2022 October ($9,000)

Last month we were down -15.95%. Now we’re only down -9.29%. [Doesn't include dividends.] Progress! (SPY is up 6.11% this month.)

| Description | Symbol | % of Account | Old Shares | New Shares | % Gain | Cost/ Share |

Notes |

|---|---|---|---|---|---|---|---|

| HEWLETT PACKARD ENTERPRISE CO COM | HPE | 1.14% | 8 | 13.66% | $12.66 | PE 4.8 | |

| CAPITAL ONE FINANCIAL CORP COM USD0.01 | COF | 1.06% | 1 | 9.59% | $97.72 | PE 4.2 | |

| LENOVO GROUP ADR | LNVGY | 1.07% | 7 | 7.00% | $14.43 | PE 4.2 | |

| HP INC COM | HPQ | 1.11% | 4 | 5.53% | $26.58 | PE 4.8 | |

| MKS INSTRS INC COM | MKSI | 0.84% | 1 | 4.48% | $80.95 | PE 8 but I like the graph | |

| ALPHABET INC CAP STK CL A | GOOGL | 0.95% | 1 | 4.42% | $92.21 | PE 21, seemed like a fine time to jump in | |

| ALPHABET INC CAP STK CL C | GOOG | 0.96% | 1 | 4.36% | $92.54 | ^ | |

| V F CORP COM NPV | VFC | 0.84% | 3 | 4.09% | $27.16 | PE 25 yikes, but nice graph. (Retail seems risky.) Vans, North Face, etc. |

|

| CARMAX INC | KMX | 0.63% | 1 | 0.61% | $63.40 | Popular with superinvestors | |

| PETROLEO BRASILEIRO SA PETROBRAS SPON ADS EACH REP 2 ORD SHS | PBR | 0.53% | 4 | -2.66% | $13.82 | PE 3.4 state-owned brazilian oil | |

| CLEVELAND-CLIFFS INC NEW COM | CLF | 0.40% | 3 | -3.10% | $13.88 | PE 3.6 iron & steel | |

| VANGUARD TOTAL INTERNATIONAL STOCK INDEX FUND | VXUS | 0.94% | 1 | 1 | -4.22% | $49.83 | buffed ETF |

| VANGUARD INTL EQUITY INDEX FDS FTSE SMCAP ETF | VSS | 0.96% | 0.5 | 0.5 | -4.50% | $101.71 | buffed ETF |

| PARAMOUNT GLOBAL CLASS B COM | PARA | 1.13% | 5 | 1 | -20.52% | $23.93 | small buff on a loser |

| NETFLIX INC | NFLX | 1.46% | 0.5 | 0 | 38.10% | $214.12 | |

| NORWEGIAN CRUISE LINE HLDG LTD SHS | NCLH | 2.45% | 15 | 0 | 32.12% | $12.50 | |

| ROYAL CARIBBEAN GROUP COM USD0.01 | RCL | 2.09% | 4 | 0 | 28.39% | $41.02 | |

| ROBINHOOD MKTS INC COM CL A | HOOD | 1.71% | 15 | 0 | 22.90% | $9.36 | |

| OCCIDENTAL PETE CORP COM | OXY | 1.42% | 2 | 0 | 16.50% | $61.66 | |

| UNIVERSAL HEALTH SERVICES INC | UHS | 1.16% | 1 | 0 | 11.52% | $104.93 | |

| STONECO LTD COM USD0.000079365 CLASS A | STNE | 1.01% | 10 | 0 | 11.51% | $9.12 | |

| NORDSTROM INC COM NPV | JWN | 1.02% | 5 | 0 | 10.20% | $18.62 | |

| LIBERTY LATIN AMERICA LTD COM USD0.01 CLASS C | LILAK | 0.78% | 10 | 0 | 9.40% | $7.23 | |

| JPMORGAN CHASE & CO | JPM | 1.25% | 1 | 0 | 8.45% | $116.25 | |

| LIBERTY LATIN AMERICA LTD COM USD0.01 CLASS A | LILA | 0.78% | 10 | 0 | 6.90% | $7.39 | |

| MODERNA INC COM | MRNA | 0.75% | 0.5 | 0 | 6.57% | $141.66 | |

| GLOBAL PAYMENTS INC | GPN | 1.24% | 1 | 0 | 6.09% | $118.11 | |

| GENERAL MTRS CO COM | GM | 1.15% | 3 | 0 | 6.08% | $36.62 | |

| PAYPAL HLDGS INC COM | PYPL | 1.71% | 2 | 0 | 3.91% | $83.00 | |

| ZOOM VIDEO COMMUNICATIONS INC CL A | ZM | 0.83% | 1 | 0 | 3.28% | $81.53 | |

| BAYERISCHE MOTOREN WERKE AG ADR EACH REPR 0.33333 SHS SPONSORED | BMWYY | 1.31% | 5 | 0 | 0.87% | $26.16 | |

| KOHLS CORP COM | KSS | 1.51% | 5 | 0 | 0.78% | $30.25 | |

| SIX FLAGS ENTERTAINMENT CORP | SIX | 1.75% | 8 | 0 | 0.68% | $22.01 | |

| ONEMAIN HLDGS INC COM | OMF | 0.76% | 2 | 0 | 0.60% | $37.99 | |

| AT&T INC COM USD1 | T | 1.83% | 10 | 0 | 0.57% | $18.38 | |

| LAS VEGAS SANDS CORP COM USD0.001 | LVS | 0.73% | 2 | 0 | -0.59% | $37.31 | |

| DISNEY WALT CO COM | DIS | 1.05% | 1 | 0 | -1.91% | $108.01 | |

| POSCO HOLDINGS INC ADR EACH REP 1/4 ORD KRW5000 (BNY) | PKX | 0.42% | 1 | 0 | -4.35% | $44.88 | |

| BED BATH AND BEYOND COM USD0.01 | BBBY | 0.91% | 20 | 0 | -4.97% | $4.83 | me big dumb |

| BAXTER INTERNATIONAL INC COM USD1.00 | BAX | 0.54% | 1 | 0 | -5.73% | $58.34 | |

| MICRON TECHNOLOGY INC | MU | 1.07% | 2 | 0 | -5.96% | $57.46 | |

| QORVO INC | QRVO | 0.44% | 0.5 | 0 | -6.00% | $94.10 | |

| CARNIVAL CORP COM USD0.01 | CCL | 1.33% | 15 | 0 | -6.00% | $9.51 | |

| VANGUARD TAX-MANAGED INTL FD FTSE DEV MKT ETF | VEA | 0.38% | 1 | 0 | -6.11% | $41.42 | |

| FARFETCH LTD COM USD0.04 CLASS A | FTCH | 0.41% | 5 | 0 | -6.89% | $9.00 | |

| WALGREENS BOOTS ALLIANCE INC | WBA | 1.09% | 3 | 0 | -7.41% | $39.51 | |

| DOW INC COM | DOW | 0.94% | 2 | 0 | -7.43% | $51.29 | |

| VANGUARD BD INDEX FDS TOTAL BND MRKT | BND | 2.10% | 3 | 0 | -7.74% | $76.49 | |

| WARNER BROS DISCOVERY INC COM SER A | WBD | 1.54% | 12 | 0 | -7.76% | $14.04 | |

| PVH CORPORATION COM | PVH | 0.52% | 1 | 0 | -7.78% | $56.74 | |

| US BANCORP | USB | 0.42% | 1 | 0 | -9.01% | $47.10 | |

| CITIGROUP INC | C | 1.83% | 4 | 0 | -9.20% | $50.80 | |

| AGRICULTURAL BANK-UNSPON ADR | ACGBY | 0.88% | 12 | 0 | -9.23% | $8.14 | |

| CHARTER COMMUNICATIONS INC NEW CL A | CHTR | 0.91% | 0.25 | 0 | -10.19% | $410.00 | |

| HIGHWOODS PROPERTIES INC | HIW | 0.56% | 2 | 0 | -10.72% | $31.64 | |

| CHINA CONSTRUCTION BANK CORP ADR | CICHY | 0.88% | 8 | 0 | -10.92% | $12.50 | |

| EVENTBRITE INC COM CL A | EB | 0.65% | 10 | 0 | -11.00% | $7.37 | |

| INDUSTRIAL &COMMERCIAL BK OF CHINA UNSP ADR EACH REPR 20 ORD SHS | IDCBY | 0.91% | 10 | 0 | -11.38% | $10.35 | |

| OKTA INC CL A | OKTA | 0.57% | 1 | 0 | -11.73% | $64.90 | |

| CARNIVAL ADR REP 1 ORD | CUK | 1.18% | 15 | 0 | -12.48% | $9.08 | |

| JBS SA SPON ADR EACH REP 2 ORD SHS | JBSAY | 0.48% | 5 | 0 | -12.97% | $11.08 | |

| COMCAST CORP | CMCSA | 0.95% | 3 | 0 | -13.91% | $37.11 | |

| FIDELITY NATL INFORMATION SERVICES COM USD0.01 | FIS | 0.84% | 1 | 0 | -13.98% | $98.69 | |

| 3M CO | MMM | 1.25% | 1 | 0 | -14.48% | $148.03 | |

| VANGUARD INTL EQUITY INDEX FDS FTSE EMR MKT ETF | VWO | 1.06% | 3 | 0 | -14.62% | $41.67 | |

| MOHAWK INDUSTRIES COM USD0.01 | MHK | 0.48% | 0.5 | 0 | -15.89% | $114.98 | |

| VERIZON COMMUNICATIONS INC | VZ | 1.49% | 4 | 0 | -16.46% | $45.09 | |

| DISH NETWORK CORPORATION CL A | DISH | 1.52% | 10 | 0 | -17.48% | $18.66 | |

| CELANESE CORP DEL COM | CE | 0.95% | 1 | 0 | -17.85% | $116.97 | |

| STANLEY BLACK & DECKER INC | SWK | 1.55% | 2 | 0 | -20.16% | $98.33 | |

| LIBERTY BROADBAND CORP COM SER C | LBRDK | 0.84% | 1 | 0 | -22.21% | $108.75 | |

| KIRKLANDS INC COM | KIRK | 0.36% | 10 | 0 | -22.39% | $4.69 | |

| ALLY FINANCIAL INC COM USD0.01 | ALLY | 1.39% | 5 | 0 | -23.09% | $36.39 | |

| 1 800 FLOWERS COM INC CL A | FLWS | 1.13% | 15 | 0 | -24.64% | $10.14 | |

| INTEL CORP COM USD0.001 | INTC | 1.73% | 6 | 0 | -24.68% | $38.60 | |

| TENCENT HOLDINGS LIMITED UNSPON ADR | TCEHY | 1.27% | 5 | 0 | -32.81% | $38.07 | |

| ALIBABA GROUP HOLDING LTD SPON ADS EACH REP 8 ORD SHS | BABA | 1.26% | 2 | 0 | -33.33% | $95.60 | |

| HANESBRANDS INC COM USD0.01 | HBI | 1.07% | 15 | 0 | -34.36% | $10.97 | |

| CARDLYTICS INC COM | CDLX | 0.48% | 5 | 0 | -34.57% | $14.87 | |

| META PLATFORMS INC CLASS A COMMON STOCK | META | 4.91% | 5 | 0 | -38.00% | $160.00 | my largest position (me big dumb) |

| WEIBO ADR REP 1 CL A ORD | WB | 1.08% | 10 | 0 | -42.68% | $18.98 | |

| INDUSTRIAL LOGISTICS PPTYS TR COM SHS BEN INT | ILPT | 0.24% | 5 | 0 | -44.68% | $8.73 | |

| REDFIN CORP COM | RDFN | 0.45% | 10 | 0 | -45.92% | $8.45 | ouch |

Mostly bought stock with good low PE ratios. Still expecting the market to be down/stagnant for another year, give or take. Let’s hope it’s not a decade.

I’ve been watching some of the big players, and thought it was time to jump into Google.

Redfin has done awful, which shouldn’t be too surprising since they aren’t profitable. At least I didn’t buy as much as I bought META - that sure looks bad now. (Still holding.)

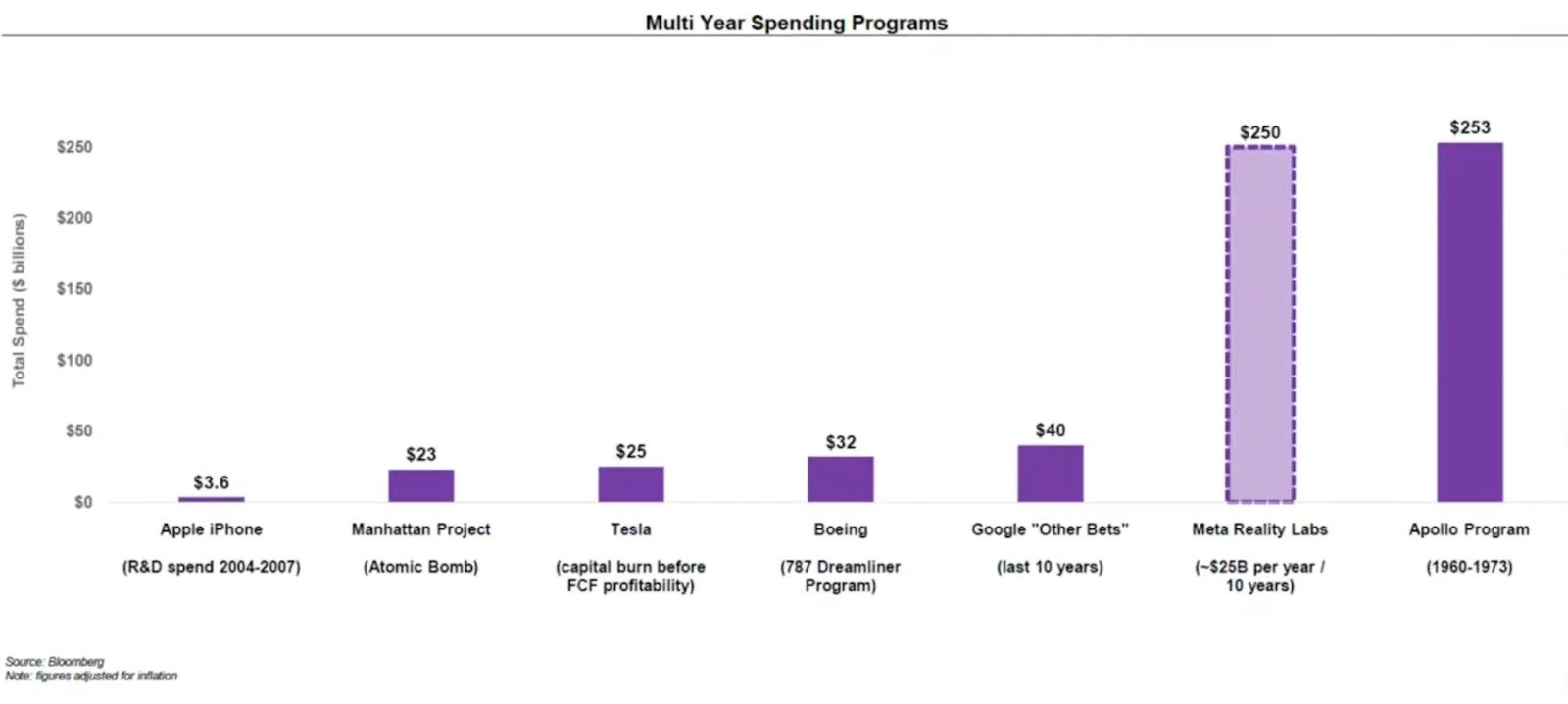

Meta Reality Labs has only cost as much as the Apollo space program…