I deposit $1000/mo into a Fidelity investment account, $41,000 total since 2022. I try to pick stocks to hold until retirement.

My favorite book this month is The Years of Lyndon Johnson: The Passage of Power by Robert Caro (2012). Volume four of five, I’ll line up at midnight for the final volume.

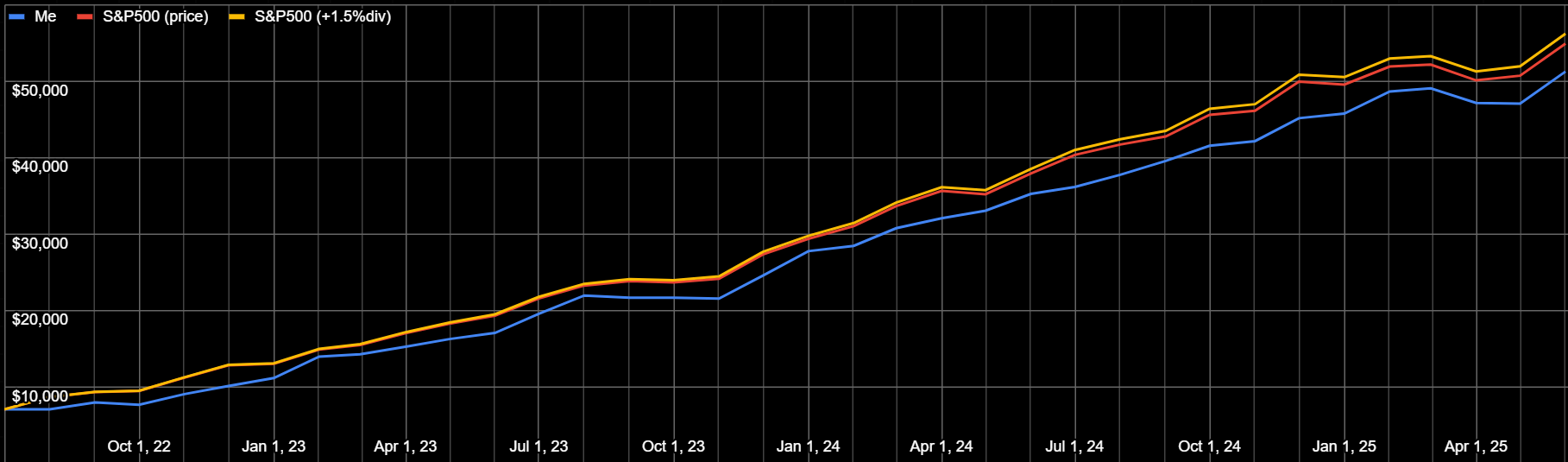

I made a graph that estimates my growth (blue) relative to the S&P500 price (red) and the S&P500 price with a rough guess of 1.5% reinvested monthly dividend (yellow).

| Fund | 1-month | 3-month | 1 Year |

|---|---|---|---|

| My Fund | 6.8% | -1.7% | 10.1% |

| S&P 500 | 6.3% | -0.4% | 13.5% |

| Dow Jones | 6.4% | -0.6% | 13.0% |

April showers bring May flowers. Three of my four nuclear energy companies (CEG, CCJ, VST) went up 25-35% this month.

Bought

I only did one thing in May, I bought $1000 of Nvidia. I’m nervous being under market weight on it, this about doubled me to 0.7x of what the S&P500 owns. I might do it again.

| # | %pos> | thismo | shrs | cost | value | $gain | %price | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 6 | 81% | $1,029 | 17 | $ 1,842 | $ 2,297 | $ 455 | 25% | NVDA | NVIDIA CORP | 4.5% | tech | USA | sc’s |

I look smart because NVDA went up 20% this month.

Top Half

These top fourteen positions are 52% of my portfolio, and the top seven are 42%.

| # | shrs | cost | value | %price | tkr | div-f | description | acct% | cat | area | type |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 9.36 | $ 3,640 | $ 4,309 | 18% | MSFT | 0.8% | MICROSOFT C | 8.4% | multi | USA | tech |

| 2 | 18.15 | $ 3,409 | $ 3,645 | 7% | AAPL | 0.7% | APPLE INC | 7.1% | multi | USA | tech |

| 3 | 5 | $ 800 | $ 3,237 | 305% | META | 1.6% | META PLATFO | 6.3% | multi | USA | tech |

| 4 | 18.25 | $ 2,505 | $ 3,155 | 26% | GOOG | 0.5% | ALPHABET IN | 6.2% | multi | USA | tech |

| 5 | 15.25 | $ 2,668 | $ 3,126 | 17% | AMZN | AMAZON.COM | 6.1% | multi | USA | tech | |

| 6 | 17 | $ 1,842 | $ 2,297 | 25% | NVDA | NVIDIA CORP | 4.5% | tech | USA | sc’s | |

| 7 | 3.47 | $ 1,439 | $ 1,749 | 22% | BRK.B | BERKSHIRE H | 3.4% | multi | USA | ||

| 8 | 5 | $ 548 | $ 967 | 76% | TSM | 2.2% | TAIWAN SEMI | 1.9% | tech | Asia | sc’s |

| 9 | 18 | $ 538 | $ 794 | 48% | BAC | 6.5% | BANK AMERIC | 1.6% | finance | USA | bank |

| 10 | 2 | $ 557 | $ 730 | 31% | V | 0.6% | VISA INC | 1.4% | finance | USA | credit |

| 11 | 1.18 | $ 556 | $ 691 | 24% | MA | 0.6% | MASTERCARD | 1.4% | finance | USA | credit |

| 12 | 11 | $ 429 | $ 691 | 61% | TCEHY | 3.1% | TENCENT HOL | 1.4% | tech | China | games |

| 13 | 16.4 | $ 993 | $ 669 | -33% | OXY | 2.7% | OCCIDENTAL | 1.3% | energy | USA | oil |

| 14 | 0.52 | $ 119 | $ 628 | 430% | NFLX | NETFLIX INC | 1.2% | media | USA | stream |

My META is +305% from $800 to $3237, and my NFLX is +430% from $119 to $628 from 79th in amount invested to 14th in value.

All Holdings

See the attached PDF of my holdings, it’s colorful.