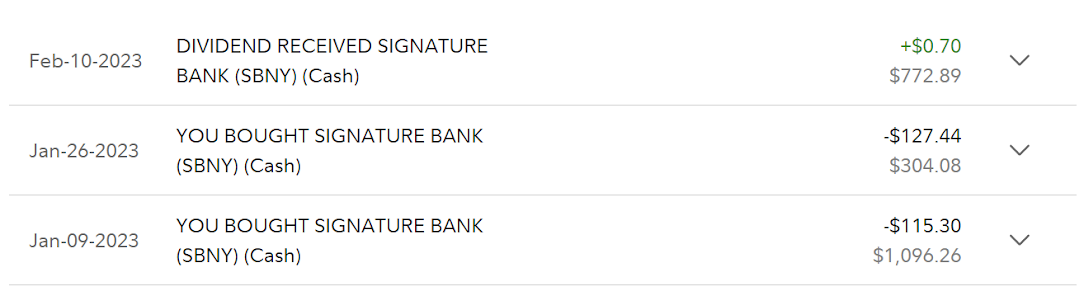

If you look back at my January email, you’ll see a hefty purchase of SBNY.

Red Flag: A stock’s wiki starts “Company Name was…”

“…Banking officials in the state of New York closed the bank on March 12, 2023, two days after the failure of Silicon Valley Bank (SVB)…It was the third-largest bank failure in U.S. history.” SVB is #2. (Seattle #1!)

Jan 26 to March 12th … that bet lasted 45 days. Here’s hoping they get bought out, then maybe I get paid? Right now it’s a big -100% in my portfolio, about the same amount as my biggest gain (META).

Portfolio sitting about even at +0.42%, about the same as last month. [Doesn't include dividends.] Looked like a good time to get into cars. Otherwise following Buffett and Munger, and asking for more trouble with banks.

New

| Description | Symbol | Percent Of Account | Old Shares | New Shares | Total Gain/Loss Percent | Total Gain/Loss Dollar | Average Cost Basis | Notes |

|---|---|---|---|---|---|---|---|---|

| TOYOTA MOTOR CORP ADR-EACH REP 10 ORD NPV LVL | TM | 0.87% | 1 | +6.07% | +$8.12 | $133.57 | cars! | |

| FORD MTR CO DEL COM | F | 0.39% | 5 | +12.00% | +$6.75 | $11.25 | cars! | |

| HONDA MOTOR LTD AMERN SHS | HMC | 0.33% | 2 | +5.79% | +$2.90 | $25.04 | cars! |

IMPROVED

| Description | Symbol | Percent Of Account | Old Shares | New Shares | Total Gain/Loss Percent | Total Gain/Loss Dollar | Average Cost Basis | Notes |

|---|---|---|---|---|---|---|---|---|

| CITIGROUP INC | C | 2.03% | 6 | 1 | -4.41% | -$15.11 | $49.05 | Buffett |

| BANK AMERICA CORP COM | BAC | 1.76% | 7 | 3 | -8.65% | -$27.08 | $31.31 | Munger |

| GENERAL MTRS CO COM | GM | 1.58% | 5 | 2 | +3.10% | +$7.74 | $35.57 | cars! |

| CELANESE CORP DEL COM | CE | 1.34% | 1 | 1 | -1.37% | -$3.01 | $110.40 | Buffett |

| 3M CO | MMM | 1.30% | 1 | 1 | -16.40% | -$41.22 | $125.72 | 10pe |

| WELLS FARGO CO NEW COM | WFC | 1.15% | 3 | 2 | -8.40% | -$17.13 | $40.81 | Munger |

| US BANCORP | USB | 1.11% | 3 | 2 | -13.18% | -$27.35 | $41.52 | Munger |

| TRUIST FINL CORP COM | TFC | 1.05% | 3 | 2 | -14.10% | -$27.97 | $39.69 | 7.5pe |

| PFIZER INC | PFE | 1.01% | 2 | 2 | -3.21% | -$5.40 | $42.15 | 7.5pe |

| MODERNA INC COM | MRNA | 0.95% | 0.5 | 0.5 | +5.30% | +$7.74 | $145.84 | 7.5pe |

Same

| Description | Symbol | Percent Of Account | Old Shares | New Shares | Total Gain/Loss Percent | Total Gain/Loss Dollar | Average Cost Basis | Notes |

|---|---|---|---|---|---|---|---|---|

| META PLATFORMS INC CLASS A COMMON STOCK | META | 6.54% | 5 | 0 | +32.46% | +$259.70 | $160.00 | |

| OCCIDENTAL PETE CORP COM | OXY | 3.08% | 8 | 0 | -1.12% | -$5.62 | $63.13 | |

| APPLE INC | AAPL | 3.05% | 3 | 0 | +17.43% | +$73.45 | $140.42 | |

| VANGUARD BD INDEX FDS TOTAL BND MRKT | BND | 2.27% | 5 | 0 | -2.31% | -$8.70 | $75.39 | |

| INTEL CORP COM USD0.001 | INTC | 2.02% | 10 | 0 | -6.25% | -$21.77 | $34.85 | |

| ALPHABET INC CAP STK CL C | GOOG | 1.93% | 3 | 0 | +15.95% | +$42.92 | $89.69 | |

| ALPHABET INC CAP STK CL A | GOOGL | 1.92% | 3 | 0 | +16.00% | +$42.94 | $89.42 | |

| WARNER BROS DISCOVERY INC COM SER A | WBD | 1.86% | 20 | 0 | +18.49% | +$47.14 | $12.74 | |

| MICROSOFT CORP | MSFT | 1.78% | 1 | 0 | +15.83% | +$39.42 | $248.88 | |

| ROYAL CARIBBEAN GROUP COM USD0.01 | RCL | 1.61% | 4 | 0 | +59.18% | +$97.11 | $41.02 | |

| ALLY FINANCIAL INC COM USD0.01 | ALLY | 1.57% | 10 | 0 | -15.33% | -$46.13 | $30.10 | |

| TENCENT HOLDINGS LIMITED UNSPON ADR | TCEHY | 1.52% | 5 | 0 | +29.08% | +$55.36 | $38.07 | |

| PARAMOUNT GLOBAL CLASS B COM | PARA | 1.38% | 10 | 0 | +3.03% | +$6.57 | $21.65 | |

| LENOVO GROUP ADR | LNVGY | 1.34% | 10 | 0 | +45.33% | +$67.55 | $14.90 | |

| SIX FLAGS ENTERTAINMENT CORP | SIX | 1.32% | 8 | 0 | +21.36% | +$37.61 | $22.01 | |

| ALIBABA GROUP HOLDING LTD SPON ADS EACH REP 8 ORD SHS | BABA | 1.26% | 2 | 0 | +6.88% | +$13.17 | $95.60 | |

| NORWEGIAN CRUISE LINE HLDG LTD SHS | NCLH | 1.24% | 15 | 0 | +7.57% | +$14.20 | $12.50 | |

| WEIBO ADR REP 1 CL A ORD | WB | 1.24% | 10 | 0 | +5.69% | +$10.80 | $18.98 | |

| VERIZON COMMUNICATIONS INC | VZ | 1.20% | 5 | 0 | -11.91% | -$26.28 | $44.15 | |

| CAPITAL ONE FINANCIAL CORP COM USD0.01 | COF | 1.19% | 2 | 0 | -1.86% | -$3.64 | $97.98 | |

| AT&T INC COM USD1 | T | 1.19% | 10 | 0 | +4.76% | +$8.75 | $18.38 | |

| BAYERISCHE MOTOREN WERKE AG ADR EACH REPR 0.33333 SHS SPONSORED | BMWYY | 1.13% | 5 | 0 | +39.74% | +$51.98 | $26.16 | |

| MICRON TECHNOLOGY INC | MU | 1.12% | 3 | 0 | +8.33% | +$13.93 | $55.70 | |

| TYSON FOODS INC | TSN | 1.10% | 3 | 0 | -8.97% | -$17.52 | $65.16 | |

| CHARTER COMMUNICATIONS INC NEW CL A | CHTR | 1.10% | 0.5 | 0 | +0.07% | +$0.13 | $357.34 | |

| NETFLIX INC | NFLX | 1.07% | 0.5 | 0 | +61.34% | +$65.68 | $214.12 | |

| 1 800 FLOWERS COM INC CL A | FLWS | 1.06% | 15 | 0 | +13.44% | +$20.45 | $10.14 | |

| CHEVRON CORP NEW COM | CVX | 1.01% | 1 | 0 | -0.30% | -$0.49 | $163.65 | |

| VANGUARD INTL EQUITY INDEX FDS FTSE EMR MKT ETF | VWO | 1.00% | 4 | 0 | -2.25% | -$3.71 | $41.33 | |

| STANLEY BLACK & DECKER INC | SWK | 0.99% | 2 | 0 | -18.06% | -$35.50 | $98.33 | |

| CARNIVAL CORP COM USD0.01 | CCL | 0.94% | 15 | 0 | +6.72% | +$9.60 | $9.51 | |

| PAYPAL HLDGS INC COM | PYPL | 0.94% | 2 | 0 | -8.51% | -$14.12 | $83.00 | |

| ROBINHOOD MKTS INC COM CL A | HOOD | 0.90% | 15 | 0 | +3.77% | +$5.30 | $9.36 | |

| CARNIVAL ADR REP 1 ORD | CUK | 0.85% | 15 | 0 | +0.73% | +$1.00 | $9.08 | |

| HANESBRANDS INC COM USD0.01 | HBI | 0.81% | 25 | 0 | -44.06% | -$103.57 | $9.40 | |

| JPMORGAN CHASE & CO | JPM | 0.80% | 1 | 0 | +12.09% | +$14.06 | $116.25 | |

| HEWLETT PACKARD ENTERPRISE CO COM | HPE | 0.79% | 8 | 0 | +25.82% | +$26.16 | $12.66 | |

| UNIVERSAL HEALTH SERVICES INC | UHS | 0.78% | 1 | 0 | +21.12% | +$22.17 | $104.93 | |

| KOHLS CORP COM | KSS | 0.73% | 5 | 0 | -22.19% | -$33.56 | $30.25 | |

| HP INC COM | HPQ | 0.72% | 4 | 0 | +10.42% | +$11.08 | $26.58 | |

| LAS VEGAS SANDS CORP COM USD0.001 | LVS | 0.71% | 2 | 0 | +53.98% | +$40.28 | $37.31 | |

| COMCAST CORP | CMCSA | 0.70% | 3 | 0 | +2.15% | +$2.40 | $37.11 | |

| AGRICULTURAL BANK-UNSPON ADR | ACGBY | 0.69% | 12 | 0 | +13.85% | +$13.53 | $8.14 | |

| EXXON MOBIL CORP | XOM | 0.68% | 1 | 0 | -4.42% | -$5.06 | $114.72 | |

| VANGUARD TOTAL INTERNATIONAL STOCK INDEX FUND | VXUS | 0.68% | 2 | 0 | +10.79% | +$10.76 | $49.83 | |

| DOW INC COM | DOW | 0.68% | 2 | 0 | +6.88% | +$7.06 | $51.29 | |

| VANGUARD INTL EQUITY INDEX FDS FTSE SMCAP ETF | VSS | 0.67% | 1 | 0 | +7.40% | +$7.53 | $101.71 | |

| INDUSTRIAL &COMMERCIAL BK OF CHINA UNSP ADR EACH REPR 20 ORD SHS | IDCBY | 0.66% | 10 | 0 | +2.89% | +$3.00 | $10.35 | |

| GLOBAL PAYMENTS INC | GPN | 0.65% | 1 | 0 | -10.90% | -$12.87 | $118.11 | |

| PETROLEO BRASILEIRO SA PETROBRAS SPON ADS EACH REP 2 ORD SHS | PBR | 0.64% | 10 | 0 | -14.60% | -$17.83 | $12.21 | |

| WALGREENS BOOTS ALLIANCE INC | WBA | 0.64% | 3 | 0 | -12.48% | -$14.78 | $39.51 | |

| CHINA CONSTRUCTION BANK CORP ADR | CICHY | 0.64% | 8 | 0 | +3.74% | +$3.74 | $12.50 | |

| DISNEY WALT CO COM | DIS | 0.62% | 1 | 0 | -7.30% | -$7.88 | $108.01 | |

| STONECO LTD COM USD0.000079365 CLASS A | STNE | 0.59% | 10 | 0 | +4.60% | +$4.20 | $9.12 | |

| DISH NETWORK CORPORATION CL A | DISH | 0.58% | 10 | 0 | -50.01% | -$93.32 | $18.66 | |

| REDFIN CORP COM | RDFN | 0.56% | 10 | 0 | +7.21% | +$6.10 | $8.45 | |

| PVH CORPORATION COM | PVH | 0.55% | 1 | 0 | +57.13% | +$32.42 | $56.74 | |

| MKS INSTRS INC COM | MKSI | 0.55% | 1 | 0 | +9.47% | +$7.67 | $80.95 | |

| OKTA INC CL A | OKTA | 0.53% | 1 | 0 | +32.88% | +$21.34 | $64.90 | |

| EVENTBRITE INC COM CL A | EB | 0.53% | 10 | 0 | +16.41% | +$12.10 | $7.37 | |

| LIBERTY LATIN AMERICA LTD COM USD0.01 CLASS A | LILA | 0.51% | 10 | 0 | +12.44% | +$9.20 | $7.39 | |

| LIBERTY LATIN AMERICA LTD COM USD0.01 CLASS C | LILAK | 0.51% | 10 | 0 | +14.24% | +$10.30 | $7.23 | |

| LIBERTY BROADBAND CORP COM SER C | LBRDK | 0.50% | 1 | 0 | -24.88% | -$27.05 | $108.75 | |

| NORDSTROM INC COM NPV | JWN | 0.50% | 5 | 0 | -12.63% | -$11.75 | $18.62 | |

| ONEMAIN HLDGS INC COM | OMF | 0.46% | 2 | 0 | -2.40% | -$1.82 | $37.99 | |

| ZOOM VIDEO COMMUNICATIONS INC CL A | ZM | 0.46% | 1 | 0 | -9.44% | -$7.69 | $81.53 | |

| JBS SA SPON ADR EACH REP 2 ORD SHS | JBSAY | 0.43% | 10 | 0 | -29.37% | -$29.19 | $9.94 | |

| POSCO HOLDINGS INC ADR EACH REP 1/4 ORD KRW5000 (BNY) | PKX | 0.43% | 1 | 0 | +55.28% | +$24.81 | $44.88 | |

| V F CORP COM NPV | VFC | 0.42% | 3 | 0 | -15.64% | -$12.74 | $27.16 | |

| CARMAX INC | KMX | 0.40% | 1 | 0 | +1.38% | +$0.88 | $63.40 | |

| CLEVELAND-CLIFFS INC NEW COM | CLF | 0.34% | 3 | 0 | +32.06% | +$13.35 | $13.88 | |

| FIDELITY NATL INFORMATION SERVICES COM USD0.01 | FIS | 0.34% | 1 | 0 | -44.95% | -$44.36 | $98.69 | |

| QORVO INC | QRVO | 0.31% | 0.5 | 0 | +7.93% | +$3.73 | $94.10 | |

| MOHAWK INDUSTRIES COM USD0.01 | MHK | 0.31% | 0.5 | 0 | -12.84% | -$7.38 | $114.98 | |

| FARFETCH LTD COM USD0.04 CLASS A | FTCH | 0.30% | 10 | 0 | -25.44% | -$16.75 | $6.59 | |

| NINTENDO CO LTD UNSP ADS EACH REP 0.25 ORD SHS | NTDOY | 0.30% | 5 | 0 | -9.05% | -$4.79 | $10.60 | |

| HIGHWOODS PROPERTIES INC | HIW | 0.29% | 2 | 0 | -26.71% | -$16.90 | $31.64 | |

| VANGUARD DEVELOPED MARKETS INDEX FUND ETF | VEA | 0.28% | 1 | 0 | +9.05% | +$3.75 | $41.42 | |

| BAXTER INTERNATIONAL INC COM USD1.00 | BAX | 0.25% | 1 | 0 | -30.48% | -$17.78 | $58.34 | |

| KIRKLANDS INC COM | KIRK | 0.18% | 10 | 0 | -39.24% | -$18.40 | $4.69 |