 2 | 0 | PYPL | 0.71% | -27.45% | -$45.56 | $83.00 |

| PETROLEO BRASILEIRO SA PETROBRAS SPON ADS EACH REP 2 ORD SHS | 10 | 0 | PBR | 0.70% | -1.99% | -$2.43 | $12.21 |

| COMCAST CORP | 3 | 0 | CMCSA | 0.69% | +6.38% | +$7.11 | $37.11 |

| AGRICULTURAL BANK-UNSPON ADR | 12 | 0 | ACGBY | 0.67% | +17.99% | +$17.58 | $8.14 |

| LAS VEGAS SANDS CORP COM USD0.001 | 2 | 0 | LVS | 0.66% | +51.03% | +$38.08 | $37.31 |

| VANGUARD TOTAL INTERNATIONAL STOCK INDEX FUND | 2 | 0 | VXUS | 0.65% | +11.01% | +$10.98 | $49.83 |

| VANGUARD INTL EQUITY INDEX FDS FTSE SMCAP ETF | 1 | 0 | VSS | 0.63% | +6.48% | +$6.60 | $101.71 |

| INDUSTRIAL &COMMERCIAL BK OF CHINA UNSP ADR EACH REPR 20 ORD SHS | 10 | 0 | IDCBY | 0.63% | +4.32% | +$4.48 | $10.35 |

| CHINA CONSTRUCTION BANK CORP ADR | 8 | 0 | CICHY | 0.61% | +3.94% | +$3.94 | $12.50 |

| EXXON MOBIL CORP | 1 | 0 | XOM | 0.61% | -8.50% | -$9.75 | $114.72 |

| HANESBRANDS INC COM USD0.01 | 25 | 0 | HBI | 0.60% | -56.51% | -$132.82 | $9.40 |

| GLOBAL PAYMENTS INC | 1 | 0 | GPN | 0.59% | -15.36% | -$18.14 | $118.11 |

| KOHLS CORP COM | 5 | 0 | KSS | 0.59% | -33.79% | -$51.11 | $30.25 |

| MKS INSTRS INC COM | 1 | 0 | MKSI | 0.58% | +22.89% | +$18.53 | $80.95 |

| DOW INC COM | 2 | 0 | DOW | 0.58% | -3.22% | -$3.30 | $51.29 |

| REDFIN CORP COM | 10 | 0 | RDFN | 0.54% | +9.70% | +$8.20 | $8.45 |

| WALGREENS BOOTS ALLIANCE INC | 3 | 0 | WBA | 0.53% | -24.04% | -$28.49 | $39.51 |

| PVH CORPORATION COM | 1 | 0 | PVH | 0.52% | +56.87% | +$32.27 | $56.74 |

| OKTA INC CL A | 1 | 0 | OKTA | 0.52% | +35.74% | +$23.20 | $64.90 |

| DISNEY WALT CO COM | 1 | 0 | DIS | 0.52% | -18.26% | -$19.72 | $108.01 |

| LIBERTY MEDIA CORP DEL COM C SIRIUSXM | 3 | 0 | LSXMK | 0.50% | +1.64% | +$1.38 | $27.96 |

| LIBERTY MEDIA CORP DEL COM A SIRIUSXM | 3 | 0 | LSXMA | 0.50% | +1.35% | +$1.14 | $28.07 |

| BANK OF MONTREAL COM NPV ISIN #CA0636711016 SEDOL #2076009 | 1 | 0 | BMO | 0.49% | -4.38% | -$3.86 | $88.16 |

| NORDSTROM INC COM NPV | 5 | 0 | JWN | 0.47% | -13.97% | -$13.00 | $18.62 |

| ONEMAIN HLDGS INC COM | 2 | 0 | OMF | 0.45% | +0.02% | +$0.02 | $37.99 |

| LIBERTY LATIN AMERICA LTD COM USD0.01 CLASS C | 10 | 0 | LILAK | 0.44% | +2.90% | +$2.10 | $7.23 |

| LIBERTY LATIN AMERICA LTD COM USD0.01 CLASS A | 10 | 0 | LILA | 0.44% | +0.81% | +$0.60 | $7.39 |

| LIBERTY BROADBAND CORP COM SER C | 1 | 0 | LBRDK | 0.44% | -31.02% | -$33.73 | $108.75 |

| EVENTBRITE INC COM CL A | 10 | 0 | EB | 0.43% | -0.55% | -$0.40 | $7.37 |

| CARMAX INC | 1 | 0 | KMX | 0.42% | +14.32% | +$9.08 | $63.40 |

| AMERICAN CENTY ETF TR AVANTIS US SMALL CAP VALUE | 1 | 0 | AVUV | 0.42% | +0.59% | +$0.43 | $71.89 |

| POSCO HOLDINGS INC ADR EACH REP 1/4 ORD KRW5000 (BNY) | 1 | 0 | PKX | 0.40% | +53.07% | +$23.82 | $44.88 |

| ZOOM VIDEO COMMUNICATIONS INC CL A | 1 | 0 | ZM | 0.39% | -18.72% | -$15.26 | $81.53 |

| DISH NETWORK CORPORATION CL A | 10 | 0 | DISH | 0.39% | -64.32% | -$120.02 | $18.66 |

| JBS SA SPON ADR EACH REP 2 ORD SHS | 10 | 0 | JBSAY | 0.38% | -34.29% | -$34.08 | $9.94 |

| FORD MTR CO DEL COM | 5 | 0 | F | 0.35% | +7.46% | +$4.20 | $11.25 |

| HONDA MOTOR LTD AMERN SHS | 2 | 0 | HMC | 0.34% | +14.49% | +$7.26 | $25.04 |

| TORONTO DOMINION BANK ONT COM NPV ISIN #CA8911605092 SEDOL #2897222 | 1 | 0 | TD | 0.34% | -2.00% | -$1.17 | $58.67 |

| V F CORP COM NPV | 3 | 0 | VFC | 0.32% | -33.54% | -$27.32 | $27.16 |

| FIDELITY NATL INFORMATION SERVICES COM USD0.01 | 1 | 0 | FIS | 0.32% | -44.82% | -$44.23 | $98.69 |

| NINTENDO CO LTD UNSP ADS EACH REP 0.25 ORD SHS | 5 | 0 | NTDOY | 0.31% | -0.20% | -$0.11 | $10.60 |

| QORVO INC | 0.5 | 0 | QRVO | 0.29% | +6.31% | +$2.97 | $94.10 |

| MOHAWK INDUSTRIES COM USD0.01 | 0.5 | 0 | MHK | 0.28% | -17.29% | -$9.94 | $114.98 |

| FARFETCH LTD COM USD0.04 CLASS A | 10 | 0 | FTCH | 0.28% | -28.48% | -$18.75 | $6.59 |

| VANGUARD DEVELOPED MARKETS INDEX FUND ETF | 1 | 0 | VEA | 0.27% | +9.75% | +$4.04 | $41.42 |

| CLEVELAND-CLIFFS INC NEW COM | 3 | 0 | CLF | 0.25% | +3.45% | +$1.44 | $13.88 |

| BAXTER INTERNATIONAL INC COM USD1.00 | 1 | 0 | BAX | 0.24% | -29.23% | -$17.05 | $58.34 |

| HIGHWOODS PROPERTIES INC | 2 | 0 | HIW | 0.24% | -35.50% | -$22.46 | $31.64 |

| BARCLAYS PLC ADR-EACH CV INTO 4 ORD STK GBP0.25 JPM | 5 | 0 | BCS | 0.23% | +6.63% | +$2.43 | $7.32 |

| KIRKLANDS INC COM | 10 | 0 | KIRK | 0.17% | -38.17% | -$17.90 | $4.69 |

| CARDLYTICS INC COM | 5 | 0 | CDLX | 0.17% | -61.34% | -$45.60 | $14.87 |

| CITIZENS FINL GROUP INC COM | 1 | 0 | CFG | 0.16% | -5.93% | -$1.70 | $28.71 |

| FIFTH THIRD BANCORP | 1 | 0 | FITB | 0.15% | -4.47% | -$1.18 | $26.44 |

| SINCLAIR BROADCAST GROUP INC | 1 | 0 | SBGI | 0.09% | +7.33% | +$1.08 | $14.72 |

| INDUSTRIAL LOGISTICS PPTYS TR COM SHS BEN INT | 5 | 0 | ILPT | 0.05% | -79.36% | -$34.60 | $8.72 |

| BED BATH AND BEYOND COM USD0.01 | 20 | 0 | BBBYQ | 0.03% | -94.16% | -$90.95 | $4.83 |

| SIGNATURE BANK | 2 | 0 | SBNY | 0.00% | -99.90% | -$242.48 | $121.37 |

My tech stocks are looking good, but if those cool down my profile could be hurting.